FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a. On October 1, the Business Students' Society (BSS) placed an order for 170 golf shirts at a unit cost of $30, under

terms 2/10, n/30.

b. The order was received on October 10, but some golf shirts differed from what had been ordered. Uncertain whether

the shirts would be returned or kept, BSS decided to record any purchase discount only when taken (using the gross

method).

c On October 11, 30 golf shirts were returned to the supplier.

d On October 12, BSS complained the remaining golf shirts were slightly defective so the supplier granted a $200

allowance.

e. BSS paid for the golf shirts on October 13.

*. During the first week of October, BSS received student and faculty orders for 140 golf shirts, at a unit price of $67, on

terms 2/10, n/30.

g. The golf shirts were delivered to these customers on October 18. Unfortunately, customers were unhappy with the golf

shirts, so BSS permitted them to be returned or given an allowance (see hand. Uncertain whether customers would

keep or return the shirts, BSS decided to record any sales discount only when taken (using the gross method).

h. On October 19, one-half of the golf shirts were returned by customers to BSS.

Required:

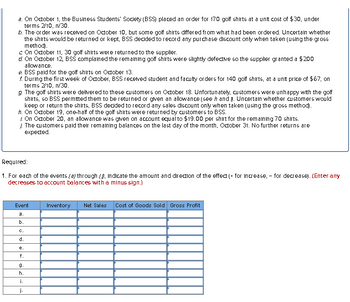

1. For each of the events (a) through , Indicate the amount and direction of the effect (+ for increase, for decrease). (Enter any

decreases to account balances with a minus sign.)

Event

a.

b.

On October 20, an allowance was given on account equal to $19.00 per shirt for the remaining 70 shirts.

The customers paid their remaining balances on the last day of the month, October 31. No further returns are

expected.

C.

d.

f.

g.

h.

i.

j.

Inventory Net Sales Cost of Goods Sold Gross Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A retailer ordered 20 sets of dining table and received an invoice dated 25 March 2009 for RM15,000 including the transportation cost with cash discount terms of 7/15, n/30 and trade discount 8% and 4%. The transportation cost was RM1,584. i) Find the last date to receive the cash discount. ii) Calculate the net price for 20 sets of dining table. iii) Determine the total payment if the retailer pays the invoice on 8 April 2009arrow_forwardButtons and Bows received a shipment with a list price of $2,600. The store received a trade discount of 25/15. How much does the store need to pay for this shipment?arrow_forwardOn March 30, Century Link received an invoice dated March 28 from ACME Manufacturing for 67 televisions at a cost of $150 each. Century received a 15/7/4 chain discount. Shipping terms were FOB shipping point. ACME prepaid the $127 freight. Terms were 2/10 EOM. When Century received the goods, 2 sets were defective. Century returned these sets to ACME. On April 8, Century sent a $195 partial payment. Century will pay the balance on May 6. What is Century’s final payment on May 6? Assume no taxes. (Do not round intermediate calculations. Round your answer to the nearest cent.)arrow_forward

