FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

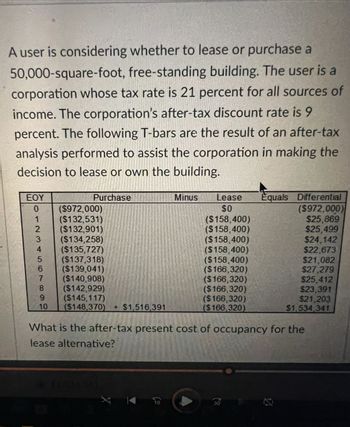

Transcribed Image Text:A user is considering whether to lease or purchase a

50,000-square-foot, free-standing building. The user is a

corporation whose tax rate is 21 percent for all sources of

income. The corporation's after-tax discount rate is 9

percent. The following T-bars are the result of an after-tax

analysis performed to assist the corporation in making the

decision to lease or own the building.

Minus Lease Equals Differential

ΕΟΥ

Purchase

0

($972,000)

($132,531)

($132,901)

3

($134,258)

($135,727)

($137,318)

6

($139,041)

7

($140,908)

8

($142,929)

9

($145,117)

10

($148,370) + $1,516,391

$0

($972,000)

($158,400)

$25,869

($158,400)

$25,499

($158,400)

$24,142

($158,400)

$22,673

($158,400)

$21,082

($166,320)

$27,279

($166,320)

$25,412

($166,320)

$23,391

($166,320)

$21,203

($166,320)

$1,534,341

What is the after-tax present cost of occupancy for the

lease alternative?

$1.534.341

X

A

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Need Help with this Questionarrow_forwardWhat is the maximum price you would be willing to pay for the business? If an investor group purchased the restaurant near the campus for $255, 867 and the fair value of the assets they acquired was $202,000, identify the account along with its balance, that is used to record the additional amount paid over the fair value of the assets.arrow_forwardFox River LLC owns a 160 - unit multifamily apartment complex in Charlotte, NC. The value allocated to the land is $4,600,000.00. The annual depreciation is $669,090.90. What percentage of the purchase price is allocated to the land?arrow_forward

- 1. A special manufacturing and handling device was purchased by Alfonso Manufacturing for $200,000 and is depreciated over MACRS. CFBT is estimated to amount to $800,000 for the first 2 years followed by $600,000 thereafter until the asset is retained. The effective tax rate, Te is 35% and interest is 10% per year. In present worth dollars determine the CFAT and determine if it was a viable purchase. (Note answer must be in a tabular format)arrow_forwardCalculate the real estate's taxes for a property with an amount of $4,500 and a closing date of October 15th? (360-day year prorated cost) 3,937.50 4,500 3,750 3,562.50 00arrow_forwardAfter real estate fees of 7% had been deducted from the proceeds of a property sale, the vendor of the property received $80,888. What was the amount of the real estate fee?arrow_forward

- What is the maximum price you would be willing to pay for the business? If an investor group purchased the restaurant near the campus for $255, 867 and the fair value of the assets they acquired was $202,000, identify the account along with its balance, that is used to record the additional amount paid over the fair value of the assets.arrow_forwardAn owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like a base rent of $11 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) b. The owner of ATRIUM believes that base rent of $11 PSF in (a) is too low and wants to raise that amount to $15 with the same $1 step-ups. However, now ATRIUM would provide ACME a $53,000 moving allowance and $130,000 in tenant improvements (Tls). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a $14 PSF with the $1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $6 PSF for 20,000 SF per year. If ATRIUM…arrow_forwardRenFair Clothing purchased land, paying $80,000 cash and signing a $220,000 note payable. In addition, RenFair Clothing paid delinquent property tax of $1,500, title insurance costing $800, and $4,000 to level the land and remove an unwanted building. Record the journal entry for purchase of the land. Begin by determining the cost of the land. Purchase price of land Add related costs: Total cost of landarrow_forward

- Catherine Steele owns two rental properties originally valued at $275,000 (Property 1t land $70,000, building $55,000) (Property 2 land $90,000, building $60,000) The buildings are Class 1 (4%) properties. Net rental income before CCA in 2020 was $11,000 • The UCC on building 1 at the beginning of 2020 was $50,00o. • The UCC on building 2 at the beginning of 2020 was $40,000 • Property 2 was soid in 2020 for $250,000 (land $200,000, bulding $50,000) Required Calculate Catherine's net rental income for 2020 then subtract the allowable CCA to arrive at her Net Income from rental property Numeric Responsearrow_forwardCaddis Company acquired a building with a loan that requires payments of $19,000 every six months for 3 years. The annual interest rate on the loan is 8%. What is the present value of the building? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice O O O O $99,600 $114,000 $38,988 $65,402 $48,965arrow_forwardPlease read and answer the question carefully.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education