Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

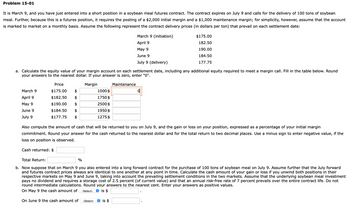

Transcribed Image Text:Problem 15-01

It is March 9, and you have just entered into a short position in a soybean meal futures contract. The contract expires on July 9 and calls for the delivery of 100 tons of soybean

meal. Further, because this is a futures position, it requires the posting of a $2,000 initial margin and a $1,000 maintenance margin; for simplicity, however, assume that the account

is marked to market on a monthly basis. Assume the following represent the contract delivery prices (in dollars per ton) that prevail on each settlement date:

March 9 (initiation)

April 9

May 9

June 9

July 9 (delivery)

$175.00

182.50

190.00

184.50

177.75

a. Calculate the equity value of your margin account on each settlement date, including any additional equity required to meet a margin call. Fill in the table below. Round

your answers to the nearest dollar. If your answer is zero, enter "0".

March 9

Price

$175.00

April 9

$182.50

May 9

$190.00

June 9

July 9

$184.50

$177.75

$

Margin

Maintenance

1000 $

이

1750 $

2500 $

1950 $

1275 $

Also compute the amount of cash that will be returned to you on July 9, and the gain or loss on your position, expressed as a percentage of your initial margin

commitment. Round your answer for the cash returned to the nearest dollar and for the total return to two decimal places. Use a minus sign to enter negative value, if the

loss on position is observed.

Cash returned: $

Total Return:

%

b. Now suppose that on March 9 you also entered into a long forward contract for the purchase of 100 tons of soybean meal on July 9. Assume further that the July forward

and futures contract prices always are identical to one another at any point in time. Calculate the cash amount of your gain or loss if you unwind both positions in their

respective markets on May 9 and June 9, taking into account the prevailing settlement conditions in the two markets. Assume that the underlying soybean meal investment

pays no dividend and requires a storage cost of 2.5 percent (of current value) and that an annual risk-free rate of 7 percent prevails over the entire contract life. Do not

round intermediate calculations. Round your answers to the nearest cent. Enter your answers as positive values.

On May 9 the cash amount of

-Select-

✪ is $

On June 9 the cash amount of

-Select-

✪ is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Similar questions

- > Question 7 After making 19 payments on a 60-month, $10,000 car loan with APR of 4%, what is the outstanding balance on the loan? Round your answer to the nearest cent (one-hundredth). Do not include the dollar sign, $.arrow_forwardCalculate the simple interest earned on an investment of: $4 200 at 4.5% for 200 days Select one: a. $103.56 b. $105.32 c. $102.47 d. $100.00arrow_forward7 Calculate the effective interest rate for each nominal annual interest rate and compounding frequency shown. Round your answer to 2 decimal places. = in showers 2 a. 12% Quarterly compounding b. 7% Semiannual compounding F1 1 C. 14% Continuous compounding Upload Choose a File 8 2 F2 W Ő - F3 O + 3 # E F4 4 $ R F5 ‒‒ Q Search -- 5 % F6 T C F7 GA 6 A Y H F8 ik 7 & U F9 8 LG BB * 1 F10 9 K ( TAY F11 - O 0 ) L F12 + P Prt Sc Scrlk = Ins + [ { Del Backspace 11arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education