Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

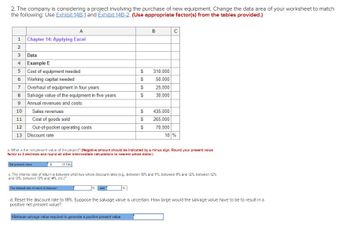

Transcribed Image Text:2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match

the following: Use Exhibit 14B-1 and Exhibit 14B-2. (Use appropriate factor(s) from the tables provided.)

A

1 Chapter 14: Applying Excel

2

3

Data

4 Example E

5

6 Working capital needed

7 Overhaul of equipment in four years

8

009

10

11

12

13

Cost of equipment needed

Salvage value of the equipment in five years

Annual revenues and costs:

Sales revenues

Cost of goods sold

Out-of-pocket operating costs

Discount rate

Net present value

S

The internal rate of ratum is between

$

$

and

$

$

$

$

$

B

310,000

50,000

25,000

30,000

a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value

factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.)

(1.734)

c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12 %, between 12%

and 13%, between 13% and 14%, etc.)?

435,000

265,000

с

70,000

18 %

d. Reset the discount rate to 18 % . Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a

positive net present value?

Minimum salvage value required to generate a positive present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following project: Period Net cash flow 0 -100 1 0 2 78.55 3 78.55 The internal rate of return is 20%. The NPV, assuming a 20% opportunity cost of capital, is exactly zero. Calculate the expected economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) 1 Period 2 3 Change in value (economic depreciation) (20.00) 54.55 65.46 Expected economic incomearrow_forward28) ABC Corporation is concerned that the following project has some problem with IRR. Year 0 1 2 4 5 -150-120 CF_Project 700 -100-90 How many discount rates produce a zero NPV for this project? A) One, a discount rate of 0% B) One, a discount rate of 36% C) One, a discount rate of 69% D) Two, discount rates of 0% and 36% E) Two, discount rates of 0% and 69% F) Two, discount rates of 36% and 69% G) None H) None of the above 29) ABC Corporation is considering an investment of $400 million with expected after-tax cash inflows of $102 million per year for seven years. The required rate of return is 10%. However, there is a possibility that the project will not get the required level of investments and ABC Corporation will have no other choice but to proceed with available funding (90% of the required investments). In this case, the after-tax cash inflows of $91,8 million per year are expected for seven years. As a result, on the NPV profile of a project: A) the vertical intercept shifts…arrow_forwardREQUIRED Study the information given below and answer the following questions: 1. Calculate the Payback Period (expressed in years, months and days). 2. Calculate the Accounting Rate of Return on average investment (expressed to two decimal places). 3. Identify TWO (2) reasons why Umdloti Limited should not use the accounting rate of return to evaluate capital investments. 4. Calculate the Net Present Value. 5. Calculate the Internal Rate of Return (expressed to two decimal places) if the net cash flows are R320 000 per year for five years. Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation.arrow_forward

- i need in words not handwritten sol assume any interest rate but please do anythingarrow_forward1- Find the internal rate using the method of Internal Rate of Return (IRR) if i= 15%, for the table shown below. If the initial cost is (220,000 U) Cost (U) 350 380 400 500 550 470 780 650 690 450 Revenue 0 0 500 1000 770 450 880 660 890 770 (U) 1 2 3 Year 4 5 6 7 8 9 10arrow_forwardConsider the following project: Period 0 1 2 3 Net cash flow −275 0 96.55 327.48 The internal rate of return is 17%. The NPV, assuming a 17% opportunity cost of capital, is exactly zero. Calculate the expected economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forward

- am. 233.arrow_forwardDetermine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2 3. 4. Future Amount $ $ $ $ 32,000 26,000 37,000 52,000 i= 5% 6% 11% 10% n = 11 19 40 13 Present Valuearrow_forwardFind the profitability index for Oman Clothing Company if the initial investment is 700 OMR and the cash Inflows are as follows: Year 1 =350 OMR; Year 2 =400 OMR; Year 3=450 OMR and Year 4=500 OMR. Use discount rate as 10%. Select one: a. 1.15 b. 1.41 c. None of the options d. 1.89 e. 2.89arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education