FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

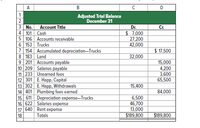

The adjusted

Transcribed Image Text:A

B

D

1

Adjustod Trial Balance

December 31

2

3 No.

4 101 Cash

5 106 Accounts receivable

6 153 Trucks

7 154 Accumulated depreciation-Trucks

8 183 Land

9 201 Accounts payable

10 209 Salaries payable

11 233 Unearned fees

12| 301| Е. Нарр, Саpital

13 302 E. Happ, Withdrawals

14 401 Plumbing fees earned

15 611 Depreciation expense-Trucks

16 622 Salaries expense

17 640 Rent expense

Account Title

Dr.

Cr.

$ 7,000

27,200

42,000

$ 17,500

32,000

15,000

4,200

3,600

65,500

15,400

84,000

6,500

46,700

13,000

$189,800

18

Totals

$189,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Epping Ltd. is a listed company based in Essex County. The company prepares its financial statements as at 31 December each year. The following trial balance is for the period ending 31 December 2019: Required: Prepare the following financial statements for Epping Ltd. for the year ended 31 December 2019 in accordance with IAS 1, Preparation of Financial Statements. Show all workings. 1)A statement of comprehensive income for the year ending 31 December 2019. 2)A statement of changes in equity for the year ending 31 December 2019. 3)A statement of financial position as at 31 December 2019.arrow_forwardThe adjusted trial balance of Ivanhoe Company at December 31, 2022, includes the following accounts: Owner's Capital $17,300, Owner's Drawings $7,200, Service Revenue $36,700, Salaries and Wages Expense $16,400, Insurance Expense $2,800, Rent Expense $4,700, Supplies Expense $2,300, and Depreciation Expense $1,100. Prepare an income statement for the year. IVANHOE COMPANY Income Statement $ $arrow_forwardOn March 1, Gonzales Company purchased $2,280 of supplies on account. On March 1, Gonzales Company debited Supplies Expense, which is an alternate way of recording the initial expenditure. By the end of the calendar year, $350 of supplies was used. Required:Journalize the adjusting entry on December 31.arrow_forward

- Selected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Adjunt problem 6-5A Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare closing entries as of May 31, 20Y8.arrow_forwardThe supplies account had a balance of $1,443 at the beginning of the year and was debited during the year for $3,065, representing the total of supplies purchased during the year. If $2,666 of supplies are on hand at the end of the year, the supplies expense to be reported on the income statement for the year is a.$2,666 b.$1,842 c.$5,731 d.$4,508arrow_forwardFollowing are the accounts and balances from the adjusted trial balance of Stark Company. Prepare the (1) income statement and (2) statement of owner’s equity for the year ended December 31 and (3) balance sheet at December 31. The Stark, Capital account balance was $24,800 on December 31 of the prior year. Notes payable. $11,000 Accumulated depreciation—Buildings. $15,000 Prepaid insurance . 2,500 Accounts receivable . 4,000 Interest expense . 500 Utilities expense . 1,300 Accounts payable . 1,500 Interest payable . 100 Wages payable . 400 Unearned revenue . 800 Cash . 10,000 Supplies expense . 200 Wages expense . 7,500 Buildings . 40,000 Insurance expense . 1,800 Stark, Withdrawals . 3,000 Stark, Capital . 24,800 Depreciation expense—Buildings . 2,000 Services revenue . 20,000 Supplies. 800arrow_forward

- The following items were taken from the adjusted trial balance of the Dylex Corporation for the year ended December 31, 2020. Assume an average 25% income tax on all ens. The accounting period ends December 31, and all amounts given are pre-tax. Dylex Corporation had 11,000 common shares outstanding in 2020 and follows IFRS Cost of goods sold Depreciation expense, building Gain on exchange Gain on sale of assets from discontinued operations Insurance expense Interest expense Interest income Loss on sale of trading investment 140,000 23,000 a) Prepare a multi-step income statement in good form. Please make sure your final anewarts) are accurate to 2 decimal places Dylex Corporation For the Year Ended December 31, 200 125,000 100,000 54,000 52,000 X 58,000 135,000 Operating loss of discontinued operation to disposal date 100,000 Salaries expense 160.000 Sales ** 900,000 REQUIRED DISCLOSURES b) Calculate basic eamings per share (EPS) from continuing operations. Please make sure your final…arrow_forwardThe supplies account had a balance of $1,021 at the beginning of the year and was debited during the year for $3,930, representing the total of supplies purchased during the year. If $2,909 of supplies are on hand at the end of the year, the supplies expense to be reported on the income statement for the year isarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Expert Answers to Latest Homework Questions

Q: I want answer

Q: Determine the standard overhead rate

Q: What is the percentage increase in the cost of goods sold

Q: General Accounting 24

Q: The following standards for variable overhead have been established for a

company that makes only…

Q: What is the answer?

Q: Financial accounting question

Q: Expert of Account Solve this asap

Q: Beginning inventory: 950600, ending inventory: 420700

Q: ?

Q: Hiii, tutor give answer

Q: Sub. General accounting

Q: Fox Run Outfitters manufactures lightweight frames that it uses in several of its backpack products.…

Q: Do fast answer of this accounting questions

Q: Wilson Finance purchased $200,000 in accounts

receivable from Harrison Manufacturing for $185,000.…

Q: For the current fiscal year, Purchases were $380,000, Purchase Returns and Allowances were $12,000,…

Q: provide answer of this General accounting question

Q: please not use any ai

Q: What is the correct price of the stock

Q: A hardware store has three departments: A, B, and C,

and incurs general advertising expenses that…

Q: What will be the firm's operating cycle?