ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

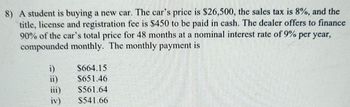

Transcribed Image Text:8) A student is buying a new car. The car's price is $26,500, the sales tax is 8%, and the

title, license and registration fee is $450 to be paid in cash. The dealer offers to finance

90% of the car's total price for 48 months at a nominal interest rate of 9% per year,

compounded monthly. The monthly payment is

i)

S664.15

ii)

$651.46

iii)

S561.64

iv) S541.66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 14. On January 1, 1997, your brother bought a used car for $8,200, and he agreed to make a down payment of $1,500 and repay the balance in 36 equal payments, with the first payment due February 1. The nominal interest rate is 13.8% per year compounded monthly. During the summer your brother made enough money so that he decided to repay the entire balance due on the car as of September 1. How much did he repay on September 1? (4.3)arrow_forwardLourdes has just retired and plans to consume $12829 from the retirement account every year for the next 14 years starting one year from today, meeting the rest of the expenses from other resources. If the annual interest rate is 9% compounded bimonthly, how much does Lourdes have in the retirement account today?arrow_forwardThe monthly average cable TV bill in 2017 is $74.72. If cable costs are climbing at an annual rate of 7% per year, how much will the typical cable subscriber pay in 2023? Assume annual compounding. Click the icon to view the interest and annuity table for discrete compounding when i= 7% per year. The typical cable subscriber will pay $ per month in 2023(Round to the nearest cent.) Garrow_forward

- Q 6 pleasearrow_forwardThe nominal interest rate is 14% compounded semiannually. What amount will need to be deposited every six months to be able to have enough money to pay three annuity payments of $20,000 for three years beginning at the end of year seven? The deposits begin now and continue every six months until six deposits have been made. The amount to be deposited every six months is $ (Round to the nearest dollar.)arrow_forwardCalculate the future worth of 20 annual $4,000 deposits in a savings account that earns 8% compounded monthly. Assume all deposits are made at the beginning of each year. a) $196,010 b) $189,673.78 c)$189,244.63 d)$199.279arrow_forward

- Ulyses needs a thousand dollar to launch the global exapansion of his software business.I have agreed to lend him money today at an interest of 6% compounded annually.I require that the loan be repaid in eight annual payment starting at year 3(n=3)with a $10,000 dollar payment.Subsequently,payment decreased by $1,000each year after.Find the present worth at year end 0.arrow_forwardAssuming I deposit my signing bonus of $36,000 at 9% APR, compounded annually, how much will I have upon retirement in 20 years?arrow_forwardI want to know how calculate CR and please don't give handwritten answer.. Thanksarrow_forward

- Gurpreet already had a balance of $1700 on her credit card when she used it to purchase items worth another $335. The minimum monthly payment is 3% of the outstanding balance or $30 dollars, whichever is greater, and the interest rate is 19.7%, compounded daily. If Gurpreet pays only the minimum each month, how long will it take her to pay off the balance? How much interest would she end up paying?arrow_forwardTrie winner of a state lottery will receive $5,300 per week for the rest of her life. If the winner's interest rate is 6.9% per year compounded weekly, what is the present worth of this jackpot? Note: Assume a 52-week year. The present worth of the jackpot is S. (Round to the nearest dollar.)arrow_forwardThe maintenance expense on a tractor is expected to be $5,000 during the first year and to increase $500 each year for the following 9 years. What present sum of money should be set aside now to pay for the required maintenance expenses over the nine-year period? (Adopt 10% compound interest per year)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education