ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Help me understand part a-c

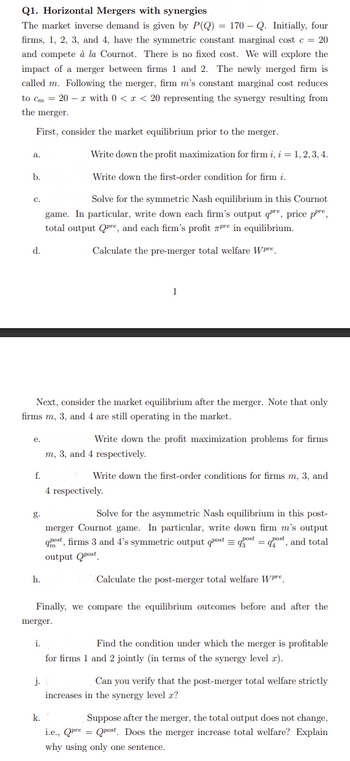

Transcribed Image Text:Q1. Horizontal Mergers with synergies

The market inverse demand is given by P(Q) = 170 - Q. Initially, four

firms, 1, 2, 3, and 4, have the symmetric constant marginal cost c = 20

and compete à la Cournot. There is no fixed cost. We will explore the

impact of a merger between firms 1 and 2. The newly merged firm is

called m. Following the merger, firm m's constant marginal cost reduces

to cm = 20 x with 0 < x < 20 representing the synergy resulting from

the merger.

First, consider the market equilibrium prior to the merger.

a.

b.

C.

d.

e.

Next, consider the market equilibrium after the merger. Note that only

firms m, 3, and 4 are still operating in the market.

f.

h.

Write down the profit maximization for firm i, i = 1, 2, 3, 4.

Write down the first-order condition for firm i.

Solve for the symmetric Nash equilibrium in this Cournot

game. In particular, write down each firm's output qe, price pre,

total output Qpre, and each firm's profit pre in equilibrium.

Calculate the pre-merger total welfare Wpre

i.

j.

k.

1

Write down the profit maximization problems for firms

m, 3, and 4 respectively.

Write down the first-order conditions for firms m, 3, and

4 respectively.

merger.

Finally, we compare the equilibrium outcomes before and after the

Solve for the asymmetric Nash equilibrium in this post-

merger Cournot game. In particular, write down firm m's output

qpost, firms 3 and 4's symmetric output post = gost = host, and total

output post

Calculate the post-merger total welfare Wpre.

Find the condition under which the merger is profitable

for firms 1 and 2 jointly (in terms of the synergy level 2).

Can you verify that the post-merger total welfare strictly

increases in the synergy level x?

Suppose after the merger, the total output does not change,

i.e., Qpre = Qpost. Does the merger increase total welfare? Explain

why using only one sentence.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- could you explain step 2 more thoroughly pleasearrow_forwardThe first step to take when you consider making a major purchase is to decide (a) whether you need the product (b) whether you have enough money to buy the product (c) what make and model of the product you should buy (d) where the best place is to purchase the product.arrow_forwardblanks C and D?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education