ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

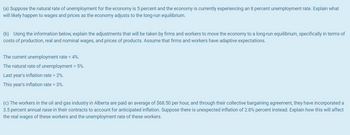

Transcribed Image Text:(a) Suppose the natural rate of unemployment for the economy is 5 percent and the economy is currently experiencing an 8 percent unemployment rate. Explain what

will likely happen to wages and prices as the economy adjusts to the long-run equilibrium.

(b) Using the information below, explain the adjustments that will be taken by firms and workers to move the economy to a long-run equilibrium, specifically in terms of

costs of production, real and nominal wages, and prices of products. Assume that firms and workers have adaptive expectations.

The current unemployment rate = 4%.

The natural rate of unemployment = 5%.

Last year's inflation rate = 2%.

This year's inflation rate = 3%.

(c) The workers in the oil and gas industry in Alberta are paid an average of $68.50 per hour, and through their collective bargaining agreement, they have incorporated a

3.5 percent annual raise in their contracts to account for anticipated inflation. Suppose there is unexpected inflation of 2.8% percent instead. Explain how this will affect

the real wages of these workers and the unemployment rate of these workers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the information given here to answer the following question. Sales revenue = Pm * Qm = 150 Payments to labor = w * Lm = 100 Payments to capital = Rk * K = 50 Agriculture: Sales revenue = Pa * Qa = 150 Payments to labor = w * La = 50 Payments to land = Rt * T = 100 Holding the price of manufacturing constant, suppose the increase in the price of agriculture is %10 and the increase in the wage is %5. Explain what has happened to the real rental on land and the real rental on capital ? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward11. Suppose that the production function is Y=K^(0.5) N^(0.5). With this production function the marginal product of labor is MPN=0.5K^(0.5) N^(-0.5). The capital stock is K=100. The labor supply curve is NS=100(w^2), where w is the real wage and NS denotes the quantity of labor supplied. Compute the equilibrium level of employment (N). 12. Consider Question 11 again. Compute the level of full-employment output (Y). Approximate your answer to the next integer. 13. Consider Question # 11 again. Due to a temporary reduction in immigration, the economy's labor supply curve changes to NS=90(w^2). A policy maker suggests that in order to increase full-employment output in response to the reduction in immigration the government might temporarily subsidize the firm's labor cost by paying a fractions of the wage it pays to a worker. That is, if the real wage received by a worker is w, the firm only pays a portion (1-s)w with the remaining sw coming from the government. Compute the subsidy s…arrow_forward(a) Suppose the natural rate of unemployment for the economy is 5 percent and the economy is currently experiencing an 8 percent unemployment rate. Explain what will likely happen to wages and prices as the economy adjusts to the long-run equilibrium. (b) Using the information below, explain the adjustments that will be taken by firms and workers to move the economy to a long-run equilibrium, specifically in terms of costs of production, real and nominal wages, and prices of products. Assume that firms and workers have adaptive expectations. The current unemployment rate = 4%. The natural rate of unemployment = 5%. Last year's inflation rate = 2%. This year's inflation rate = 3%. (c) The workers in the oil and gas industry in Alberta are paid an average of $68.50 per hour, and through their collective bargaining agreement, they have incorporated a 3.5 percent annual raise in their contracts to account for anticipated inflation. Suppose there is unexpected inflation of 2.8%…arrow_forward

- Graphically show the impact of a positive technological shock. Include all three markets: Labor, Product, Capital. Start with an initial steady state. Show the impact of a shock in the initial market. Next show the propagation mechanism--how it carries over into the other two markets. Show at least one set of the feedback loop, Show the new steady state.arrow_forwardIn order to mitigate the economic impacts of the COVID-19 recession, the Government plans to run large budget deficits to improve infrastructure and build more public and transitional houses in New Zealand. Briefly describe the impact of this budget plan (with everything else held constant) on the following variables in the short run. (a) aggregate demand; (b) the price level; (c) the supply of loanable funds; (d) the real interest rate; (e) the relative attractiveness of NZD-denominated assets; (f) net foreign investment; (g) the exchange rate of the NZ dollar; (h) NZ exports (i) NZ imports; (j) the value of NZ net exports.arrow_forwardThe graphs below depict the initial market for labor (on the left) and the macroeconomic production function (on the right). You will use these graphs to identify the effect of an increase in the number of available workers on employment, Potential GDP, and per-worker productivity. Suppose that a substantial increase in labor force participation increases the supply of labor by 40,000 workers at every value of the real wage. (1) Identify the effect of this event on equilibrium employment in the market for labor, and identify the specific new equilibrium level of employment. (2) Identify the effect of this event on Potential GDP, and identify the specific new level of Potential GDP. (3) Finally, identify the effect of this event on per-worker productivity, and identify the specific new level of per-worker productivity. You should embed a graph that clearly depicts (1) the correct supply shift in the market for labor, (2) the new equilibrium real wage, and (3) the new equilibrium…arrow_forward

- Assume that aggregate demand curve can be expressed by the following function: W = 55 - 3Q, while the aggregate supply curve can be expressed by the following function: W = 5+7Q. Here W denotes wage level in thousand dollar and Q denotes unit of labours in million people. What is labour equilibrium wage level and units of labour?arrow_forward11arrow_forwardIn the United States economy, there is a great deal of focus on technological advancements. These advances are said to increase worker productivity (like Zoom) or increase the productivity of capital (such as technology that makes the supply chain more efficient).What effect does advancement in technology have on the equilibrium real rental price and capital, assuming that the supply of capital is fixed? Explain, using the terms in the production function, how you know this to be true.arrow_forward

- Which of the following is INCORRECT? In a typical month more than 5 percent of workers leave their jobs. Frictional unemployment is inevitable in a dynamic economy. Although the unemployment created by sectoral shifts is unfortunate, in the long run such changes lead to higher productivity and higher living standards. At least 10 percent of U.S. manufacturing jobs are destroyed every year.arrow_forwardThe Greek letter a represents a number that determines how much output responds to unexpected changes in the price level. In this case, assume that a = $2 billion. That is, when the actual price level exceeds the expected price level by 1, the quantity of output supplied will exceed the natural level of output by $2 billion. Suppose the natural level of output is $50 billion of real GDP and that people expect a price level of 110. On the following graph, use the purple line (diamond symbol) to plot this economy's long-run aggregate supply (LRAS) curve. Then use the orange line segments (square symbol) to plot the economy's short-run aggregate supply (AS) curve at each of the following price levels: 100, 105, 110, 115, and 120. PRICE LEVEL 125 120 115 110 105 100 95 90 85 80 75 0 10 20 ☐ 30 40 50 60 70 OUTPUT (Billions of dollars) 80 90 100 -0- AS LRAS (?) The short-run quantity of output supplied by firms will fall short of the natural level of output when the actual price level level…arrow_forwardSuppose the world price of cotton falls substantially. The demand for labor among cotton-producing firms in Texas will . The demand for labor among textile-producing firms in South Carolina, for which cotton is an input, will . The temporary unemployment resulting from such sectoral shifts in the economy is best described as unemployment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education