FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A warehouse with an appraisal value of.... please answer this financial accounting question

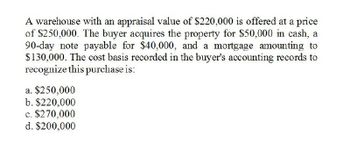

Transcribed Image Text:A warehouse with an appraisal value of $220,000 is offered at a price

of $250,000. The buyer acquires the property for $50,000 in cash, a

90-day note payable for $40,000, and a mortgage amounting to

$130,000. The cost basis recorded in the buyer's accounting records to

recognize this purchase is:

a. $250,000

b. $220,000

c. $270,000

d. $200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A building with an appraisal value of $129,802.00 is made available at an offer price of $150,878.00. The purchaser acquires the property for $33,175.00 in cash, a 90-day note payable for $25,972.00, and a mortgage amounting to $57,161.00. What is the cost basis recorded in the buyer's accounting records to recognize this purchase? Select the correct answer. $129,802.00 $150,878.00 $117,703.00 $116,308.00arrow_forwardA building with an appraisal value of $125,332 is made available at an offer price of $156,559. The purchaser acquires the property for $31,021 in cash, a 90-day note payable for $27,704, and a mortgage amounting to $55,713. The cost basis recorded in the buyer's accounting records to recognize this purchase is a.$114,438 b.$125,538 c.$156,559 d.$125,332arrow_forwardA building with an appraisal value of $132,331 is made available at an offer price of $151,729. The purchaser acquires the property for $35,281 in cash, a 90-day note payable for $28,200, and a mortgage amounting to $57,872. The cost basis recorded in the buyer's accounting records to recognize this purchase is a. $116,448 b. $151,729 c. $121,353 Od. $132,331 All work saved. Used Car I Ford Search Your Local Blue Advantagearrow_forward

- Need helparrow_forwardPrint Rem A building with an appraisal value of $154,000 is made available at an offer price of $172,000. The purchaser acquires the property for $40,000 in cash, a 90-day note payable for $45,000, and a mortgage amounting to $75,000. The cost basis recorded in the buyer's accounting records to recognize this purchase is O $172,000 ON $160,000 Oc 1154,000 Od $120,000arrow_forwardOwe A building with an appraisal value of $131,275 is made available at an offer price of $151,428. The purchaser acquires the property for $35,492 in cash, a 90-day note payable for $20,114, and a mortgage amounting to $51,247. The cost basis recorded in the buyer's accounting records to recognize this purchase is a. $151,428 b. $131,275 c. $115,936 d. $106,853arrow_forward

- A building with an appraisal value of $125,601 is made available at an offer price of $153,140. The purchaser acquires the property for $31,231 in cash, a 90-day note payable for $23,994, and a mortgage amounting to $57,725. The cost of the building to be reported on the balance sheet is a.$121,909 b.$125,601 c.$112,950 d.$153,140arrow_forwardA building with an appraisal value of $131,641 is made available at an offer price of $159,680. The purchaser acquires the property for $39,020 in cash, a 90-day note payable for $25,373, and a mortgage amounting to $53,957. The cost of the building to be reported on the balance sheet is O a. $118,350 Ob. $120,660 Oc. $131,641 O d. $159,680arrow_forwardV6. A company purchases land, building and equipment for $1,500,000. An independent appraisal shows that the best available indications of fair value at the time of purchase are: land: $760,000; building: $540,000; and equipment: $320,000. The purchase is financed through long-term debt. Required: Prepare the journal entry to record the purchase Prepare the journal entry to record the purchase:arrow_forward

- Following are descriptions of land purchases in four separate cases. Requireda. Determine the cost used for recording the land acquired in each case.b. Record the journal entry for each case on the date of the land’s acquisition. Note: Round your answers to the nearest whole dollar. Case One 1. At the midpoint of the current year, a $32,000 check is given for land, and the buyer assumes the liability for unpaid taxes in arrears of $800 at the end of last year and those assessed for the current year of $720. a. Determine the cost used for recording the land acquired.Cost of land $Answer b. Record the journal entry on the date of the Account NameDr.Cr. Answer Answer Answer To record land acquisition.arrow_forwardIsland, Inc. made a basket purchase involving four assets. Their market values were A: $56,000; B: $42,000 C: $44,000; and D: $58,000. The price Island paid for the four assets was $145,000. To the nearest dollar, what final price will be recorded for asset D? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.) ... O A. $3,000 O B. $31,900 O C. $42,050 O D. $58.000arrow_forward1. Suppose you have purchased land, a building, and some equipment. At the time of the acquisition, the land has a current fair value of $75,000, the building’s fair value is $60,000, and the equipment’s fair value is $15,000. Journalize the lump-sum purchase of the three assets for a total cost of $140,000. Assume you sign a note payable for this amount. Show all steps please.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education