FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

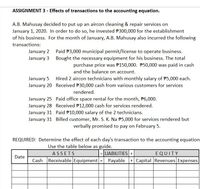

Transcribed Image Text:ASSIGNMENT 3 - Effects of transactions to the accounting equation.

A.B. Mahusay decided to put up an aircon cleaning & repair services on

January 1, 2020. In order to do so, he invested P300,000 for the establishment

of his business. For the month of January, A.B. Mahusay also incurred the following

transactions:

January 2

January 3

Paid P3,000 municipal permit/license to operate business.

Bought the necessary equipment for his business. The total

purchase price was P150,000. P50,000 was paid in cash

and the balance on account.

January 5

January 20 Received P30,000 cash from various customers for services

Hired 2 aircon technicians with monthly salary of P5,000 each.

rendered.

January 25 Paid office space rental for the month, P6,000.

January 28 Received P12,000 cash for services rendered.

January 31 Paid P10,000 salary of the 2 technicians.

January 31 Billed customer, Mr. S. K. Na P5,000 for services rendered but

verbally promised to pay on February 5.

REQUIRED: Determine the effect of each day's transaction to the accounting equation

Use the table below as guide.

|= LIABILITIES+

Cash Receivable Equipment = Payable + Capital Revenues Expenses

ASSETS

EQUITY

Date

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mr. Harrington had a new heating system installed in his office. The balance owing to the heating company is $40,000 which includes equipment and installation fees. The heating company has agreed to let him make individual payments on the account whenever he’d like, but the final balance must be paid two years (24 months) from now. Starting today, interest will accumulate on the balance at 3.45% compounded monthly. Mr. Harrington will make a payment of $8000 4 months from now and $6000 19 months from now. What is the final balance owing on the account in two years (24 months from now)?arrow_forward1. Debbie acquired a franchise to operate a donut shop from Dollar Donuts, Inc., for $100,000. She incurred anadditional $4,000 in legal costs to negotiate the terms with the franchiser. In five years, the franchise contract will berenegotiated. The current contract also states that there will be a $3, 000 annual fee plus a two percent charge basedon the store's annual revenue, which is expected to average 90,000 per year. What is the franchise cost that should becapitalized? a. $88,000 b. $92, 000 c. $100,000 d. $104,000arrow_forward11. Olabisi operates a lawn care service in southeastern Missouri. Olabisi incurs $63,000 of expenses determining the feasibility of expanding the business to southwestern Missouri. If Olabisi expands the business, the $63,000 is deductible in the current year. If Olabisi does not do so, then the $63,000 must be amortized over a 180-month period. True Falsearrow_forward

- During 2021, Stork Associates paid $85,800 for a 20-seat skybox at Veterans Stadium for eight professional football games. Regular seats to these games range from $50 to $150 each. At one game, an employee of Stork entertained 18 clients. Stork furnished food and beverages for the event (provided by a local restaurant) at a cost of $1,800. The game was preceded by a bona fide business discussion, and all expenses are adequately substantiated. How much may Stork deduct for this event?$fill in the blank 1arrow_forwardJoy's House of Cheese (stocks Cougar Cheese) purchases a tract of land and an existing building for $940,000. The company plans to remove the old building and construct a new building on the site in a few months. In addition to the purchase price, Joy's pays closing costs, including title insurance of $2,400. The company also pays $12,800 in property taxes, which includes $8,400 of back taxes (unpaid taxes from previous years) paid by Joy's on behalf of the seller and $4,400 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $47,000 to tear down the old building and remove it from the site. Joy is able to sell salvaged materials from the old building for $3,800 and pays an additional $10,400 to level the land to make it ready for use. Required: Determine the amount Joy's should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) Total cost of the land $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education