Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

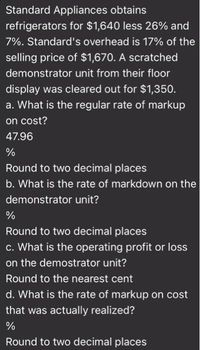

Transcribed Image Text:Standard Appliances obtains

refrigerators for $1,640 less 26% and

7%. Standard's overhead is 17% of the

selling price of $1,670. A scratched

demonstrator unit from their floor

display was cleared out for $1,350.

a. What is the regular rate of markup

on cost?

47.96

%

Round to two decimal places

b. What is the rate of markdown on the

demonstrator unit?

Round to two decimal places

c. What is the operating profit or loss

on the demostrator unit?

Round to the nearest cent

d. What is the rate of markup on cost

that was actually realized?

%

Round to two decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following equations is correct for determining the required sales in units to generate a targeted amount of pre-tax income (πB) under the equation method (where Q = sales in units, F = total fixed costs, πB = pre-tax profit, v = variable cost per unit, and p = selling price per unit)?arrow_forward1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $48,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage?arrow_forwardNow suppose that annual unit sales, variable cost, and unit price are equal to their respective expected values—that is, there is no uncertainty. Determine the company's annual profit for this scenario. Round answer to a whole number, if needed.$arrow_forward

- using the price p=20 - .05x, use the Revenue function to find the marginal Revenue function R'(x), Find a. R'(100)= b. R'(175)= c. R'(250)= The marginal Revenue R'(x) approximates how the revenue will change on the sale of the next item. a. Given R(100) = 642 and R'(100)= 18 then R(101) ≈ b. Given R(400) = 16,250 and R'(400)= -10 then R(401) ≈ c. Given R(1000) = 3500 and R'(1000) = 3 then R(1001) ≈arrow_forwardPlease solve accurately. Thank youarrow_forwardThe contribution margin equals sales minus all O period O variable O fixed O product expenses.arrow_forward

- Crex Co was set up by Cynthia Rex who created her own brand of chalk paint 20 years ago. Using her background in fine art, she developed this specialist chalk paint to be used in the restoration of furniture and to decorate accessories. The chalk paints are exclusively available through Crex Co's network of over 800 independent stockists who are located in over 30 countries around the world. The manufacturing process begins with the three chemicals required for the paint being measured on electronic scales. A worker then takes the chemicals and places them into a machine for mixing. Once mixed the worker removes the mixture from the machine and transfers it to tin containers. The standard material costs per litre of chalk paint are as follows: Litres required $ per litre 0.80 1.20 0.15 1.40 0.10 0.80 1.05 Material Latex paint Plaster of Paris Calcium carbonate At the end of the last period, actual output of the chalk paint was 3,325 litres and actual data relating to this production…arrow_forwardHelp4arrow_forwardWhat are the answers for the following? Construct a cost-volume-profit chart on your own paper. What is the break-even sales? What is the expected margin of safety in dollars and as a percentage of sales? Determine the operating leverage. Round to one decimal place.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education