- Review the following sales transactions for Dish Mart and record any required journal entries. Note that all sales transactions are with the same customer, Emma Purcell. Mar. 5 Dish Mart made a cash sale of 14 sets of dishes at a price of $900 per set to customer Emma Purcell. The cost per set is $450 to Dish Mart. Mar. 9 Dish Mart sold 30 sets of dishes to Emma for $850 per set on credit, at a cost to Dish Mart of $420 per set. Terms of the sale are 10/15, n/60, invoice date March 9. Mar. 13 Emma discovers 8 of the dish sets are damaged from the March 9 sale and returns them to Dish Mart for a full refund. Mar. 14 Dish Mart sells 7 sets of dishes to Emma for $870 per set on credit, at a cost to Dish Mart of $420 per set. Terms of the sale are 10/10, n/60, invoice date March 14. Mar. 15 Emma discovers that 3 of the dish sets from the March 14 purchase and 7 of the dish sets from the March 5 sale are missing a few dishes but keeps them since Dish Mart granted an allowance of…arrow_forwardWarwick’s Co., a women’s clothing store, purchased $75,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Warwick’s returned $9,000 of the merchandise, receiving a credit memo. Journalize Warwick’s entries to record (a) the purchase, (b) the merchandise return, and (c) the payment within the discount period of ten days, and (d) payment beyond the discount period of ten days. Refer to the Chart of Accounts for exact wording of account titles. For grading purposes use December 31 as the date for all transactions. Chart of Accounts CHART OF ACCOUNTS Warwick’s Co. General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 131 Estimated Returns Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation-Office Equipment…arrow_forwardReview the following sales transactions for Dish Mart and record any required journal entries. Note that all sales transactions are with the same customer, Emma Purcell. Mar. 5 Dish Mart made a cash sale of 14 sets of dishes at a price of $700 per set to customer Emma Purcell. The cost per set is $460 to Dish Mart. Mar. 9 Dish Mart sold 30 sets of dishes to Emma for $650 per set on credit, at a cost to Dish Mart of $430 per set. Terms of the sale are 10/15, n/60, invoice date March 9. Mar. 13 Emma discovers 8 of the dish sets are damaged from the March 9 sale and returns them to Dish Mart for a full refund. Mar. 14 Dish Mart sells 7 sets of dishes to Emma for $670 per set on credit, at a cost to Dish Mart of $410 per set. Terms of the sale are 10/10, n/60, invoice date March 14. Mar. 15 Emma discovers that 3 of the dish sets from the March 14 purchase and 7 of the dish sets from the March 5 sale are missing a few dishes but keeps them since Dish Mart granted an allowance of $220 per…arrow_forward

- The following transactions were selected from among those completed by Bear's Retail Store: November 20 Sold two items of merchandise to Cheryl Jahn, who paid the $2,200 sales price in cash. The goods cost Bear's $1,200. November 25 Sold 20 items of merchandise to Vasko Athletics at a selling price of $7,600 (total); terms 3/10, n/30. The goods cost Bear's $4,300. November 28 Sold 10 identical items of merchandise to Nancy's Gym at a selling price of $8,000 (total); terms 3/10, n/30. The goods cost Bear's $4,900. November 29 Nancy's Gym returned one of the items purchased on the 28th. The item was in perfect condition and credit was given to the customer on account. No further returns are expected. December 6 Nancy's Gym paid the account balance in full. December 30 Vasko Athletics paid in full for the invoice of November 25. Required: Prepare journal entries to record the transactions, assuming Bear's Retail Store records discounts using the gross method in a perpetual inventory…arrow_forwardThe original price of a Honda Shadow to the dealer was $17,045, but the dealer will pay only $16,335 after rebate. If the dealer pays Honda within 15 days, there is a 1% cash discount. a. How much is the rebate? Answer is complete and correct. Amount of rebate $ 710 b. What percent is the rebate? Note: Round your answer to the nearest hundredth percent. X Answer is complete but not entirely correct. Percentage of rebate 4.00 × %arrow_forwardAssume Bella Donna's General Store bought, on credit, a truckload of merchandisc from American Wholesaling costing $3,960. The company paid $170 in transportation cost to National Trucking to deliver the morchandise to Bella Donna. Bella Donna immediately returned goods to Amorican Wholesaling costing $690, and then took advantage of American Wholesaling's 1/10, n/30 purchase discount. At the end of the period the inventory account will have a balance of $arrow_forward

- The following transactions occurred over the months of September to December at Nicole's Getaway Spa (NGS). September Sold spa merchandise to Ashley Welch Beauty for $1,850 on account; the cost of these goods to NGS was $920. October Sold merchandise to Kelly Fast Nail Gallery for $478 on account; the cost of these goods to NGS was $210. November Sold merchandise to Raea Gooding Wellness for $320 on account; the cost of these goods to NGS was $200. December Received $1,230 from Ashley Welch Beauty for payment on its account. Required: 1. Prepare journal entries for each of the transactions. Assume a perpetual inventory system. 2. Estimate the Allowance for Doubtful Accounts required at December 31, assuming the only receivables outstanding at December 31 arise from the transactions listed above. NGS uses the aging of accounts receivable method with the following uncollectible rates: one month, 3%; two months, 5%, three months, 20%; more than three months, 30%. 3. The Allowance for…arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education