FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

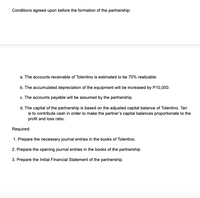

Transcribed Image Text:Conditions agreed upon before the formation of the partnership:

a. The accounts receivable of Tolentino is estimated to be 70% realizable.

b. The accumulated depreciation of the equipment will be increased by P10,000.

c. The accounts payable will be assumed by the partnership.

d. The capital of the partnership is based on the adjusted capital balance of Tolentino. Tan

is to contribute cash in order to make the partner's capital balances proportionate to the

profit and loss ratio.

Required:

1. Prepare the necessary journal entries in the books of Tolentino.

2. Prepare the opening journal entries in the books of the partnership

3. Prepare the Initial Financial Statement of the partnership.

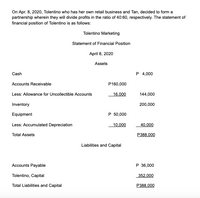

Transcribed Image Text:On Apr. 8, 2020, Tolentino who has her own retail business and Tan, decided to form a

partnership wherein they will divide profits in the ratio of 40:60, respectively. The statement of

financial position of Tolentino is as follows:

Tolentino Marketing

Statement of Financial Position

April 8, 2020

Assets

Cash

P 4,000

Accounts Receivable

P160,000

Less: Allowance for Uncollectible Accounts

16,000

144,000

Inventory

200,000

Equipment

P 50,000

Less: Accumulated Depreciation

10,000

40,000

Total Assets

P388,000

Liabilities and Capital

Accounts Payable

P 36,000

Tolentino, Capital

352,000

Total Liabilities and Capital

P388,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dengerarrow_forwardhow do i calculate remainder to allocate?arrow_forwardAssume the G&L partnership forms with cash contributions of $100,000 each from G and L. The partnership then borrows $800,000 on a nonrecourse loan and purchases a building on leased land for $ 1,000,000. Assume that the building is rented and that annual cash revenues equal cash expenses but depreciation of $50,000 per year results in a $50,000 annual loss. All items of income, loss, and deduction are shared equally. When is the first year that the partnership will record Partnership Minimum Gain ( PMG)? Please don't use any AI. It's strictly prohibited. Help me out asap Thanksarrow_forward

- Assume the G&L partnership forms with cash contributions of $100,000 each from G and L. The partnership then borrows $800,000 on a nonrecourse loan and purchases a building on leased land for $1,000,000. Assume that the building is rented and that annual cash revenues equal cash expenses but depreciation of $50,000 per year results in a $50,000 annual loss. All items of income, loss, and deduction are shared equally. When is the first year that the partnership will record Partnershiparrow_forward2. Hammer and Nail formed a partnership. Hammer contributed equipment with original cost of P370,000 and fair value of P300,000 while Nail contributed cash of P180,000. Hammer and Nail agreed to have a 60:40 interest in the partnership and that their initial capital credits should reflect this fact. A partner's capital account should be increased accordingly by way of additional cash investment. Which of the partners should make an additional investment and by how much? a. Hammer, P20,000 b. Nail, P20,000 c. Hammer, P70,000 d. Nail, P70,000arrow_forwarda. Prepare a profit distribution account for the year ended 31 October 2021. b. Prepare the partners' current accounts (in columnar form) for the year to 31 October 2021. c. (Note: All the figures must be rounded up to the nearest RM) note i need the answer in full format thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education