FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please Do not Give image format

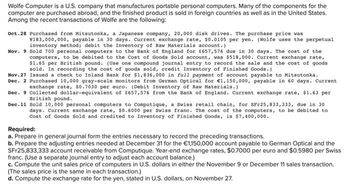

Transcribed Image Text:Wolfe Computer is a U.S. company that manufactures portable personal computers. Many of the components for the

computer are purchased abroad, and the finished product is sold in foreign countries as well as in the United States.

Among the recent transactions of Wolfe are the following:

Oct.28 Purchased from Mitsutonka, a Japanese company, 20,000 disk drives. The purchase price was

¥183,000,000, payable in 30 days. Current exchange rate, $0.0105 per yen. (Wolfe uses the perpetual

inventory method; debit the Inventory of Raw Materials account.)

Nov. 9 Sold 700 personal computers to the Bank of England for £657,576 due in 30 days. The cost of the

computers, to be debited to the Cost of Goods Sold account, was $518,000. Current exchange rate,

$1.65 per British pound. (Use one compound journal entry to record the sale and the cost of goods

sold. In recording the cost of goods sold, credit Inventory of Finished Goods.)

Nov. 27

Issued a check to Inland Bank for $1,836,000 in full payment of account payable to Mitsutonka.

Dec. 2 Purchased 10,000 gray-scale monitors from German Optical for €1,150,000, payable in 60 days. Current

exchange rate, $0.7030 per euro. (Debit Inventory of Raw Materials.)

Dec. 9 Collected dollar-equivalent of £657,576 from the Bank of England. Current exchange rate, $1.63 per

British pound.

Dec.11 Sold 10,000 personal computers to Computique, a Swiss retail chain, for SFr25,833,333, due in 30

days. Current exchange rate, $0.6000 per Swiss franc. The cost of the computers, to be debited to

Cost of Goods Sold and credited to Inventory of Finished Goods, is $7,400,000.

Required:

a. Prepare in general journal form the entries necessary to record the preceding transactions.

b. Prepare the adjusting entries needed at December 31 for the €1,150,000 account payable to German Optical and the

SFr25,833,333 account receivable from Computique. Year-end exchange rates, $0.7000 per euro and $0.5980 per Swiss

franc. (Use a separate journal entry to adjust each account balance.)

c. Compute the unit sales price of computers in U.S. dollars in either the November 9 or December 11 sales transaction.

(The sales price is the same in each transaction.)

d. Compute the exchange rate for the yen, stated in U.S. dollars, on November 27.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education