Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

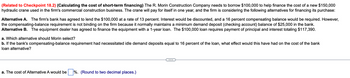

Transcribed Image Text:(Related to Checkpoint 18.2) (Calculating the cost of short-term financing) The R. Morin Construction Company needs to borrow $100,000 to help finance the cost of a new $150,000

hydraulic crane used in the firm's commercial construction business. The crane will pay for itself in one year, and the firm is considering the following alternatives for financing its purchase:

Alternative A. The firm's bank has agreed to lend the $100,000 at a rate of 13 percent. Interest would be discounted, and a 16 percent compensating balance would be required. However,

the compensating-balance requirement is not binding on the firm because it normally maintains a minimum demand deposit (checking account) balance of $25,000 in the bank.

Alternative B. The equipment dealer has agreed to finance the equipment with a 1-year loan. The $100,000 loan requires payment of principal and interest totaling $117,390.

a. Which alternative should Morin select?

b. If the bank's compensating-balance requirement had necessitated idle demand deposits equal to 16 percent of the loan, what effect would this have had on the cost of the bank

loan alternative?

a. The cost of Alternative A would be %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a failing bank. How much is a deposit of $300,000 if the CDIC uses the payoff method? The purchase-and-assumption method? Which method is more costly to taxpayers? Using the payoff method, the $300,000 deposit is worth $ (Round to the nearest dollar) Using the purchase-and-assumption method, a deposit of $300,000 is worth $ (Round to the nearest dollar) Which method is more costly to taxpayers? Select the best answer: A. The payoff method is more costly, since taxpayers will only pay $0.10 on the dollar. B. The purchase and assumption method is more costly, because depositors receive the full value of their deposits. C. The purchase and assumption method is more costly, because depositors will refuse to keep account balances in excess of $100,000 in a single bank. D. The payoff method is more costly, since the cost to insure the fund will be lower.arrow_forwardHow does compound interest affect the loans you undertake? For example, how would this affect student loans that are currently in deferral?arrow_forwardQ4: From the standpoint of a borrower, is long-term or short-term credit riskier?arrow_forward

- How might thetreasurer of a multinational firm use the interest rate parity concept (a) when deciding howto invest the firm’s surplus cash and (b) whendeciding where to borrow funds on a short-termbasis?arrow_forwardThe borrowing base used to guarantee collateral on an operating line of credit is highly dependent on the valuation rates allowed on short-term assets by the lender. A. True B. Falsearrow_forward6) Bruce the Bank Manager can reduce interest rate risk by assets to increase their rate sensitivity or, alternatively, liabilities. A) shortening; lengthening B) shortening; shortening C) lengthening; lengthening D) lengthening; shortening the duration of the bank's the duration of the bank'sarrow_forward

- If a bank wants to shorten its asset duration, what type of risk is the bank concerned about? Group of answer choices Off balance sheet risk. The risk of rising interest rates. The risk of falling interest rates. Foreign exchange rate risk.arrow_forwardFractional reserve banking refers to a banking system in which bank loans are less than bank reserves. bank deposits are less than bank reserves. bank reserves are less than total deposits. bank reserves are only a fraction of required reserves.arrow_forwardWhat risks might commercial banks face if they use short-term deposits from savers to pay for long-term loans, like mortgages, that often have fixed interest rates? What could the financial institution do to lower these risks?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education