FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

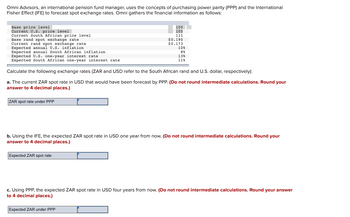

Transcribed Image Text:Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International

Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:

Base price level

Current U.S. price level

Current South African price level

Base rand spot exchange rate

Current rand spot exchange rate

Expected annual U.S. inflation

Expected annual South African inflation.

Expected U.S. one-year interest rate

Expected South African one-year interest rate

ZAR spot rate under PPP

100

105

111

$0.190

$0.173

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively):

a. The current ZAR spot rate in USD that would have been forecast by PPP. (Do not round intermediate calculations. Round your

answer to 4 decimal places.)

Expected ZAR spot rate

10%

8%

138

11%

b. Using the IFE, the expected ZAR spot rate in USD one year from now. (Do not round intermediate calculations. Round your

answer to 4 decimal places.)

c. Using PPP, the expected ZAR spot rate in USD four years from now. (Do not round intermediate calculations. Round your answer

to 4 decimal places.)

Expected ZAR under PPP

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 9 images

Knowledge Booster

Similar questions

- Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.62%, E(2r1) = 3.90%, E(3r1) = 4.40%, E(4r1) = 5.90%Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forwardPlease answer and provide solutions for three questions. 1. Given i(26) = 3.150%, find the equivalent nominal interest rate compounded quarterly. 2. Given an effective quarterly rate of 2.22500%, find the equivalent effective semi-annual rate. (You might need to keep more than the usual number of decimal places!) 3. Given an effective quarterly rate of 1.25000%, find the equivalent nominal rate i(2).arrow_forwardSuppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.50%, E(2r1) = 3.75%, E(3r1) = 4.25%, E(4r1) = 5.75% Using the unbiased expectations theory, calculate the current (long-term) rates for 1-, 2-, 3-, and 4-year-maturity Treasury securitiesarrow_forward

- Suppose 1-year T-bills currently yield 7.00% and the future inflation rate is expected to be constant at 2.00% per year. What is the real risk-free rate of return, r*? The cross-product term should be considered , i.e., if averaging is required, use the geometric average. (Round your final answer to 2 decimal places.)arrow_forwardplease do the following questions with full workingarrow_forwardBaghibenarrow_forward

- Nonearrow_forwardUsing below information: Current spot rate CAD1 = USD 0.95 Annual interest rate in Canada: 2% Annual interest rate in US: 6% Applying International Fishier Effect theory, what should be the expected future spot rate for CAD? Use 4 numbers after decimal point.arrow_forwardSolve for the unknown interest rate in each of the following (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.):arrow_forward

- Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (ie.. years 2, 3, and 4, respectively) are as follows: 181 = 4%, E(201) = 5%, E(31) = 5.50 %, E(41) = 5.85% Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Round your answers to 2 decimal places.) Years AGN- Current (Long-term) Ratesarrow_forwardCurrent interest rates are i$ = 4%;i€ = 6%. Expected interest rates next year are: i$ = 7%;i € = 3%. The expected spot rate in two years is S2($/€) = 1. Use the asset market approach to compute the current spot rate S0($/€). Please type in the number without the currency signs. For example, if your answer is $1.25/€, then type in 1.25 as your final answer. Please keep at least three decimal places (up to 5 decimal places)arrow_forwardSuppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.62%, E(2r1) = 3.90%, E(3r1) = 4.40%, E(4r1) = 5.90%Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education