Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

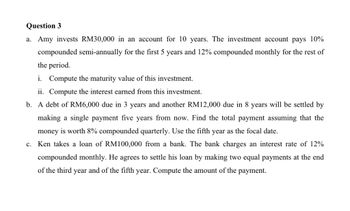

Transcribed Image Text:Question 3

a. Amy invests RM30,000 in an account for 10 years. The investment account pays 10%

compounded semi-annually for the first 5 years and 12% compounded monthly for the rest of

the period.

i. Compute the maturity value of this investment.

ii. Compute the interest earned from this investment.

b. A debt of RM6,000 due in 3 years and another RM12,000 due in 8 years will be settled by

making a single payment five years from now. Find the total payment assuming that the

money is worth 8% compounded quarterly. Use the fifth year as the focal date.

c. Ken takes a loan of RM100,000 from a bank. The bank charges an interest rate of 12%

compounded monthly. He agrees to settle his loan by making two equal payments at the end

of the third year and of the fifth year. Compute the amount of the payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company needs to buy an annuity package that will provide a future income to an individual over a 33-year period at the following levels: £4421 paid at the beginning of each year for the first 13 years followed by £3318 paid at the beginning of each year up until year 33 (inclusive). Calculate in £s, to 2 decimal places, the price of this investment in order to assure the required payments, given that the rate of interest during this period is: 4.0% pa effective for the first 20 years and then 7.1% pa effective thereafter. (no tables, only formulas, please)arrow_forwardVincent received a loan of $28,000 at 4.25% compounded monthly. She had to make payments at the end of every month for a period of 5 years to settle the loan. a. Calculate the size of payments. Round to the nearest cent b. Complete the partial amortization schedule, rounding the answers to the nearest cent. Payment Number Payment K 0 1 2 0 0.00 0 0 Total :: :: $0.00 $0.00 $0.00 $0.00 $0.00 Interest Portion Principal Portion $0.00 $0.00 :: :: $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Principal Balance $28,000.00 $0.00 $0.00 :: $0.00 $0.00 0.00arrow_forward

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education