FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A1

Clipboard

A

B

Font

Alignment

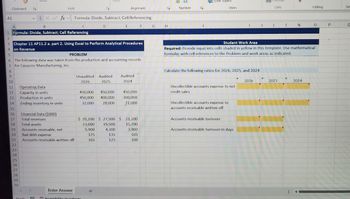

Xfx Formula: Divide, Subtract; Cell Referencing

C

1 Formula: Divide, Subtract; Cell Referencing

2

D

E

F

G

H

3 Chapter 11 AP11.2 a. part 2. Using Excel to Perform Analytical Procedures

on Revenue

000

Number

Styles

Cells

Student Work Area

Editing

Ser

L

N

0

P

Required: Provide input into cells shaded in yellow in this template. Use mathematical

formulas with cell references to the Problem and work areas as indicated.

4

5

PROBLEM

6 The following data was taken from the production and accounting records

7 for Casuccio Manufacturing, Inc.

8

Calculate the following ratios for 2026, 2025, and 2024

O

9

10

Unaudited Audited

2026

2025

Audited

2024

2026

2025

2024

11

Operating Data

12

Capacity in units

13

Production in units

14

Ending inventory in units

450,000 450,000

450,000 400,000

32,000 28,000

450,000

300,000

21,000

Uncollectible accounts expense to net

credit sales

15

Uncollectible accounts expense to

accounts receivable written off

16

Financial Data ($000)

17

Total revenues

$ 35,200 $ 27,500 $ 21,200

Accounts receivable turnover

18

Total assets

23,000

19,500

15,700

19

Accounts receivable, net

5,900

4,300

3,900

Accounts receivable turnover in days

20

Bad debt expense

175

135

105

21

Accounts receivable written off

165

125

100

22

23

24

25

26

27

28

29

30

Enter Answer

+

Ready

Accessibility: Investigate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How to solve this?arrow_forwardJasmine Thompson Document2 - Word O Search B Share Home Design Layout References Mailings Review View Help Insert Draw O Find Cut Calibri (Body) 12 A A Aa A E E E EE T AaBbCcDd AaBbCcDd AaBbC AaBbCcC AaB AABBCCD AaBbCcDd AaBbCcDd S Replace Dictate Copy 田 1 Normal 1 No Spac.. Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis A Select v BIU ab x, x' A v 3 Format Painter Styles Editing Voice pboard Paragraph Font 7 17. The Brown Company's 12/31 Trail Balance totals $10,000. Two adjusting entries are made: 1. Depreciation on machinery $1,000 2. Expiration of Prepaid Insurance $500 Brown's Adjusted Trial Balance will total: a. $9,000 b. $9,500 c. $11,500 d. $11,000 e. $10,500 age 5 of 6 969 words English (United States) Focus ב P Type here to search ENG 1:13 AM US 1/19/2021 127arrow_forwardted with McGraw-Hill CoX O Question 2 - chapter 16- proble X ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-grou chapter 16 - problems i Saved Help Save & Exit Su 2 Lazare Corporation expects an EBIT of $30,800 every year forever. Lazare currently has no debt, and its cost of equity is 14%. The firm can borrow at 9%. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) a. If the corporate tax rate is 35%, what is the value of the firm? Value of the firm b. What will the value be if the company converts to 50% debt? Value of the firm c. What will the value be if the company converts to 100% debt? Value of the firm Next > %24 %24 %24arrow_forward

- Home Insert Draw Page Layout Aa Colors Themes Aa Fonts 2 AutoSave OFF 2 C E30 4A) 5 B) 6C) 7 218) 22 23 24 28 29 25 C) 26 27 30 Dy 31 36 37 38 39 32 33 34 E) * x 8D) 9 10 E) 11 12 13 14 15 Answer all questions using Excel functions, no mathematical solutions. 16 A) 17 Month 18 19 20 A Margins Orientation Size Formulas Data Review H Print Breaks Background Print Page Area Titles Setup Years V fx 8 D E F G H Assume a hypothetical age. Assume you drink one coffee per day, 5 days a week. Assume the coffee price is $4.00. 1. That makes it $20 per week and $80 per month. Assume you can invest $80 per month in the stock market and assume you can cam 11% per year compouded monthly on your stock investment. i ii. Homework.xls - Compatibility Mode - Saved to my Mac View Automate Tell me FEA TA I J Width: Height: What is your holding period retum both in dollars and in percentage? What is your Effective Annual Retum in percentage? Automatic K Automatic L M v All answers must be done using PV, FV,…arrow_forwardAutoSave Off File Home Module ThreeProblem Set Question3 ⚫ Saved to this PC Search Insert Page Layout Formulas Data Review View Automate Help ✗Cut Calibri 12 Α' Α' ab Wrap Text Text Copy ▾ Paste B I U ~A~ Merge & Center $ % 9 +0.00 Format Painter Clipboard √☑ Font Б Alignment √☑ Number Г A1 A B C D E F G H Accent3 Accent4 Accent5 Conditional Format as Formatting Accent6 Comma Comma [0] Table ▾ Styles Katherine Apuzzo KA Comments Share ☐☐ > AutoSum ✓ ĄT பப Fill Insert Delete Format Sort & Find & Add-ins > Clear Filter Select Cells Editing Analyze Data Add-ins J K L M N о P Q R S T U V W X Y ✓ ✓ ✓ fx Function: MAX; Formulas: Subtract; Divide; Cell Referencing 1 Function: MAX; Formulas: Subtract; Divide; Cell Referencing 2 3 BE5.7 - Using Excel to Determine Profitability Given a Constrained Reso 4 PROBLEM 5 Rachel wants to use her knitting skills to make a little extra money so she 6 can enjoy a theatre weekend with her besties. She's got the pattern down 7 for a hat, scarf, and mittens,…arrow_forwardMindTap - Cengage Learning CengageNOWv2 | Online teachin x 9 Cengage Learning b Answered: CengageNOWv2| Onli x i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Ch 13-2 Practice Exercises E Calculator eBook Show Me How Print Item Reporting Stockholders' Equity Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 50,000 shares of common stock authorized, and 2,000 shares have been reacquired. Common Stock, $80 par $3,200,000 Paid-In Capital from Sale of Treasury Stock 64,000 Paid-In Capital in Excess of Par-Common Stock 440,000 Retained Earnings 1,728,000 Treasury Stock 42,000 Stockholders' Equity Paid-In Capital: Common Stock, $80 Par 3,200,000 Excess over par 440,000 Treasury Stock From Sale of Treasury Stock 64,000 Total Paid-in Capital $ 3,704,000 Retained Earnings Total Treasury Stock Total Stockholders' Equity Check My Work 2 more…arrow_forward

