Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

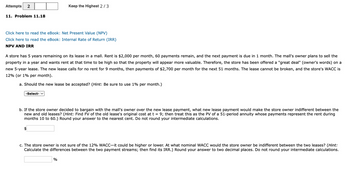

Transcribed Image Text:Attempts

11. Problem 11.18

Click here to read the eBook: Net Present Value (NPV)

Click here to read the eBook: Internal Rate of Return (IRR)

NPV AND IRR

Keep the Highest 2/3

A store has 5 years remaining on its lease in a mall. Rent is $2,000 per month, 60 payments remain, and the next payment is due in 1 month. The mall's owner plans to sell the

property in a year and wants rent at that time to be high so that the property will appear more valuable. Therefore, the store has been offered a "great deal" (owner's words) on a

new 5-year lease. The new lease calls for no rent for 9 months, then payments of $2,700 per month for the next 51 months. The lease cannot be broken, and the store's WACC is

12% (or 1% per month).

a. Should the new lease be accepted? (Hint: Be sure to use 1% per month.)

-Select- ✓

b. If the store owner decided to bargain with the mall's owner over the new lease payment, what new lease payment would make the store owner indifferent between the

new and old leases? (Hint: Find FV of the old lease's original cost at t = 9; then treat this as the PV of a 51-period annuity whose payments represent the rent during

months 10 to 60.) Round your answer to the nearest cent. Do not round your intermediate calculations.

c. The store owner is not sure of the 12% WACC-it could be higher or lower. At what nominal WACC would the store owner be indifferent between the two leases? (Hint:

Calculate the differences between the two payment streams; then find its IRR.) Round your answer to two decimal places. Do not round your intermediate calculations.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Similar questions

- A store has 5 years remaining on its lease in a mall. Rent is $2,100 per month, 60 payments remain, and the next payment is due in 1 month. The mall's owner plans to sell the property in a year and wants rent at that time to be high so that the property will appear more valuable. Therefore, the store has been offered a "great deal" (owner's words) on a new 5-year lease. The new lease calls for no rent for 9 months, then payments of $2,500 per month for the next 51 months. The lease cannot be broken, and the store's WACC is 12% (or 1% per month). a. Should the new lease be accepted? (Hint: Be sure to use 1% per month.) -Select- ✓ b. If the store owner decided to bargain with the mall's owner over the new lease payment, what new lease payment would make the store owner indifferent between the new and old leases? (Hint: Find FV of the old lease's original cost at t = 9; then treat this as the PV of a 51-period annuity whose payments represent the rent during months 10 to 60.) Do not round…arrow_forwardSandra has just signed a 7-year lease for her new business. The full annual lease amount is due at the beginning of every year and such cash flows have been agreed to be 25,918 dollars now and the subsequent payments to increase by 4% per year until maturity. Given that the prevailing average market interest rate is 8% per year compounded monthly, compute the present value of this financial asset. (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas) Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA user has an option to renew a lease on 10,000 square feet at a rate of $8 per square foot for five years. The current market rate is $10 per square foot. What is the value of the user's leasehold interest at 10 percent?arrow_forward

- Kim Inc. must install a new air-conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs, respectively). HCC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher operating costs because it uses more electricity. The costs of the units are shown here. Kim's WACC is 6%. HCC LCC 0 -Select- 1 -$50,000 -$50,000 -$610,000 -$50,000 -$90,000 -$175,000 -$175,000 -$175,000 2 -Select- 3 -Select- ✓ 4 -$50,000 -$175,000 a. Which unit would you recommend? I. Since all of the cash flows are negative, the IRR's will be negative and we do not accept any project that has a negative IRR. II. Since all of the cash flows are negative, the NPV's cannot be calculated and an alternative method must be employed. III. Since all of the cash flows are negative, the NPV's will be negative and we do not…arrow_forwardA real estate broker decides to lease a car for 36 months. Suppose the annual interest rate is 7.8%, the negotiated price is $48,000, there is no trade-in, and the down payment is $3,000. Find the monthly lease payment (in dollars). Assume that the residual value is 48% of the MSRP of $51,800.arrow_forwardYou are considering either leasing or purchasing a car. You notice an ad that says you can lease the car you want for $229.00 per month. The lease term is 48 months with the first payment due at inception of the lease. You must also make an additional down payment of $1,120. The ad also says that the residual value of the vehicle is $12,760. The list price of the vehicle is $20,274, but after much research, you have concluded that you could buy the car for a total "drive-out" price of $18,600. What is the quoted annual interest rate you are actually paying with the lease? 10.23% 10.38% 7.21% 7.11% 8.22%arrow_forward

- Kuehner estimates that it can lease Parker Road Plaza for $18.50 per square foot (GLA) base rent with a 3 percent overage on gross sales in excess of $200 per square foot (GLA). The company expects rents to increase by 5 percent per year during the lease period and tenant reimbursements to run $8 per square foot (GLA) and to increase at the same rate as rents. Kuehner expects to have the shopping center 70 percent leased during the first year of operation After that, vacancies should average about 5 percent per year. The vacancy losses should be cal-culated on the entire gross potential income, which includes minimum rents, percentage rents and tenant reimbursements. Sales, which are expected to average $210 per square foot (GLA) for the first year of operation, should grow at 6 percent per year. The operating expenses are expected to average $14 per square foot of GLA for the first year and will increase at the same rate as the rents. Kuehner will collect an additional 5 percent of…arrow_forwardRed Sun Rising Corporation has just signed a lease for its new manufacturing facility. The lease agreement calls for annual payments of $1,850,000 for 20 years with the first payment due today. If the interest rate is 3.55 percent, what is the value of this liability today?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education