CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

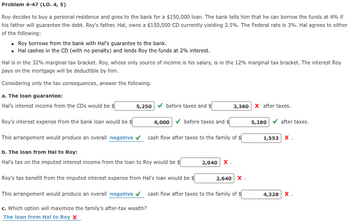

Transcribed Image Text:Problem 4-47 (LO. 4, 5)

Roy decides to buy a personal residence and goes to the bank for a $150,000 loan. The bank tells him that he can borrow the funds at 4% if

his father will guarantee the debt. Roy's father, Hal, owns a $150,000 CD currently yielding 3.5%. The Federal rate is 3%. Hal agrees to either

of the following:

• Roy borrows from the bank with Hal's guarantee to the bank.

Hal cashes in the CD (with no penalty) and lends Roy the funds at 2% interest.

Hal is in the 32% marginal tax bracket. Roy, whose only source of income is his salary, is in the 12% marginal tax bracket. The interest Roy

pays on the mortgage will be deductible by him.

Considering only the tax consequences, answer the following.

a. The loan guarantee:

Hal's interest income from the CDs would be $

before taxes and $

6,000 ✓ before taxes and $

Roy's interest expense from the bank loan would be $

This arrangement would produce an overall negative ✓ cash flow after taxes to the family of $

b. The loan from Hal to Roy:

Hal's tax on the imputed interest income from the loan to Roy would be $

Roy's tax benefit from the imputed interest expense from Hal's loan would be $

2,640 X.

This arrangement would produce an overall negative cash flow after taxes to the family of $

c. Which option will maximize the family's after-tax wealth?

The loan from Hal to Roy X

5,250

2,040 X.

3,360 X after taxes.

5,280✔ after taxes.

1,553 X.

4,328 X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dina loans $24,000 to her daughter Erin and does not charge any interest. Erin has investment income of $1,400 and investment expenses of $300. Assume that the applicable federal rate is 5%. How much interest must be imputed on the loan? 1. $1,000. 2. $1,100. 3. $1,200. 4. $1,400. Ⓒ$1,100. $1,200. $1,400. $1,000.arrow_forward(20) Please show how you got a. the first cell of column 3 b. how you got the first cell of column 4 c. how you got the first cell of column 5 d. how you got the second cell of column 3 e. how you got the second cell of column 4 f. how you got the second cell of column 5arrow_forwardCarlos opens a dry cleaning store during the year. He invests 30,000 of his own money and borrows 60,000 from a local bank. He uses 40,000 of the loan to buy a building and the remaining 20,000 for equipment. During the first year, the store has a loss of 24,000. How much of the loss can Carlos deduct if the loan from the bank is nonrecourse? How much does Carlos have at risk at the end of the first year?arrow_forward

- mn.3arrow_forwardRob asks his good friend Ted to borrow $5,000 and says he will pay it back to him in 6 months with 8% interest, meaning Rob will owe Ted $5,200 if he pays it back at that time. Ted asks Rob to "make" a promissory note payable to Ted stating these terms. Rob does prepare the "note" and signs and gives it to Ted and at the same time Ted gives Rob the $5,000. Ted in need of money unexpectedly, because he loses his job, contacts his buddy Gullible, and asks him if he will buy the note at a discount of $4,800. Gullible accepts and stands to make a nice profit when the note owed by Rob comes due. When Gullible gives Ted the $4,800, Ted writes on the note "Without Recourse" and signs his name and tenders the note to Gullible. Gullible does see Ted write this on the note, but is not sophisticated with regard to legal lingo, and thinks nothing of it. He therefater gets nervous and thinks maybe he should sell the note himself right away. He calls his aunt Saviour who says she will buy the…arrow_forwardJohn borrows $700 from a bank. He promises to pay $749 in 1 year's time. How much interest is john being charged by the bank?arrow_forward

- Chapter 4, Question 9. Please see attachedarrow_forwardHi, I attached an image of a question. could you please explain how to solve it? Thanks in advance!arrow_forwardDan buys a property for $290,000. He is offered a 20-year loan by the bank, at an interest rate of 6% per year. What is the annual loan payment Dan must make? A. $35,396.93 B. $30,340.22 C. $25,283.52 D. $40,453.63arrow_forward

- Please answer.upvote for surearrow_forwardYour are in need of cash and turn to your cousin, who offered to lend you some money. You decide to borrow $1450 and agree to pay back $1660 in two years? Rate of interest charged by cousin ?arrow_forward1. Robert borrowed a certain sum of money from Joey on June 1, 1994 and signed a note promising to pay him a total of P 20,000 at the end of 5 years. Joey sold this promissory note to Peter on June 1, 1997. If Peter insists on discounting the note at 5% compounded quarterly, what will he pay for the note? 2. In this regard to the promissory note on Problem 1, Robert gets permission to delay his payment until June 1, 2999, under the assumption that money is worth 5% compounded quarterly after the note measures. What final payment is Robert required to make?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you