ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

a) What is the NPV of each project? Which projects should Xia undertake, and how much cash should it retain?

b) What is the total value of Xia’s assets today?

c) What cash flows will the investors in Xia receive? Based on these cash flows, what is the value of Xia today?

d) Suppose Xia pays any unused cash to investors today, rather than investing it. What are the total cash flows to the investors in this case? What is the value of Xia now?

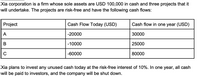

Transcribed Image Text:Xia corporation is a firm whose sole assets are USD 100,000 in cash and three projects that it

will undertake. The projects are risk-free and have the following cash flows:

Project

Cash Flow Today (USD)

Cash flow in one year (USD)

A

-20000

30000

В

-10000

25000

-60000

80000

Xia plans to invest any unused cash today at the risk-free interest of 10%. In one year, all cash

will be paid to investors, and the company will be shut down.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Payback Period and Net Present Value If a project with conventional cash flows has a payback period less than the project’s life, can you definitively state the algebraic sign of the NPV? Why or why not? If you know that the discounted payback period is less than the project’s life, what can you say about the NPV? Explain. Qarrow_forwardGiven that a country will analyze the total benefit of its oil supply-demand in two periods of time by using the following data: Period I Deman curve: P = -0.2 Q₁ + 210 Suply curve: P = 0.04 Q₁ + 30 Interest rate : 10%, Oil reserve : 3.6 billion barrels of oil Units: P in USD, Q in million barrel Period II Deman curve: P = -0.2 Q₂ +210 Suply curve: P = 0.05 Q₂ + 30 Find the efficient allocation! (Q₁, Q₂, P₁, P₁, NB₁, NB₂, TNB), draw a graphical illustration!arrow_forwardb) Adagio Corporation has return on equity (ROE) of 20% and its plowback ratio is p. The ROE and the plowback ratio are expected to stay the same in all future periods. The company's earnings are expected to be £4 per share next year. The cost of capital is 15%. What is the present value of growth opportunities of this corporation as a function of p? Calculate the present value of its growth opportunities for p = 30%.arrow_forward

- 2.4. Company C is planning to undertake a project requiring initial investment of P105 million. The project is expected to generate P25 million per year in net cash flows for 7 years. Calculate the payback period of the project.arrow_forwardAssume r = 0.1 is the present real interest rate and this rate is expected to prevail for the next 2 years. The monetary return (i.e. marginal revenue product) on machine A is expected to be R1 = $100,000 for year 1 and R2 = $50,000 for year 2. The present discounted value (PDV) of the net revenue flow from machine A to its owner is equal to ???arrow_forwardA firm that owns and manages rental properties is considering buying a building that would cost $800,000 this year, but would yield an annual revenue stream of $50,000 per year for the foreseeable future. For what range of interest rates would this purchase increase the present value of the firm?arrow_forward

- A project that will provde annual cash flows of $2,350 for nine years costs $9,700 today. a. At a required return of 12 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At a required return of 28 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) а. NPV b. NPV C. Discount rate %arrow_forwardIf there is a $120,000 investment on a project and the profits generates $180,0000, what is the return on investment (ROI)? 50% 40% 40% 60% 30%arrow_forwardYour division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10 percent and that the investments will produce the following after-tax cash flows (in millions of dollars): Year 1 2 3 4 Project A 5 10 15 20 Project B 20 10 8 6 a. What is the regular payback period for each of the projects?arrow_forward

- Question 6. You are asked to evaluate a mining project with costs in the developmental stage followed by benefits in the production stage and ending with significant costs at the end of the study period for reclamation of the land to its original state. You have determined that the project has two positive IRRs. a. Summarize a strategy for modifying the CB C cash flow pattern into a simpler CB cash flow pattern with just one IRR solution and a straightforward decision rule. b. Ilustrate your strategy with the following example: Capital cost at t-0 is $70 million; Constant benefits of $40 million in years 1-5; Year 6 reclamation cost of S140 million; Appropriate MARR = 20%. Set up the cash flow diagram, but do not solve for IRR.arrow_forwardI need answer typing no chatgpt usedarrow_forward2. Thomas is considering buying an artificial Christmas tree. The tree costs $285 and is expected to last six years. The alternative is to keep purchasing natural trees, which currently cost $35 (Christmas year 0) and are expected to increase $5 in price each of the subsequent years, e.g. +$40, +$45, +$50, etc. Note: Draw two cash flow diagrams for this problem. a. What decision would you advise regarding the two options? b. What additional information may be useful or necessary in order to make a decision? c. Which option is the better choice? Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education