FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

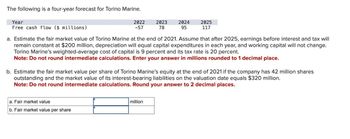

Transcribed Image Text:The following is a four-year forecast for Torino Marine.

Year

Free cash flow ($ millions)

2022

-57

a. Fair market value

b. Fair market value per share

2023

78

2024

95

a. Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will

remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change.

Torino Marine's weighted-average cost of capital is 9 percent and its tax rate is 20 percent.

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place.

million

2025

117

b. Estimate the fair market value per share of Torino Marine's equity at the end of 2021 if the company has 42 million shares

outstanding and the market value of its interest-bearing liabilities on the valuation date equals $320 million.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment Answer is complete but not entirely correct. 1,019 x 894 $.79 29 50 a. Total value b. Laputa's equity 44853 55 15 13 Year 2 3 $.99 $ 114 44 70 21 19 39 60 18 16 4 $ 119 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 60% by equity and 40 % by debt. Its cost of equity is 12%, its debt yields 8%, and it pays corporate tax at 30%. 49 70 a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions…arrow_forwardOne of four mutually exclusive alternatives below must be selected. First cost & BTCF (Before Tax Cash Flow) values of the alternatives are given in the Table. Equal life of the alternatives is 10 years but the value of the investment (first cost) will not diminish with time. Alternative First Cost ROR on Incremental Investment B Annual BTCF C 2,000 3,000 4,000 -100 В 150 320 D 5,000 450 i. Find the value of ROR (Rate of Return) on incremental investment and fill the table.arrow_forwardNeed help with this Questionarrow_forward

- How do I create an After tax Cash Flow Analysis? Use rounded answers for subsequent calculationsarrow_forwardA firm buys a piece of equipment for $115,866.00 and will straight-line depreciate it to zero over five years. If the tax rate is 39.00%, what is the present value of the depreciation tax shield if the cost of capital is 10.00%? Submit Answer format: Currency: Round to: 2 decimal places. Show Hintarrow_forwardVishuarrow_forward

- Suppose you sell a fixed asset for $312,000 when its book value is $102,000. If your company’s marginal tax rate is 35 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forwardMf1. Consider an asset that costs $492,800 and is depreciated straight-line to zero over its 6-year tax life. The asset is to be used in a 2-year project; at the end of the project, the asset can be sold for $61,600. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset?arrow_forwardYour firm is considering a number of mutually exclusive choices for a property that you recently acquired. The following are the projected cash flows for one of the projects over its seven-year life. Cash Flows 0 1 2 3 4 5 6 7 (600,000) 100,000 120,000 140,000 160,000 180,000 200,000 220,000 If the appropriate discount rate is 12%, what is the annualized Net Present Value for this option? (Do not round intermediate calculations and enter your answer in dollars with-no decimal places, e.g., 24316.)arrow_forward

- Firm X has the opportunity to invest $285,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Initial investment Revenues. Expenses Return of investment Before-tax net cash flow Req A1 Year 0 $ (285,000) Req A2 $ (285,000) Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the venture will be 30 percent. Required: a1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductible. a2. Should firm X make the investment? Req B1 Before-tax cash flow Tax cost Net cash flow Discount factor (8%) Present value NPV b1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, but the expenses are nondeductible. b2. Should firm X make the investment? Complete this question by entering your answers in the tabs below. Year 1 $ 54,800 (32,880) $ 21,920 Req B2 Year 0 Year 2 S $ 54,800 (8,220) $ 46,580 Complete the below…arrow_forwardUnder the assumption that KMS's market share will increase by 0.22% per year, you determine that the plant will require an expansion in 2015, KMS's current outstanding debt, the interest on the debt, and the interest tax shield are given in the table below. The expansion will cost $21.8 million. Assuming that the financing of the expansion will be delayed accordingly (end of 2015) calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond, interest rates remain the same at 7.1%, and KMS's tax rate is 35%) through 2018. Current values (5000) Outstanding debt before expansion Interest on debt before expansion Interest Tax Shield before expansion 2013 $4,447 $316 $111 2014 $4,447 $316 $111 2015 $4,447 $316 $111 2016 $4,447 $316 $111 The total projected interest payments beginning in 2015 will be $ (Round to the nearest dollar) 2017 $4,447 $316 $111 2018 $4,447 $316 $111arrow_forwardHow to calculate the answer of Tax Allowable depreciation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education