FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

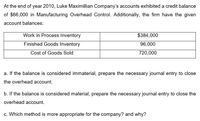

Transcribed Image Text:At the end of year 2010, Luke Maximillian Company's accounts exhibited a credit balance

of $66,000 in Manufacturing Overhead Control. Additionally, the firm have the given

account balances:

Work in Process Inventory

$384,000

Finished Goods Inventory

96,000

Cost of Goods Sold

720,000

a. If the balance is considered immaterial, prepare the necessary journal entry to close

the overhead account.

b. If the balance is considered material, prepare the necessary journal entry to close the

overhead account.

c. Which method is more appropriate for the company? and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. What accounts are debited / credited for overhead cost incurred vs overhead cost applied?arrow_forwardWhen materials are used as indirect materials, their cost is debited to Facotry or Manufacturing overhead account. TRUE FALSEarrow_forwardWhat features of the cost accounting system would be expected to prevent the omission ofrecording materials used in production?arrow_forward

- Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.arrow_forward1. How do the relationships between the balance sheet, income statement, job cost ledger, and equipment ledger help determine the changes made by each transaction?arrow_forwardCan you give us the actual formula for determining the overhead rate and not just the two components without relating them to each other, please? That should then help you give a better explanation of how/why the overhead could be over or underapplied.arrow_forward

- How do accounting books handle over and under absorption of overheads?arrow_forwardDescribe how the over or under application of overhead should be corrected in the accounting records.arrow_forwardWhat affect would closing an OVERAPPLIED Manufacturing Overhead account to Cost of Goods Sold have on the accounting records? Group of answer choices A. Cost of Goods Sold would increase B. Net Income would decrease C. Cost of Goods Sold would decrease Both A & Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education