ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

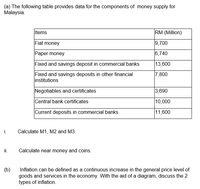

Transcribed Image Text:(a) The following table provides data for the components of money supply for

Malaysia.

Items

RM (Million)

Fiat money

9,700

Paper money

6,740

Fixed and savings deposit in commercial banks

13,600

Fixed and savings deposits in other financial

institutions

7,800

Negotiables and certificates

3,690

Central bank certificates

10,000

Current deposits in commercial banks

11,600

i.

Calculate M1, M2 and M3.

i.

Calculate near money and coins.

(b)

Inflation can be defined as a continuous increase in the general price level of

goods and services in the economy. With the aid of a diagram, discuss the 2

types of inflation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 60. Suppose the central bank wishes to increase the money supply directly. To do so, it could buy government securities on the open market. sell some of its foreign currency assets. sell government securities on the open market. change the price level. reduce its deposits at commercial banks.arrow_forward1. Suppose velocity is 3, real output is 9000, and the price level is 1.5. What is the level of real money balances in this economy? 2. Considered the following data for an economy. Currency in circulation held by the public: CU = 400 dollars; Monetary Base: B = 800 dollars; currency/deposit ratio: cu = 0.25. What is the value of reserves in this economy? 3. Considered the following data for an economy. Currency in circulation held by the public: CU = 400 dollars; Monetary Base: B = 800 dollars; currency/deposit ratio: cu = 0.25. What is the value of the money multiplier in this economy? Please answer the three questions above (and highlight the answer if you can). Please explain the math/reasoning usedarrow_forwardI only need Help with part (B)arrow_forward

- 61.The preferences of households determine the: A)reserve–deposit ratio. B)currency–deposit ratio. C)size of the monetary base. D)loan–deposit ratio. 62.If the monetary base is denoted by B, rr is the ratio of reserves to deposits, and cr is the ratio of currency to deposits, then the money supply is equal to ______ divided by ______ multiplied by B. A)(rr + 1); (rr + cr) B)(cr + 1); (cr + rr) C)(rr + cr); (rr + 1) D)(rr + cr); (cr + 1) 63.The ratio of the money supply to the monetary base is called: A)the currency–deposit ratio. B)the reserve–deposit ratio. C)high-powered money. D)the money multiplier. 64.High-powered money is another name for: A)currency. B)demand deposits. C)the monetary base. D)M2. 65.If the ratio of reserves to deposits (rr) increases, while the ratio of currency to deposits (cr) is constant and the monetary base (B) is constant, then: A)it cannot be determined whether the money…arrow_forwardAnswer questions 1-4 about Nigeria's macroeconomy (Nigeria's currency): Currency in Circulation (October 2020) 40.5 billion nigerian currency Reserves (October 2020) 34.2 billion nigerian currency M1 (October 2020) 2,465.9 billion nigerian currency M2 (October 2020) 2,638.8 billion nigerian currency Calculate the size of the monetary base in October 2020. one decimal place. Calculate the size of demand (checking) deposits in October 2020. Round your answer to one decimal place. Calculate the size of savings deposits in October 2020. Round your answer to one decimal place.arrow_forwardTable: Statistics for a Small Economy Item Value (millions) $7 130 Money market mutual funds 18 Checkable deposits 36 Currency and total reserves at the Fed 12 Large-time deposits 20 Demand deposits 14 Cash held by public Small-time deposits The table shows some statistics for a small economy. Based on only the information provided, M2 in this country amounts to: $105 million. $121 million. $137 million. $129 million.arrow_forward

- 50. Commercial banks maintain their reserves in the form of cash in their bank vaults and deposits at the Bank of Canada. deposits at other commercial banks that are immediately accessible. cash in their bank vaults. cash and foreign currency at the Bank of Canada. gold in their bank vaults.arrow_forward1. Explain the differences between commodity money and fiat money. What are the major disadvantages of commodity money?arrow_forwardMatch the moneys source of value with the examplearrow_forward

- Money as a means of payments refers only to: a. Actual currency b. Coins and currency c. Coins, currency and credit cards d. Anything that is generally accepted as payment for goods and servicesarrow_forwardplease answer this question in 30 minutes. please answer each parts according to wordcount.arrow_forwardSolve all this question......you will not solve all questions then I will give you down?? upvote.....arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education