FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Ma3.

Please give only typed answer.

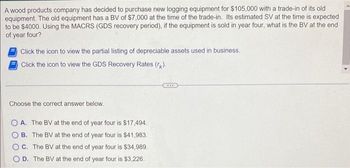

Transcribed Image Text:A wood products company has decided to purchase new logging equipment for $105,000 with a trade-in of its old

equipment. The old equipment has a BV of $7,000 at the time of the trade-in. Its estimated SV at the time is expected

to be $4000. Using the MACRS (GDS recovery period), if the equipment is sold in year four, what is the BV at the end

of year four?

Click the icon to view the partial listing of depreciable assets used in business.

Click the icon to view the GDS Recovery Rates (rk).

Choose the correct answer below.

OA. The BV at the end of year four is $17,494.

B. The BV at the end of year four is $41,983.

C. The BV at the end of year four is $34,989.

D. The BV at the end of year four is $3,226.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need answer typing clear urjent no chatgpt used i will give upvotes all answers plsarrow_forwardCreate a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forwardPLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT ANSWERS ARE FOR (i) V(t) = exp (-2e^0.02t + 2 ) for 0 15 (i) Derive, and simplify as far as possible, expressions in terms of t for V(t), where V(t) is the present value of a unit sum of cash flow made at time t. You should derive separate expressions for the three sub-intervals. (ii) Hence, making use of the result in part (i), calculate the value at time t = 3 of a payment of £2,500 made at time t = 15. (iii) Calculate, to the nearest 0.01%, the constant nominal annual rate of interest convertible half-yearly implied by the transaction in part (ii). (iv) Making use of the result in part (i), calculate the present value of a payment stream p(t) paid continuously from time t = 15 to t = 20 at a rate of payment at time t given by: p(t) = 300e 0.02tarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education