Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

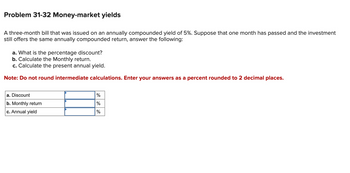

Transcribed Image Text:Problem 31-32 Money-market yields

A three-month bill that was issued on an annually compounded yield of 5%. Suppose that one month has passed and the investment

still offers the same annually compounded return, answer the following:

a. What is the percentage discount?

b. Calculate the Monthly return.

c. Calculate the present annual yield.

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.

a. Discount

b. Monthly return

c. Annual yield

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A one-year discount factor Z(0, 1) is at 0.999 and a two-year discount factor Z(0, 2) is at 0.99. The quarterly - compounded forward rate f 4 (0, 1, 2) equals to A. 0.905% B. 0.907% C. 1.810% D . 1.812% E. None of A to D is correctarrow_forward7) the math of interest. please indicate if you are unsure or totally sure about the answerarrow_forward(Annual percentage yield) Compute the cost of the following trade credit terms using the compounding formula, or effective annual rate. Note: Assume a 30-day month and 360-day year. a. 2/5, net 60 b. 4/15, net 30 c. 3/10, net 75 d. 4/15, net 60. BETER a. When payment is made on the net due date, the APR of the credit terms of 2/5, net 60 is%. (Round to two decimal places.)arrow_forward

- Suppose that a three-year FRN pays a six-month Libor plus 4% semi-annually. Currently, the six-month Libor is 2%. The price of the floater is 90 per 100 of par value. What is the discount margin?arrow_forwardSuppose you make equal quarterly deposits of $2,500 into a fund that pays interest at a rate of 5% compounded monthly. Find the balance at the end of year 3. Hint: You will need an effective interest rate in your calculations. As a proportion, round this value to 4 places after the decimal when you use this in subsequent calculations. Note: Note: When entering your answer, do not use any dollar symbols or any other units. Enter only the value rounded to the nearest integer (nearest dollar). Also, for longer values, do not use any commas.arrow_forwardAn estimate has the following cost and revenue cash flows. The cash flows are assumed to occur at the end of the year. (a) If interest is 10%, find the net present worth, net future worth, and net annual equivalentworth.(b) Find the rate of return. (Hint: The guessing range is 25 to 30%).(c) Present a summary of the four methods Year Cost Revenue 0 $800 $0 1 - $450 2 - $425 3 - $400arrow_forward

- 1.An investment that has a maturity value of $3,400 and is discounted 5 years and 6 months before maturity at 4.80% compounded semi-annually. a. Calculate the discounted value of the investment. $0.00 Round to the nearest cent b. Calculate the amount by which the money is discounted.arrow_forward92. Subject :- Financearrow_forwardFor each of the following cases, indicate (a) what interest rate columns and (b) what number of periods you would refer to in looking up the present value factor. (1) In Table 3 (present value of 1): Number of Discounts Annual Rate Years Involved per Year Case A 9% 7 Case B 10% 8 Annually Semiannually Case C 8% 8 Semiannually Case A Case B Case C (a) (b) % periods % periods % periods (2) In Table 4 (present value of an annuity of 1): Annual Rate Number of Years Involved Number of Payments Involved Frequency of Payments Case A 8% 15 15 Annually Case B 8% 4 4 Annually Case C 12% 8 16 Semiannually (a) Case A % Case B % (b) periods periods Case C % periodsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education