Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

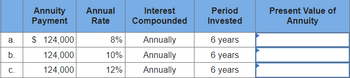

![You have entered into an agreement to purchase a local accounting firm. The agreement specifies you will pay the seller $124, 000 at the end of each year for six years. What is the

cost today of the purchase, assuming a discount rate of (a) 8%, (b) 10%, or (c) 12% ? Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1, and PVA of $1)\

table[[, \table[[Annuity], [Payment]], \table[[Annual], [Rate]], \table[[Interest], [Compounded]], \table [[Period], [Invested]], \table[[Present Value of], [Annuity]]], [a., $124, 000, 8%,

Annually,6 years,], [b., 124, 000, 10 %, Annually, 6 years,], [c., 124, 000, 12 %, Annually,6 years,]]](https://content.bartleby.com/qna-images/question/15d9252b-6018-44f2-9a1f-cb985d8a3be6/bf0fadde-22a1-45f5-991a-b2c0de6c8a8b/u73c9am_thumbnail.png)

Transcribed Image Text:You have entered into an agreement to purchase a local accounting firm. The agreement specifies you will pay the seller $124, 000 at the end of each year for six years. What is the

cost today of the purchase, assuming a discount rate of (a) 8%, (b) 10%, or (c) 12% ? Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1, and PVA of $1)\

table[[, \table[[Annuity], [Payment]], \table[[Annual], [Rate]], \table[[Interest], [Compounded]], \table [[Period], [Invested]], \table[[Present Value of], [Annuity]]], [a., $124, 000, 8%,

Annually,6 years,], [b., 124, 000, 10 %, Annually, 6 years,], [c., 124, 000, 12 %, Annually,6 years,]]

Transcribed Image Text:a.

b.

C.

Annuity Annual

Payment Rate

$ 124,000

124,000

124,000

Interest

Compounded

8%

Annually

10% Annually

12%

Annually

Period

Invested

6 years

6 years

6 years

Present Value of

Annuity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- fond the periodic deposit and intrest earned. C Future compounding time periodic interest in Value r frequency deposit (m) earned years $ $ $25,000 7.9% annually 11 $ $250,000 3% semiannually 13 $ $ $ $125,000 2.2% quarterly 15 $ $ $150,000 6.2% monthly 7 $ $ $125,000 4% weekly 15arrow_forwardUNIT 7-18arrow_forwardDetermine the value of the perpetuity annual amount $20,000 discount rate 8%arrow_forward

- Project 1 requires an original investment of $84,200. The project will yield cash flows of $19,000 per year for seven years. Project 2 has a calculated net present value of $18,000 over a five-year life. Project 1 could be sold at the end of five years for a price of $81,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest 10% Year 6% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 0.890 0.797 0.756 0.694 0.826 0.579 0.840 0.751 0.712 0.658 0.792 0.683 0.636 0.572 0.482 0.567 0.621 0.402 0.747 0.497 0.705 0.564 0.507 0.335 0.432 0.665 0.513 0.452 0.376 0.279 0.233 8. 0.627 0.467 0.404 0.327 0.424 0.361 9. 0.592 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 10% 12% 15% 20% 1.arrow_forwardnnuityPayment PaymentFrequency TimePeriod (years) NominalRate (%) InterestCompounded Present Valueof the Annuity $800 every month 2 1/4 1 4 6 monthlyarrow_forward1) $6000 at 4% compounded semiannually for 12 years Find the future value of the ordinary annuity. Interest is compounded annually, unless otherwise indicated.arrow_forward

- Lepp Complete present value of an ordinary annuity: Note: Round your answer to the nearest cent. Amount of Annuity Expected $ 16,000 Payment Payable Years Quarterly 2 Interest Rate earned 12% Present valuearrow_forwardK (Compound annuity) What is the accumulated sum of each of the following streams of payments? a. $500 a year for 8 years compounded annually at 10 percent. b. $104 a year for 7 years compounded annually at 9 percent. c. $32 a year for 12 years compounded annually at 11percent. d. $21 a year for 6 years compounded annually at 6 percent.arrow_forwardNonearrow_forward

- Amount of annuity expected $900 Payment Annually Time 4 years Interest rate 6% Present value (amount needed now to invest to receive annuity) $3,118.59 Check the correctness of annuity payment by completing the following table. Note: Round the answers the nearest cent. Opening balance ces Interest Annuity Closing balance Year 1 Year 2 Year 3 Year 4 3,118.59arrow_forwardCalculate future value of annuity due Annuity payment- $80 Payment frequency - every month Time period - 1 1/2 years 6% interest compounded monthlyarrow_forwardFV-Ordinary Annuity. Various Compounding 9-15 Find the future values of the following ordinary annuities: a. FV of $400 each six months for five years at a simple rate of 12 percent, compounded semiannually b. Periods FV of $200 each three months for five years at a simple rate of 12 percent, compounded quarterly C. The annuities described in parts (a) and (b) have the same amount of money paid into them during the five-year period and both earn interest at the same simple rate, yet the annuity in part (b) earns $101.75 more than the one in part (a) over the five years. Why does this occur?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education