FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

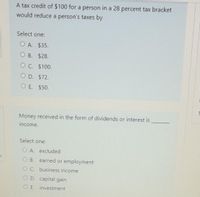

Transcribed Image Text:A tax credit of $100 for a person in a 28 percent tax bracket

would reduce a person's taxes by

Select one:

O A. $35.

О В. $28.

O C. $100.

O D. $72.

O E. $50.

Money received in the form of dividends or interest is

income.

Select one:

O A. excluded

O B. earned or employment

C. business income

D. capital gain

O E. investment

O O

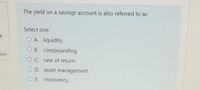

Transcribed Image Text:The yield on a savings account is also referred to as

Select one:

of

O A. liquidity.

O B. compounding.

zion

O C. rate of return.

O D. asset management.

O E. insolvency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ront Peragraph Styies Edting Senitty Now let's do a problem where we know the person's taxes and want to find their taxable income, and their AGI You may find the functions you determined in the question above helpha 6. Suppose someone paid $17,500 in taxes What could this person's adjusted gross income be? 1040 Linels) Description Amount 1 and Sb Wagen, salanes, and Sps Adjusted gross income (AGI) Standard deduction and exemption (singie. nondependent) Subtract line 5 trom line 4 Taxable income Total Tax (hom schedule) Elfective tax rate (tax asacentage of all income) 11a $12 200 11b $17.500 2019 Tax Schedule (NOT ued for HW- separate Tax Schedules previded wm Single Taxable Income Tax Brackets and Rates, 2019 If taxxable income is over- but not oer the tax i $0,700 $0,700 $39,475 584 200 $160,725 $204, 100 $30 475 $94.200 $160,725 $204.100 $610,300 10% of the amount over $0 $970 plus 12% of the amount over $0,700 $4,543 plus 22s of the amount over $39475 $14,382 plus 24 of the amount…arrow_forwardWhat is the alternative minimum tax (AMT) rate for individuals? 1 %. 7%. 12.3%. 20%.arrow_forwardGiven the following tax structure: Taxpayer Mae Salary $ 44,500 Pedro $ 68,500 Total Tax $ 3,738 ??? Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax p b. This would result in what type of tax rate structure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? Minimum tax $5,754 X mirod Required Parrow_forward

- 2) Suppose the income tax rate schedule is O percent on the first $10,00O; 10 percent on the next $20,000; 20 percent on the next $20,000; 30 percent on the next $20,000; and 40 percent on any income over $70,000. Family A earns $32,000 a year and Family B earns $70,000 a year. Both families each receive a ten percent raise. What is the marginal tax rate of each and what is the extra tax paid by each after the raise? 3) "Only in a progressive tax system does the amount of taxes increase as income increases." Do you agree or disagree? Explain.arrow_forwardSuppose a tax is such that an individual with an income of $10,000 pays $2000 of tax, a person with an income of $20,000 pays $3000 of tax, a person with an income of $30,000 pays $4000 of tax, and so forth. What is each person’s average tax rate? Is this tax regressive, proportional, or progressive?arrow_forwardIf you would have to pay $5,000 in taxes on $50,000 taxable income and $8,000 in taxes on $60,000 taxable income, then the marginal tax rate on the additional $10,000 of income is A.- 15 percent, and the average tax rate is 30 percent at the $60,000 income level. B.- 30 percent, and the average tax rate is about 13 percent at the $60,000 income level. C.- 30 percent, but average tax rates cannot be determined from the information given. D.- 30 percent, and the average tax rate is 20 percent at the $50,000 income level.arrow_forward

- Which taxes are major taxes on income? That is, which taxes are normally paid in the form of deductions from a worker's paycheck? Major Tax Sc property tax Medicare tax income tax 1 Not a Major Tax Q A 2 ZI option WS # 3 X H command c E D S4 JAR 19 CRF +++ % 5 sales tax Search or type URL Social Security tax VT 6 GY B tv 7 H SHIVA UN* CO 8 J1 M 9 K(+ OH comarrow_forwardwhich of these two has a higher after-tax yield, assuming a 21% income tax bracket? a. 4.00% taxable b. 3.25% tax-free bandarrow_forward□ Mikeez gross income is $57,000, and he is in the 22 percent tax bracket. His taxable income is $43,175. Therefore, his tax liability is $5,357. Mikeez effective tax rate is approximately (BLANK) percent. Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a Question 17 с b 9 d 22 11 12arrow_forward

- A taxable investment produced interest earnings of $2,800. A person in a 26 percent tax bracket would have after-tax earnings of: (Round your answer to the nearest whole number.) Multiple Choice $2,800. $728. $1,347. $2,072. $2,285.arrow_forwardI am working on creating an excel sheet using tax brackets. Can you please assist me with an excel formula that would automatically calculate the tax with the following bracket: Cumulative Tax Income Less than 22,000 22,000 89,450 190,750 364,200 462,500 693,750 Rate 10% 12% 22% 24% 32% 35% 37% $2,200 10,294 32,580 74,208 105,664 186,602 My objective is to determine net income after taxes. I need to determine the formula so I can automatically calculate tax based on the respective tax rates when typing in their income. I have figured out the other part, but am not sure with the IF/Then formula. Thank you! Taxable Income 72,300 Federal Income Tax ??????arrow_forward3kk.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education