Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

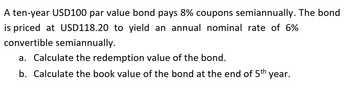

Transcribed Image Text:A ten-year USD100 par value bond pays 8% coupons semiannually. The bond

is priced at USD118.20 to yield an annual nominal rate of 6%

convertible semiannually.

a. Calculate the redemption value of the bond.

b. Calculate the book value of the bond at the end of 5th year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A 15-year bond with a coupon of Sx payable every 6 months has a face (and redemption) value of $10,000. At the nominal annual interest rate of 6.5% convertible semi-annually, the price of the bond is $9,000. Compute X.arrow_forwardA S80000 bond bearing interest at 7% payable semi dash annually is bought six years before maturity to yield 7.1% compounded quarterly. If the bond is redeemable at par, what is the purchase price?arrow_forwardA bond promises to pay the bondholder equal payments of php 6000.00 in six month interval for 30 years. if the face amount is php 450000. What is the fair price of the bond ? Assume that market rate is 2% compounded annually?arrow_forward

- Calculate the yield to maturity on the following bonds: A 9.4 percent coupon (paid semiannually) bond, with a $1,000 face value and 19 years remaining to maturity. The bond is selling at $965. An 8.4 percent coupon (paid quarterly) bond, with a $1,000 face value and 10 years remaining to maturity. The bond is selling at $901. An 11.4 percent coupon (paid annually) bond, with a $1,000 face value and 6 years remaining to maturity. The bond is selling at $1,051. (For all requirements, do not round intermediate calculations. Round your percentage answers to 3 decimal places.arrow_forwardA 5-year bond has a face value of £100. The bond pays coupons semi-annually at a rate of 4%. The bond currently yields 5% p.a. effective in the market. Calculate the price of the bond £ 数字 Enter your answer as a decimal correct to 2 decimal placesarrow_forwardA $1,000, 9.50% semiannual bond is purchasedfor $1,010. If the bond is sold after three years andsix interest payments, what should the selling pricebe to yield a 10% return on the investment?arrow_forward

- A 15-year maturity bond with par value $1,000 makes semiannual coupon payments at a coupon rate of 6%. Required: a. Find the bond equivalent and effective annual yield to maturity of the bond if the bond price is $940. (Round your intermediate calculations to 4 decimal places. Round your answers to 2 decimal places.) b. Find the bond equivalent and effective annual yield to maturity of the bond if the bond price is $1,000. (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. Find the bond equivalent and effective annual yield to maturity of the bond if the bond price is $1,040. (Round your intermediate calculations to 4 decimal places. Round your answers to 2 decimal places.)arrow_forwardA 10-year bond with a $1,000 face value has a coupon rate of 8 percentpaid semiannually. If current interest rates are 7 percent for bonds of asimilar nature, calculate the price of the bond.arrow_forwardA three-year, 1000 dollars, 6 percent bond with semiannual coupons has redemption amount 1,040 dollars. Make amortization tables for this bond if it is bought to yield a nominal rate of 4 percent convertible semiannually.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education