ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a. What increase in aggregate demand is necessary to achieve this?

$

15 billions.

b. If successful, what will be the growth rate? Round your answer below to 2 decimal places.

%

c. If successful, what will be the inflation rate? Round your answer below to 2 decimal places.

8.33

%

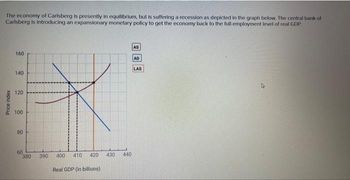

Transcribed Image Text:The economy of Carlsberg is presently in equilibrium, but is suffering a recession as depicted in the graph below. The central bank of

Carlsberg is introducing an expansionary monetary policy to get the economy back to the full-employment level of real GDP.

Price index

160

140

120

100

80

60

380

390 400 410 420

Real GDP (in billions)

430

440

AS

AD

LAS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- An unanticipated increase in inflation can a. reduce the real interest rate earned by lenders. b. make creditors better off. c. make debtors worse off. d. make workers who signed contracts at the beginning of the year better off. e. lead to a higher purchasing power for the currency.arrow_forwarda. Examine the fundamental causes of a nation’s business cycle fluctuations. Also, examine the relationship between total spending by government and consumers in a nation and the location of the countries’ GDP on the business cycle. b. 1. Suppose you have $200,000 in a bank term account. You earn 5% interest per annum from this account.You anticipate that the inflation rate will be 4% during the year. However, the actual inflation rate for the year is 6%.Calculate the impact of inflation on the bank term deposit you have and examine the effects of inflation in your city of residence with attention to food and accommodation expenses. 2. The Australian Bureau of Statistics (ABS) reported in May 2017 that the civilian population in Australia over 15 years of age was 20.8 million.Of this population of 20.8 million Australians, 13.5 million were employed and 0.7 million were unemployed.Calculate Australia’s labor force and the number of people in the civilian population who were not in…arrow_forwardSuppose both nominal GDP rises by 10 percent and real GDP rise by 2percent. What has happened to the general price level? What is the inflationrate? Show your calculation.arrow_forward

- Inflation and international tradeIdentify which statements are true and which ones are false. For all statements, briefly explain why they are true or false. a) Economists projected inflation rate to be 4% in 2022 in country X. In reality, inflation rate was 7%. Borrowers in country X are better off.b) The government in country X decided to print more money and give transfers of $1,000 to citizens who recently retired. It will cause a decrease in money supply, so the value of money will increase, and prices will decrease.c) Countries X and Y are neighbors. When the government in country X decides to print more money, the value of currency of country Y increases, so this currency appreciates, while the currency of country X depreciates.d) Budget surplus in country X causes a shift of the supply curve for loanable funds to the left, so the real interest rate increases. Then, the net capital outflow decreases, and hence the real exchange rate decreasesarrow_forwardImagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, how much would you be able to buy with the money in this account?A. More than todayB. Exactly the sameC. Less than todayarrow_forwardHigh inflation could be a problem to business firms. Explain THREE costs of inflation that could adversely affect business operations.arrow_forward

- 3. Consider the relative PPP. If Foreign country's inflation rate is 5% and E changes by 2%, how much in % is Home's inflation rate?arrow_forwardAnswer is near about 7 , please show your work how to solve this ( Thanks in advance)arrow_forwardWho would inflation affect the least? O Students with student loan debt O The employee of a local shop who receives a non-adjusted salary O Creditors O Your grandmother who keeps money under her mattressarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education