Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Finance

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Do not provide Excel Screet shot rather use tool table

Answer completely

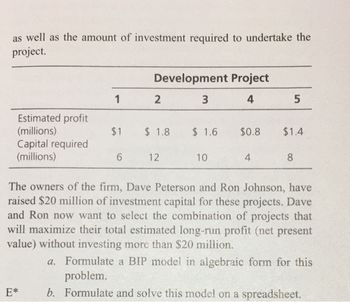

Transcribed Image Text:as well as the amount of investment required to undertake the

project.

Estimated profit

(millions)

Capital required

(millions)

1

E*

Development Project

3

4

2

$1 $1.8 $ 1.6

6 12

10

$0.8

4

5

$1.4

8

The owners of the firm, Dave Peterson and Ron Johnson, have

raised $20 million of investment capital for these projects. Dave

and Ron now want to select the combination of projects that

will maximize their total estimated long-run profit (net present

value) without investing more than $20 million.

a. Formulate a BIP model in algebraic form for this

problem.

b. Formulate and solve this model on a spreadsheet.

Transcribed Image Text:7.5. A real-estate development firm, Peterson and Johnson,

is considering five possible development projects. Using units of

millions of dollars, the following table shows the estimated long-

run profit (net present value) that each project would generate,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- collects data for the problem t hand, is a very involved collection process, has a high collection cost and a long collection time: a. Word association b. Secondary data c. Primary data d. A confidence intervalarrow_forwardThe section of the annual report titled "Management Discussion and Analysis" is: Multiple Choice Required by the Securities and Exchange Commission (SEC). Not required, but it may be included by management. Required by generally accepted accounting principles (GAAP). Reported to the Securities and Exchange Commission (SEC), but it is not included in the annual report.arrow_forwarduestion 6 If a pattern of purchase of two products are seen to be made together or closely follow one another, the best method to strategically analyze this purchase pattern would be with: A. Link Analysis B. Case based reasoning C. Sequence analysis D. Cluster analysisarrow_forward

- Need urgent answer please. Q2. What is the role of an internal auditor? This is full question and not an eassy question at all. Answer must be plagirism free and in reasonable length. Length should not be too short or too long. Give reasonable answer please.arrow_forwardPls help ASAParrow_forwardCalculator A producer must deliver an Outline of Coverage to a prospective insured who is eligible for Medicare at which of the following times? OA. Before the application is taken O B. After the application is signed O C. When the policy is delivered O D. When the prospect requests itarrow_forward

- helparrow_forward35. Chris was recently hired by a homeowner to sell their single-family home. The homeowner wants to list the property for $649,000; however, Chris strongly believes the current market value is only $620,000. What should Chris present to the homeowner to justify his price? O Chris should prepare a comparative market analysis using recently sold properties in the area. • Chris shuld prepare an appraisal. O Chris should present print-outs of three similar properties currently on the market. O Chris should prepare a property survey.arrow_forward%24 wP NWP Assessment Builder UI App X WP NWP Assessment Player UI Appli X A Player A Player Chapter 13 Wiley Assignment - H x A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Da67db8cb-3f9b-4d0b-ae91-9b01aaada0c5#/question/7 e Chapter 13 Wiley Assignment - Homework Question 8 of 8 View Policies Current Attempt in Progress The concession stand at the Shelby High School stadium sells slices of pizza during boys' and girls' soccer games. Concession stand sales are a primary source of revenue for the high school athletic programs, so the athletic director wants to sell as much food as possible; however, any pizza not sold is given away free to the players, coaches, and referees or it is thrown away. Thus, the athletic director wants to determine a reorder point that will meet the demand for pizza. Pizza sales are normally distributed with a mean of 6 pizzas per hour and a standard deviation of 3.70 pizzas. The pizzas are ordered from Pizza Beth's restaurant, and the…arrow_forward

- accounting Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Do not provide Excel Screet shot rather use tool table Answer completely. The Lowlands publishing company has decided to launch a new magazine for financial special-ists with the brand new title The Daily Financial Times. The problem is that this has not been done before. The Lowlands management does not have a clue how many copies will be sold and they think it will be somewhere between 60 000 and 120 000 copies. The magazine sells for €4 and the variable cost to print is €1.20. Unsold magazines are destroyed. Required: 1. Prepare a results matrix (or pay-off table) for different levels of demand: 60 000, 80 000, 100 000 and 120 000. 2. Suppose Lowlands management wants to avoid being blamed afterwards for having selected the wrong production plan, what production level should they then choose? 3. What strategy should be chosen if management wants to…arrow_forward2 Sort Lists Create, edit, and format charts Utilise Financial Functions (PMT) and (FV) Question 1 [44 marks] Cape Produce is a fruit and vegetable retail shop based in the Western Cape province. With 15 branches in the region, their main branch is in the Cape Town city center. The branch has experienced a decline in demand for most of its products. The business has neglected marketing efforts in the past three years due to the COVID-19 pandemic, which impacted sales and profitability. You have been employed to lead the Sales department and implement marketing promotions. Before you strategise any marketing campaign, you must understand how the business performs. Background You have been provided with the attached Cape Produce Sales data in an Excel sheet. Answering these questions will provide a marketing promotion planning basis. Required: Note: add columns to the provided data table to calculate discounts and sales. Complete all calculations using formulas in Excel. Use the provided…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.