Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

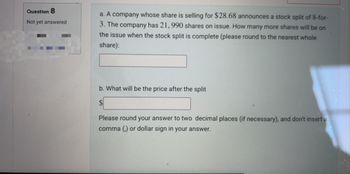

Transcribed Image Text:Question 8

Not yet answered

a. A company whose share is selling for $28.68 announces a stock split of 8-for-

3. The company has 21, 990 shares on issue. How many more shares will be on

the issue when the stock split is complete (please round to the nearest whole

share):

b. What will be the price after the split

Please round your answer to two decimal places (if necessary), and don't insert a

comma (,) or dollar sign in your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.arrow_forwardSuppose a stock had an initial price of $50 per share, paid a dividend of $1.05 per share during the year, and had an ending share price of $37. Compute the percentage total return. Enter the answer in 4 decimals e.g. 0.1234.arrow_forward# 1 A firm issues preferred stock with a dividend of $3.42. If the appropriate discount rate is 7.05% what is the value of the preferred stock? Submit Answer format: Currency: Round to: 2 decimal places. unanswered not_submitted Attempts Remaining: Infinity %23arrow_forward

- Skyler Industries's preferred stock currently sells for $43 per share. The stock pays an annual dividend of $2.95 per share. The cost of preferred stock, Rp, is ____%. Round your final answer to 2 decimal places (example: enter 12.34 for 12.34%), but do not round any intermediate work in the process. [Note: Correct answer feedback may show more than 2 decimal places, but you should still follow instructions above for entering your answers.]arrow_forwardYou have 35,000 shares of preferred stock outstanding in the market, with a current price of $124 per share. What is the cost of preferred stock if the dividend per share is $6.20? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Cost of preferred stock %arrow_forwardNAME Herbalife Nutrition Herc Holdings Heritage Insurance Holdings HRTG Hersha Hospitality Trust CIA HT Hershey HSY HTZ SYMBOL CLOSE NET CHG 57.94 -1.39 26.86 -0.71 14.57 -0.38 Hertz Global Holdings Hess Corp. Hess Midstream Partners HLF HRI HES HESM Hewlett Packard Enterprise HPE 16.59 -0.16 106.24 0.80 -0.77 13.27 42.39 0.15 17.87 0.25 13.18 -0.28 VOLUME DIV YIELD P/E 1,149,773 60.41 389,826 72.99 81,929 19.15 732,879 24.16 1,145,889 114.63 52 WK 52 WK HIGH LOW 34.16 1.20 2.07 47.75 -1.71 24.16 3.10 3.35 12.85 0.24 1.65 22.01 -1.02 2,965,201 25.14 16.50 1.12 6.75 ...dd -5.42 89.10 2.89 2.72 22.00 -0.88 13.01 2.24 -2.78 35.59 1.00 2.36 ...dd 47,899 24.51 16.17 1.43 8.00 14.60 12.09 0.45 3.41 11.46 5,969,511 74.81 11,756,695 19.48 **** **** YTD %CHG Figure 2.8 Listing of stocks traded on the New York Stock Exchange Source: WSJ Online, January 4, 2019. 4.67 5.24 -0.23arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education