FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

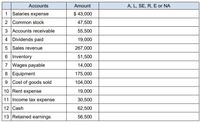

A. Identify the nature of each account using the letter A for assets, L for liabilities, SE for shareholders’ equity, R for revenue, E for expenses, and NA for not applicable.

B. Calculate net income for the period.

C. How much has been earned by the company’s operations but not distributed to shareholders?

D. What is the total investment by shareholders?

E. How much do customers owe the company?

Transcribed Image Text:Accounts

Amount

A, L, SE, R, E or NA

1 Salaries expense

$ 43,000

2 Common stock

47,500

3 Accounts receivable

4 Dividends paid

5 Sales revenue

55,500

19,000

267,000

6 Inventory

7 Wages payable

8 Equipment

9 Cost of goods sold

51,500

14,000

175,000

104,000

10 Rent expense

19,000

11 Income tax expense

30,500

12 Cash

62,500

13 Retained earnings

56,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Match the appropriate terms with the definitions. Definition 1. The economic benefit (increase in assets) gained by providing goods or services to customers. 2. Investors who purchase common stock. 3. The economic sacrifice (decrease in assets) incurred in the process of providing goods or services to customers. 4. Created when a company borrows money from a bank. 5. Assets minus liabilities and retained earnings. 6. Occurs when expenses exceed revenues during the year. 7. Individuals or institutions that have loaned goods or services to a business. 8. Complete set of accounts used in accounting systems. 9. Occurs when revenue exceeds expenses during the year. 10 Assets minus liabilities. 11. The section of the statement of cash flows that reflects cash paid for expenses. 12 The section of the statement of cash flows that reflects cash collected from the issue of stock. 13 The section of the statement of cash flows that reflects cash paid to purchase land. 14 The item shown on the…arrow_forwardWhat are the rights of creditors (claims against the assets of the company--creditors' equity) that represent debts of the business called? Group of answer choices liabilities assets expenses revenuesarrow_forwardWhat information does the balance sheet provide about a company's financial position, and how is it structured?arrow_forward

- Liabilities and stockholders' equity are: O increases in assets resulting from profitable operations O economic resources used by a business entity. O sources of financing for economic resources. shown on the income statement in calculating net income.arrow_forwardWhich of the following financial statements shows a company's revenues and expenses over a specific period of time? A) Balance sheet B) Income statement C) Statement of cash flows D) Statement of retained earningsarrow_forwardWhich of the following is classified as a financing activity? Receipt of dividend income Receipt of interest on loan receivable Payment of dividends Investment in another company’s stockarrow_forward

- What does the balance sheet show? A) The financial performance of operations during a specific period. B) The company's financial condition at a specific point in time. C) cash flows in and out of the business. D) Details of company sales only. Please explain each option why is correct and notarrow_forwardWhat is Market Value? A. Any cost that has not yet been charged to the expense B. The amount of money a business must currently spend to replace an essential asset C. Maintaining an account tied to a certain asset D. The value of a company according to the stock marketarrow_forwardWhat does the balance sheet show? A) the financial performance of operations during a specific period. B)The financial condition of a company at a specific point in time. C) cash flows in and out of the business. D) Company sales details only.arrow_forward

- Accounts Payable (A/P) are: Amounts totaling the net worth of a company Amounts paid to owners Amounts that customers owe your business Amounts owed to others that are obligationsarrow_forwarddescribe the roles of the key fi nancial statements (statement of fi nancial position, statementof comprehensive income, statement of changes in equity, and statement of cash fl ows) inevaluating a company’s performance and fi nancial positionarrow_forwardThe ability of a business to pay its debts as they come due and to earn a reasonable net income is a. solvency and equity b. solvency and profitability c. solvency and leverage d. solvency and liquidityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education