Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

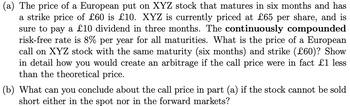

Transcribed Image Text:(a) The price of a European put on XYZ stock that matures in six months and has

a strike price of £60 is £10. XYZ is currently priced at £65 per share, and is

sure to pay a £10 dividend in three months. The continuously compounded

risk-free rate is 8% per year for all maturities. What is the price of a European

call on XYZ stock with the same maturity (six months) and strike (£60)? Show

in detail how you would create an arbitrage if the call price were in fact £1 less

than the theoretical price.

(b) What can you conclude about the call price in part (a) if the stock cannot be sold

short either in the spot nor in the forward markets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The price of a stock, which pays no dividends, is $30 and the strike price of a three-year European call option on the stock is $27. The risk-free rate is 8% (continuously compounded). Which of the following is a precise lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? Round your answer to 2 decimal places. Question 12Answer a. $8.76 b. $8.42 c. $8.57 d. $8.70arrow_forwardAm. 103.arrow_forwardThe risk-free rate is 8% per annum with continuous compounding. The price of stock CPU is $30. CPU currently does not pay a dividend. You use a two-step tree to price a European put on CPU with a strike price of $32. The option expires in six months. If you estimate that u=1.1 and d=0.9, what is the price of your put? A.$1.50 B.$2.24 C.$1.88 D.$2.56arrow_forward

- Please give me answer fast. I will rate for sure.arrow_forwardThe current market share price of Belta Airlines plc is $20. Every month, the stock price is expected either to increase by a multiplicative factor u = 1.1, or decrease by d = 0.91. The relevant annual continuously compounded risk-free rate of interest is 6%. 2. (a) What, according to the binomial option pricing model, will be the price of a 3-month European put option on a share of Belta stock, with a strike price of £19.50? (b) (c) What would the price of the put option was American style? If your answers to parts (a) and (b) differ, why do they differ?arrow_forwardPlease show all stepsarrow_forward

- A futures price is currently 70, its volatility is 20% per annum, and the risk-free interest rate is 6% per annum. What is the value of a five-month European put on the futures with a strike price of 65?arrow_forwardThe price of a stock, which pays no dividends, is $30 and the strike price of a two-year European call option on the stock is $25. The risk-free rate is 8% (continuously compounded). Which of the following is a precise lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? Round your answer to 2 decimal places. a. $8.42 b. $8.76 c. $8.57 d. $8.70arrow_forwardSuppose an investor purchases $114,000 of TIPS with a 6.14% coupon rate and 12 years until maturity. How much with the second coupon payment be if the level of CPI adjusts to the levels below? Today 6 months from now 12 months from now 18 months from now 228 246.2 256.1 265.5arrow_forward

- A stock price is currently $51. It is assumed that at the end of six months it will be either $30 or $74. The risk-free interest rate is 1.3% per annum with continuous compounding. The stock doesn't pay dividends. One-step binomial tree is used to value options. What is the value of a six-month European call option with a strike price of $51? Round your final result to the nearest cents and input one number only, without units or percentage sign [%], using the dot [.] to separate decimals. Your Answer: Answerarrow_forwardThe market price of a security can be modelled by assuming that it will either increase by 25% or decrease by 15% each month, independently of price movement in other months. No dividends are payable in the next two months. The continuously compounded monthly risk-free rate of interest is 1%. The current market price of the security is 127. a.) Use the binomial model to calculate the value of a two-month European put option on the security with strike price of 125. b.) Calculate the value of a two-months American put option on the same security with the same strike price. c.) Calculate the value of a two-months American call option on the same security with the same strike price.arrow_forwardWhat is the price of an American CALL option that is expected to pay a dividend of $2 in three months with the following parameters? s0 = $40d = $2 in 3 monthsk = $43 r = 10%sigma = 20%T = 0.5 years (required precision 0.01 +/- 0.01)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education