FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

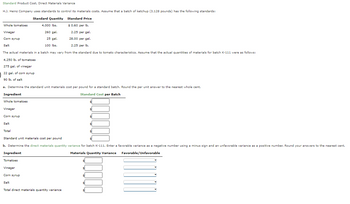

Transcribed Image Text:Standard Product Cost, Direct Materials Variance

H.J. Heinz Company uses standards to control its materials costs. Assume that a batch of ketchup (3,128 pounds) has the following standards:

Standard Quantity

Standard Price

Whole tomatoes

4,000 lbs.

$ 0.60 per lb.

Vinegar

260 gal.

2.25 per gal.

Corn syrup

25 gal.

28.00 per gal.

Salt

100 lbs.

2.25 per lb.

The actual materials in a batch may vary from the standard due to tomato characteristics. Assume that the actual quantities of materials for batch K-111 were as follows:

4,250 lb. of tomatoes

275 gal. of vinegar

22 gal. of corn syrup

90 lb. of salt

a. Determine the standard unit materials cost per pound for a standard batch. Round the per unit answer to the nearest whole cent.

Ingredient

Standard Cost per Batch

Whole tomatoes

Vinegar

Corn syrup

$

$

Salt

Total

Standard unit materials cost per pound

b. Determine the direct materials quantity variance for batch K-111. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Round your answers to the nearest cent.

Ingredient

Materials Quantity Variance Favorable/Unfavorable

Tomatoes

Vinegar

Corn syrup

Salt

Total direct materials quantity variance

00000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The management of Earth Barber Lawnmowers has calculated the following variances: Direct materials cost variance Direct materials efficiency variance Direct labor cost variance Direct labor efficiency variance Variable overhead cost variance Variable overhead efficiency variance Select one: $8000 U 5000 F Fixed overhead cost variance 4000 F Fixed overhead volume variance 2,500 F When determining the total product cost flexible budget variance, what is the total fixed overhead variance of the company? A. $7000 F B. $4000 F C. $9000 F D. $5000 F 37,000 F 18,000 F 12,000 U 3000 Farrow_forwardPlease Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please Thanks In Advance ?arrow_forwardTitle Calculate the material quantity variance. Description (JIT variances) Natural Gardens makes recylcable pots for plants and uses JIT to manage inventories and production. The following are standards for a typical 1-gallon pot: Annual Material Standards 32 ounces of Component X × $0.02 $0.64 2 ounces of Component Y × $0.05 0.10 $0.74 Current Material Standards 27 ounces of Component X × $0.02 $0.54 4 ounces of Component Y × $0.05 0.20 $0.74 In-house experiments indicated that changing the material standard would make the pots stronger, so the company issued an engineering change order for the product in February; this ECO established the current material standards. March production was 8,000 pots. Usage of raw material (all purchased at standard price) in March was 220,000 ounces of Component X and 31,000 ounces of Component Y. a. Calculate the material quantity variance. b. Calculate the ECO variance. c. Summarize the…arrow_forward

- See attached image Required:Calculate Parker Plastic’s direct materials price and quantity variances. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).)arrow_forwardPlease do not give solution in image formatarrow_forwardMaterial, Labor, and Variable Overhead Variances The following summarized manufacturing data relate to Brown Corporation's May operations, during which 2,000 finished units of product were produced. Normal monthly capacity is 1,100 direct labor hours. Standard Units Costs Total Actual Costs Direct material Standard (3 lb. @ $7.00/lb.) $21 $46,080 Actual (6,400 lb. @ $7.20/lb.) Direct labor Standard (0.5 hr. @ $19/hr.) $9.50 Actual (950 hrs. @ $18.70/hr.) 17,765 Variable overhead Standard (0.5 hr. @ $9/hr.) $4.50 Actual 9,300 $35 $73,145 Totalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education