Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Sepia Inc. issued bonds for $400,000 that were redeemable in 7 years. They established a sinking fund that was earning 5.44% compounded semi-annually to pay back the principal of the bonds on maturity. Deposits were being made to the fund at the end of every 6 months.

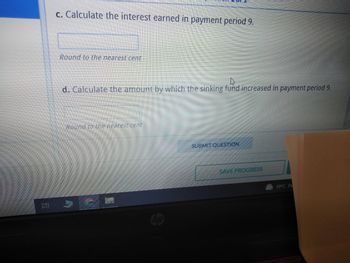

Transcribed Image Text:c. Calculate the interest earned in payment period 9.

Round to the nearest cent

d. Calculate the amount by which the sinking fund increased in payment period 9.

Round to the nearest cent

HAHA

SUBMIT QUESTION

SAVE PROGRESS

19°C Pa

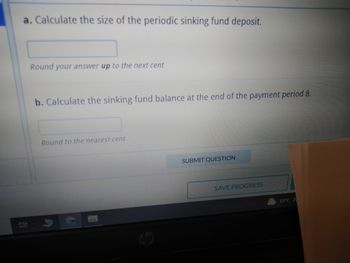

Transcribed Image Text:a. Calculate the size of the periodic sinking fund deposit.

Round your answer up to the next cent

b. Calculate the sinking fund balance at the end of the payment period 8.

Round to the nearest cent

SUBMIT QUESTION

SAVE PROGRESS

19°C P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company issues $75000 face value bonds with a state interest rate of 10% paying interest semi-annually and maturing in 5 years. the market rate on the date the bonds are issued is 8%. Complete the partial amortization schedule schedule provided, the journal entry at issuance, and the journal entry for the second interest payment.arrow_forwardOak Branch Inc. issued $900,000 of 5%, 10-year bonds when the market rate was 4%. They received $973,595. Interest was paid semi-annually. Prepare an amortization table for the first three years of the bonds. Round intermediate and final answers to whole dollar amount. Jan. 1, Year 1 June 30, Year 1 Dec. 31, Year 1 June 30, Year 2 Dec. 31, Year 2 June 30, Year 3 Dec. 31, Year 3 Cash Interest Payment ✔ 22,500 22,500 ✓ 22,500 ✔ 22,500 ✔ 22,500 ✓ 22,500 ✓ Interest on Carrying Value 19,472 19,411 V ✓ 19,350 ✔ 19,287 ✔ 19,222 ✔ 19,157 ✔ Amortization of Premium 3,028 3,089 3,150 ✔ ✓ 3,213 3,278 ✓ 3,343 ✔ Carrying Value 973,595 970,567 967,478 ✔ 964,328 ✔ 961,114 X 957,837 ✔ 954,493 Xarrow_forwardSepia Inc. issued $350,000 bonds that were redeemable in 7 years. They established a sinking fund that was earning 5.50% compounded semi-annually to pay back the principal of the bonds on maturity. Deposits were being made into the fund at the end of every 6 months. a. Calculate the size of the periodic sinking fund deposits. b. Calculate the sinking fund balance at the end of the 4th payment period. c. Calculate the amount of interest earned during the 5th payment period. d. Calculate the amount by which the sinking fund increased in the 5th payment period.arrow_forward

- Blossom Company issued $700,000, 9-year bonds. It agreed to make annual deposits of $75,500 to a fund (called a sinking fund), which will be used to pay off the principal amount of the bond at the end of 9 years. The deposits are made at the end of each year into an account paying 4% annual interest. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What amount will be in the sinking fund at the end of 9 years? (Round answer to 2 decimal places, e.g. 25.25.) Amount in the sinking fund $ 803100.94arrow_forwardSandia Corporation issued $2,000,000 worth of callable bonds paying 7% interest. The maturity date for the bonds was in 10 years. A year later, interest rates fell to 5%. The bonds were called and new bonds were sold at the 5% rate. How much did Sandia Corporation save by calling the bonds?arrow_forwardA Corporation has a 6%, $500,000 bond issue that originally was issued 5 years ago. There are now eight years remaining on the bond issue, and the market interest rate is 10%. Interest is paid semiannually. Calculate the current market value of the bond issue, using present value tables. Please label all work.arrow_forward

- On January 1, 2014, Fabco borrowed $5,000,000 from First Bank of Newburg. The loan had a term of five years with the principal amount due at the end of the fifth year. Interest is at an annual rate of 6% with interest being paid semiannually on June 30 and December 31. In connection with the loan, the borrower incurred $84,438 of debt issuance costs that are to be amortized over the term of the loan. The effective interest method is to be used to account for the loan. Fabco was able to make the first two semiannual debt service payments, but then began to see a serious deterioration in its business. Fabco is currently in default on a number of debts and is unable to secure additional capital at market rates of interest. Based on projected cash flows, it is doubtful that the company will continue as a going concern. The company accrued the interest due on June 30, 2015, but is unable to make the interest payment. In an attempt to resolve these serious issues, Fabco received concessions…arrow_forwardSepia Inc. issued bonds for $450,000 that were redeemable in 6 years. They established a sinking fund that was earning 4.87% compounded semi-annually to pay back the principal of the bonds on maturity. Deposits were being made to the fund at the end of every 6 months. a. Calculate the size of the periodic sinking fund deposit. b. Calculate the sinking fund balance at the end of the payment period 8. c. Calculate the interest earned in payment period 9. d. Calculate the amount by which the sinking fund increased in payment period 9.arrow_forwardOn January 1, 2014 Victory Falls Company issued $2,100,000 in bonds that mature in 5 years. The bonds have a stated interest rate of 8% and pay interest quarterly each year. When the bonds were sold, the market rate of interest was 6%. These bonds, when issued and sold, contained a call feature, which allowed the company to retire the bonds early, if they elected, for a one-time payment equal to 1% of the book value at the time of retirement. Required: 1- Provide the adjusting journal entries to record interest expense on June 30, 2014, and December 31, 2014 using the straight-line method and using the effective-interest method. 2- What is the book value of the bonds on June 30, 2014 and December 31, 2014 using straight-line method and using effective-interest method?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education