Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

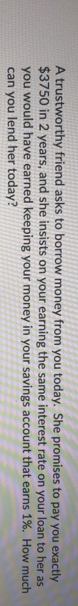

Transcribed Image Text:A trustworthy friend asks to borrow money from you today. She promises to pay you exactly

$3750 in 2 years, and she insists on your earning the same interest rate on your loan to her as

you would have earned keeping your money in your savings account that earns 1%. How much

can you lend her today?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mm. 140.arrow_forwardplease explain correctly and in detail.Not use of excel. Q)A bank offers a Loyal Saver account to the customers who deposit between £3000 and £4000 at the start of every year for at least 10 years. The account will pay 7% pa (compounded) tax free, i.e., the customers will not have to pay any income tax on the interest earned. Amy opens a Loyal Saver account for 13 years and is going to make a deposit of £3,500 every year. Sam opens a Loyal Saver account for 13years as well, but plans to make the first seven deposits of £3800 and the last six deposits of £3200. Who will have more money in the account at the end of the 13th year?arrow_forwardMichaela buys a new car for $31,600. The simple interest rate is 5.6% and the amount of loan (plus simple interest) is repayable in 6 years. What is the total amount that must be repaid? Round your answer to the nearest dollar and do not round until the final answer. Provide your answer below:arrow_forward

- Ms. Dory asks Axis Bank to lend her Rs. 100 today. She says she will not be able to pay anything at the end of the first & second years but will pay the entire loan amount due at the end of 3rd year. Tenor Borrowing/Lending Rates 1 yr 3.5% 2 yr 5.5% 3 yr 7.5% What combination of products would enable Ms. Dory to ascertain the amount that should be repaid at the end of 3 years? Skiparrow_forwardIf this family of 4 wants to save up for a vacation in 2 years, how much should they deposit each month into a savings account earning 1.85% annual interest? iF THEY HAVE TO SAVE UP $4580 (Round your answer to the nearest DOLLAR and type it without any commas, dollar signs, ect) If instead they decide to take the vacation now and put it on a credit card, how much would they need to pay each month to cover the cost of this credit card charge after 2 years if their credit card charges an APR of 19% (which is the average APR for new credit cards currently)? (Round your answer to the nearest DOLLAR and type it without any commas, dollar signs, ect) $ How much more will this family pay for their vacation using their credit card instead of saving?arrow_forwardFinancial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Zoe deposited $900 in a savings account at her bank. Her account will earn an annual simple interest rate of 7%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 13 years? O $967.41 $2,168.86 O $163.00 O $1,719.00 Now, assume that Zoe's savings institution modifies the terms of her account and agrees to pay 7% in compound interest on her $900 balance. All other things being equal, how much money will Zoe have in her account in 13 years? O $1,719.00 O $963.00 O $2,168.86 O $151.82arrow_forward

- You decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you insist on paying them interest. The agreement is that they will lend you $8000.00 at a simple interest rate of 2% per year. Once the interest amounts to $480, you agree to pay them back the $8000 plus the $480 interest. After how many months will you have to pay them back? Please answer step by steparrow_forwardImelda opens a savings account with $12,000, which pays an annual interest rate of 7.8%. If she reinvests the generated interest every month and also deposits $2,300 each month, how much will be in the account after 2 years? The interest is reinvested on the same day as the $2,300 deposit. Otions: 69177.89 71052.15 73548.61 70524.79arrow_forwardAlien Jackson has $2,000 on her credit card which charges a 23% interest rate. If she wants to pay off the credit card in 4 years, how much will she need to pay each month (assuming she don't charge anything new to the card)?arrow_forward

- 2. Alex needs to repay a $ 8500 debt. His bank offers personal loans with terms from one to five years at 8.9% per year, compounded monthly. a) Determine Alex's monthly payment for a five-year term. Use formula and show your work. ( gag. b) Calculate the total interest paid on the loan if he makes monthly payment. c) Determine Alex's payment if he chooses to make bi-weekly and weekly payments. Use TVM Advanced Calculator and fill up the blank. Bi-weekly Weekly TVM Advanced Calculator TVM Advanced Calculator Mode *End O Beginning Mode End Beginning Present Value PV Present Value PV Payments PMT Payments PMTarrow_forwardAt the time of her grandson's birth, a grandmother deposits $4000 in an account that pays 4% compounded monthly. What will be the value of the account at the child's twenty-first birthday, assuming that no other deposits or withdrawals are made during this period? Click the icon to view some finance formulas. The value of the account will be $ (Round to the nearest dollar as needed.) Formulas In the provided formulas, A is the balance in the account after t years, P is the principal investment, r is the annual interest rate in decimal form, n is the number of compounding periods per year, and Y is the investment's effective annual yield in decimal form. nt A=P(1+1) " P= A (₁.3⁰² Print A=Pet Y Done -1arrow_forwardWhen you were born, your dear old Aunt Minnie promised to deposit $1,000 into a savings account bearing a 5% compounded annual rate on each birthday, beginning with your first. You have just turned 22 and want the dough. However, it turns out that dear old (forgetful) aunt Minnie made no deposits on your third, fifth, and eleventh birthdays. How much is in the account right now?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education