Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

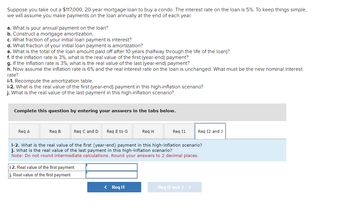

Transcribed Image Text:Suppose you take out a $117,000, 20-year mortgage loan to buy a condo. The interest rate on the loan is 5%. To keep things simple,

we will assume you make payments on the loan annually at the end of each year.

a. What is your annual payment on the loan?

b. Construct a mortgage amortization.

c. What fraction of your initial loan payment is interest?

d. What fraction of your initial loan payment is amortization?

e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)?

f. If the inflation rate is 3%, what is the real value of the first (year-end) payment?

g. If the inflation rate is 3%, what is the real value of the last (year-end) payment?

h. Now assume the inflation rate is 6% and the real interest rate on the loan is unchanged. What must be the new nominal interest

rate?

i-1. Recompute the amortization table.

i-2. What is the real value of the first (year-end) payment in this high-inflation scenario?

j. What is the real value of the last payment in this high-inflation scenario?

Complete this question by entering your answers in the tabs below.

Req A

Req B

Req C and D Req E to G

i-2. Real value of the first payment

j. Real value of the first payment

Req H

< Req 11

Req 11

i-2. What is the real value of the first (year-end) payment in this high-inflation scenario?

j. What is the real value of the last ayment in this high-inflation scenario?

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Req 12 and J

Req 12 and J >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ordinary annuity, annuity due, perpetuity, growing annuity or amortization topics. Then describe steps involved in calculating it and provide an example using your financial calculator. there is a difference between EAR and APR when compounding interest. Describe this difference. Assume you are a financial investor and have to advise a customer on the difference. How would you describe the differences to them and what would you advise?arrow_forward8. How do rising interest rates affect the size of real estate loans that lenders will advance?Again, be specific.arrow_forwardWhat are the Effects of Maturity on Monthly Payments on Fully Amortizing Loans?arrow_forward

- Answer the following questions: REGARDING AMLS A: What is the difference between an interest rate change cap and a life of loan interest rate change cap.? Be specific and give an example. B: What is the rationale/consideration in not using the initial interest rate for the rate used to qualify a borrower?arrow_forwardWhat is meant by a “purchase-money” mortgage loan? When could a loan not be a purchase-money mortgage loan?arrow_forwardWhen you borrow money, you typically have to pay an interest rate. What does interest represent? a) The cost of borrowing money b) The profit earned on an investment c) A bank fee d) A penalty for late payment????arrow_forward

- If an interest rate of 8.9% compounded semi-annually is charged on a car loan, what effective rate of interest should be disclosed to the borrower?arrow_forwardIf an installment loan is paid in full before the maturity date, the full amount of interest on the loan must still be paid. False O Truearrow_forwardExplain Fully Amortizing, Constant Payment Mortgage (CPM) Loans?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education