FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:omework

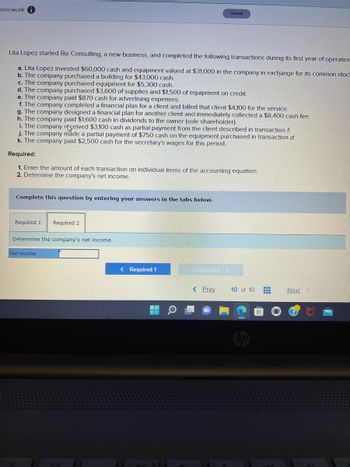

Lita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of operation

a. Lita Lopez invested $60,000 cash and equipment valued at $31,000 in the company in exchange for its common stock

b. The company purchased a building for $43,000 cash.

c. The company purchased equipment for $5,300 cash.

d. The company purchased $3,600 of supplies and $1,500 of equipment on credit.

e. The company paid $870 cash for advertising expenses.

f. The company completed a financial plan for a client and billed that client $4,100 for the service.

g. The company designed a financial plan for another client and immediately collected a $8,400 cash fee.

h. The company paid $1,600 cash in dividends to the owner (sole shareholder).

i. The company received $3,100 cash as partial payment from the client described in transaction f

j. The company made a partial payment of $750 cash on the equipment purchased in transaction d.

k. The company paid $2,500 cash for the secretary's wages for this period.

Required:

1. Enter the amount of each transaction on individual items of the accounting equation.

2. Determine the company's net income.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Determine the company's net income.

Net income

Saved

< Required 1

Q

ING12 >

< Prev

10 of 10 #

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 38arrow_forwardQuestion 14: Based on the wage-bracket method, the federal income tax withholding for an employee who is married, is paid biweekly, completed the pre-2020 Form W-4, claims 2 federal withholding allowances, and earns $1,899 is $arrow_forwardThe following events occurred for Favata Company: a. Received $14,000 cash from owners and issued stock to them. b. Borrowed $11,000 cash from a bank and signed a note due later this year. c. Bought and received $1,200 of equipment on account. d. Purchased land for $20,000; paid $1,800 in cash and signed a long-term note for $18,200. e. Purchased $7,000 of equipment; paid $1,800 in cash and charged the rest on account. Required: For each of the above events, prepare journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 Transaction a 2 Received $14,000 cash from owners and issued stock to them. Record the transaction. Note: Enter debits before credits. 3 4 Record entry 5 General Journal Clear entry Debit Credit View general journalarrow_forward

- Keaubie Co. purchased machinery at a cost of $175,000 cash. Other costs included: taxes, $15,500, freight charges$6,500, and insurance during transit, $5,500, insurance for first year $10,000 . Assume that Keaubie Co. sold the equipment for $14,000 cash and accumulated depreciation on the equipment is $190,000, . Journalize the transaction.arrow_forwardValaarrow_forwardHusky Company has provided the following information for its most recent year of operation: Cash collected from customers totaled $90,000. Cash borrowed from banks totaled $33,100. Cash paid to employees for salaries totaled $32,800. Cash received from selling Husky common stock to stockholders totaled $48,000. Cash payments to banks for repayment of money borrowed totaled $8,200. Cash paid to suppliers totaled $8,600. Land costing $26,000 was sold for $26,000 cash. Cash paid for dividends to stockholders totaled $4,000. How much was Husky's cash flow from operating activities?arrow_forward

- Please help mearrow_forward“P” and “Q” entered into a joint venture to construct a house for a price of L 8,00,000. For this purpose “P” put L 2,00,000 and “Q” L 1,50,000 into joint bank A/c opened for this purpose.The payments as follows :Materials L 60,000Salary & wages L 1,40,000 Plant & Machinery L 20,000These payments were made from joint bank A/c, but in addition “P” supplied cement bags valued L10,000. The house was constructed and paid the contract price.The plant and machinery taken over by “Q” @ L 10,000 and unused materials was taken by “P” @ L 5,000. They shared the profit in the ratio of 2:1.Show 1) Joint venture A/c2) Joint Bank A/c3) Co-ventures A/c answer with all work pleasearrow_forwardKelly Company acquired an iron mine for $2,349,000. Kelly paid a $1,000 filing fee with the county recorder, $50,000 license fee to the state, and $100,000 for a geologic survey. It was estimated that the land would have a value of $400,000 after completion of the mining operations, and that 1,000,000 tons of iron ore could be extracted from the mine. During the first year of operations, 100,000 tons of iron ore were extracted and 80,000 tons of iron ore were sold for $5 per ton. How much gross profit is shown on the Income Statement for the current period? What is the amount of depletion to record in the current period?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education