ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Answer all part I will rate

Transcribed Image Text:This question is a file-upload question. Work your answer in a piece of paper, take a picture

with your phone and upload the file.

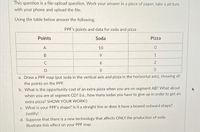

Using the table below answer the following:

PPF's points and data for soda and pizza

Points

Soda

Pizza

A

10

B.

6.

D

3

a. Draw a PPF map (put soda in the vertical axis and pizza in the horizontal axis), showing all

the points on the PPF.

b. What is the opportunity cost of an extra pizza when you are on segment AB? What about

when you are at segment CD? (i.e., how many sodas you have to give up in order to get an

extra pizza? SHOW YOUR WORK!)

c. What is your PPF's shape? Is it a straight line or does it have a bowed outward shape?

Justify!

d. Suppose that there is a new technology that affects ONLY the production of soda.

Illustrate this effect on your PPF map.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please work these out both parts do not understandarrow_forwardA financial institution (loan shark ) is willing to lend you $400. You pay $450 after one week. a) What is the nominal interest rate b) What is the effective annual interest ratearrow_forwardYou can afford a $900 per month mortgage payment. You've found a 30 year loan at 6.5% interest. a) How big of a loan can you afford? (Round to the nearest cent, as needed.) b) How much total money will you pay the loan company? (Round to the nearest cent, as needed.) c) How much of that money is interest? (Round to the nearest cent, as needed.)arrow_forward

- breakeven point explainedarrow_forwardIMF loan condition and challenges in Bangladesh. Please write this in 1500 word. Also include the referencearrow_forwardMaria takes out a 30-year mortgage at 5.5% to buy a house that costs $280,000. She must have a down payment of 3% of the purchase price.arrow_forward

- Typed plz and Asap Please give me a quality solution thanksarrow_forwardriginal price 3. Five years ago, Mary opened a savings account for a condo on the beach that earns 2.6% simple interest each year. She started the account with $550 and has not touched the account since. How much money is in the account now?arrow_forwardI need the answer as soon as possiblearrow_forward

- Don’t do question 9, just look at the info and chart on question 9 and apply it to question 10 in the next image.arrow_forwardWhat is the U.S 6 month interest rate?arrow_forwarduestion 3 If you want to minimize interest payments on a loan, you'll need one that has a simple interest rate so that yo John opened an account, and knew exactly how much it would be worth at the end of the year, because it used year. What is simple interest? Oa. Interest only on original amount saved or borrowed Ob. interest on original amount saved, borrowed and other interest earned Oc. a fee paid for the use of someone else's money Od. taxes on the original amount saved or borrowed L A Moving to another question will save this response. →arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education