- how do I do thisarrow_forwardompatibility Mode - Word Search Rafael Luna RL File Home Insert Draw Design Layout References Mailings Review View Help Share Comments X Times New Rom 12 AA Aa A E ALT Find Sc Replace Select AaBbCcl AaBbc AaBbCd AaBbCc. AaBbCcD Emphasis Heading 1 1 Normal Strong Subtitle Paste BIU Dictate ab x, X? ADA Sensitivity Editor Clipboard Font Paragraph Styles Editing Voice Sensitivity Editor Two projects are competing for funding at your company. The current interest rate is 5%. Project A is an Energy Saving project that costs $15,000. It doesn't save any money in Year 1. but begins in Year 2 at $1000, Year 3 at $2000, Year 4 at $3000, and Year 5 at $4000. Project B is a Water Saving project that costs $13,500. It begins saving money in Year 1 through 4 at $3000. f. Draw the cash flow diagrams g. Which should you select as the best economic alternative? Show your calculations for both alternatives for credit (and use the compound interest tables, not formulas) to justify your answer. Pay close…arrow_forward2 Project: Company Accour X D21. 7-1 Problem Set: Module Sev X CengageNOWv2 | Online tea X Cengage Learning +| x Dw.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator3D&inprogress%3Dfalse eBook Show Me How Current Position Analysis The following items are reported on a company's balance sheet: $365,600 Marketable securities 285,700 Accounts receivable (net) 254,900 Inventory 236,400 Accounts payable 394,000 Determine (a) the current ratio and (b) the quick ratio. Round to one declmal place. a. Current ratio b. Quick ratio Check My Work a. Divide current assets by current liabilities. b. Divide quick assets by current liabilities. Quick assets are cash, temporary investments, and receivables. Check My Work Previous ELE AD dy f4 f12 prt sc 米arrow_forward

- Chapter 6 Assignment - ACCT-2X * CengageNOWv2 | Online teachir x + genow.com/ilrmn/takeAssignment/takeAs gnmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false еВook Lample re makes brass and gold frames. The company computed this information to decide whether to switch from the traditional allocation method to ABC: Brass Gpld units Planed 700 150 Material Moves 300 75 Machine Setups 300 450 Direct Labor Hours 700 1,300 The estimated overhead for the material cost pool is estimated as $8,250, and the estimate for the machine setup pool is $24,000. A. Calculate the allocation rate per unit of brass and per unit of gold using the traditional method? Round intermediate calculations and final answers to two decimal places. Allocation Rate per Unit Brass Gold B. Calculate the allocation rate per unit of brass and per unit of gold using the activity-based costing method? Round intermediate calculations and final answers to two decimal places. Allocation Rate per Unit Brass…arrow_forwardExcel File Edit View Insert Format Tools Data .. AutoSaveB2-C- Home Insert Draw Page Layout - n Paste H16 X 12 13 Calibri (Body) B I U . 14 14 15 16 17 18 19 20 21 33 Ready HY B A B 1 Formulas: Multiply, Add, Divide; Cell Referencing 2 12 Direct labor rate per hour Markup charged on jobs Enter Answer + Accessibility: Investigate Formulas LEOO tab *** A A & A ✓ Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. x ✓ fx Budgeted MOH costs at start of year Budgeted direct labor hours at start of year Estimated hours for new client's job esc BE8.12-Using Excel to Determine Job Cost and Bid Price for a Service 4 Company 5 PROBLEM 6 Jace and Associates provides professional consulting services to a variety of 7 clientele in an effort to help them improve the operating effectiveness and 8 profitability of their businesses. The company's accountant established 9 budgeted direct labor hours as its allocation base. The company is 10…arrow_forwardal Acco X M Question 4 - Comprehensive Pr + heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252F ve Problem 5 i Saved Required information [The following information applies to the questions displayed below.] Jasper Company, a machine tooling firm, has several plants. One plant, located in Saint Cloud, Minnesota, uses a job order costing system for its batch production processes. The Saint Cloud plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $242,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the Saint Cloud plant for the past year are as follows: Budgeted department overhead (excludes plantwide overhead) Actual…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education