FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

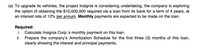

Transcribed Image Text:(a) To upgrade its vehicles, the project Insignia is considering undertaking, the company is exploring

the option of obtaining the $10,000,000 required via a loan from its bank for a term of 4 years, at

an interest rate of 12% per annum. Monthly payments are expected to be made on the loan.

Required:

i.

Calculate Insignia Corp.'s monthly payment on this loan.

ii. Prepare the company's Amortization Schedule for the first three (3) months of this loan,

clearly showing the interest and principal payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Omega Venture Group needs to borrow to finance a project. Repayment of the loan involves payments of $880 at the end of every month for five years. No payments are to be made during the development period of six years. Interest is 9% compounded quarterly. (a) How much should the Group borrow? (b) What amount will be repaid? (c) How much of that amount will be interest? a) The Group should borrow $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) b) The amount that will be repaid is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) c) The amount of interest will be $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.).arrow_forwardA road is constructed at the capital cost of $10 million. At the end of Year 10, major improvements are to be made costing $12 million. At the end of Year 25, a replacement and upgrade is to be done at a cost of $27 million. At the end of year 40, the federal government issues a one-time tax credit in the amount of $11 million. FIND Over a 50-year analysis period (assuming a 10% interest rate) what is the annualized cost (to the nearest dollar, $###) of all of these expenses?arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,080,000 March 1, 2021 900,000 June 30, 2021 320,000 October 1, 2021 700,000 January 31, 2022 720,000 April 30, 2022 1,035,000 August 31, 2022 1,800,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,000,000 and $7,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should…arrow_forward

- The Stinch Fertilizer Corporation wants to accumulate $8,000,000 for plant expansion. The funds are needed on 01/01/2029. Stinch intends to make five equal annual deposits in a fund that will earn interest at 7% compounded annually. The first deposit is to be made on 01/01/2024. Present value and future value facts are as follows: What is the amount of the required annual deposit? A. $1,300,813 B. $1,391,304 C. $1,951,220 D. $1,704,000 +arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,080,000 March 1, 2021 900,000 June 30, 2021 320,000 October 1, 2021 700,000 January 31, 2022 720,000 April 30, 2022 1,035,000 August 31, 2022 1,800,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,000,000 and $7,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required:1. Calculate the amount of interest that Mason should…arrow_forwardA property is expected to have NOI of $100,000 the first year. The NOI is expected to increase by 5 percent per year thereafter. The appraised value of the property is currently $1.25 million and the lender is willing to make a $1,125,000 participation loan with a contract interest rate of 5.5 percent. The loan will be amortized with monthly payments over a 20-year term. In addition to the regular mortgage payments, the lender will receive 50 percent of the NOI in excess of $100,000 each year until the loan is repaid. The lender also will receive 50 percent of any increase in the value of the property. The loan includes a substantial prepayment penalty for repayment before year 5, and the balance of the loan is due in year 10. (If the property has not been sold, the participation will be based on the appraised value of the property.) Assume that the appraiser would estimate the value in year 10 by dividing the NOI for year 11 by an 8 percent capitalization rate. Required: Calculate…arrow_forward

- A property is expected to have NOI of $100,000 the first year. The NOI is expected to increase by 5 percent per year thereafter. The appraised value of the property is currently $1.25 million and the lender is willing to make a $1,125,000 participation loan with a contract interest rate of 5.5 percent. The loan will be amortized with monthly payments over a 20-year term. In addition to the regular mortgage payments, the lender will receive 50 percent of the NOI in excess of $100,000 each year until the loan is repaid. The lender also will receive 50 percent of any increase in the value of the property. The loan includes a substantial prepayment penalty for repayment before year 5, and the balance of the loan is due in year 10. (If the property has not been sold, the participation will be based on the appraised value of the property.) Assume that the appraiser would estimate the value in year 10 by dividing the NOI for year 11 by an 8 percent capitalization rate. Assume that another…arrow_forward(Loan Amortization Problem) Your company is planning to borrow $2,500,000. This will be a six-year, 2 percent per year, annual payment, fully amortized term loan. The first payment will be made one year from today. What fraction of the total annual payment made at the end of year three will represent repayment of principal? [Hint: you need only complete the first three rows of the amortization schedule to answer this question.] Step By Step please, as if writing down the solution on a sheet of paper.arrow_forwardA corporation has decided to use borrowed capital to finance a portion of an equipment purchase. The equipment will be partially financed by borrowing $40,000 on a 2-year contract at 7% interest compounded annually, with the loan to be repaid in two equal EOY installments. The average inflation rate during this period is expected to be 2%. Determine the loan payment amount.arrow_forward

- The management of a condominium association anticipates a capital expenditure of $150,000 in 3 years for the purpose of painting the exterior of the condominium. To pay for this maintenance, a sinking fund will be set up that will earn interest at the rate of 5.6%/year compounded monthly. Determine the amount of each (equal) monthly installment the association will be required to deposit into the fund at the end of each month for the next 3 years. (Round your answer to the nearest cent.)arrow_forwardBank Al Ain Islami provides a financing facility based on the Murabaha principle to Seif Construction to purchase specialized Equipment to be used for their construction project. The amount of financing is $15,000,000 at a constant rate of return of 10% for a period of 5 years. Due to some cash flow problems, Seif Construction paid the final installment in Year 6. Required: i. ii. Present a statement showing the amount of Net Receivable, Unearned Murabaha Income, and Murabaha Income for the whole duration of the contract.Prepare journal entries for Bank Al Ain Islami for the above transactions (YO-Y6).arrow_forwardA building is expected to require $1,000,000 in capital improvement expenditures in five years (60 months). The building's net operating cash flow prior to that time is expected to be at least $20,000 at the end of every month. How much of that monthly cash flow must the owners set aside each month in order to have the money available for the capital improvements, assuming monthly interest rate is 1.5%? Group of answer choices $14,332.83 $13,609.73 $12,666.67 $10,393.43arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education