ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:!

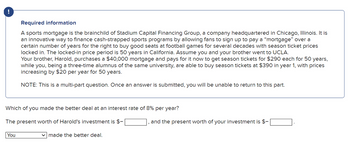

Required information

A sports mortgage is the brainchild of Stadium Capital Financing Group, a company headquartered in Chicago, Illinois. It is

an innovative way to finance cash-strapped sports programs by allowing fans to sign up to pay a "mortgage" over a

certain number of years for the right to buy good seats at football games for several decades with season ticket prices

locked in. The locked-in price period is 50 years in California. Assume you and your brother went to UCLA.

Your brother, Harold, purchases a $40,000 mortgage and pays for it now to get season tickets for $290 each for 50 years,

while you, being a three-time alumnus of the same university, are able to buy season tickets at $390 in year 1, with prices

increasing by $20 per year for 50 years.

NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part.

Which of you made the better deal at an interest rate of 8% per year?

The present worth of Harold's investment is $-

You

✓ made the better deal.

and the present worth of your investment is $-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the current price of a bond is greater than its face value: A) There is no right answer. B) the yield to maturity must be larger than the current yield. C) the coupon rate must be equal to the current yield.arrow_forwardFind the spot rate for a theoretical 2 year zero coupon bond using the following information: 6 month T-bill rate = .5% 1 year T-Bill rate = .75% 1.5-year T-Note rate = 1.10% 2-year T-Note rate = 1.65%arrow_forwardA bank agrees a repurchase agreement (Repo) with its prime broker using £30 million of Mortgage Backed Securities as collateral for a period of 50 days. The prime broker levies a haircut of 10 per cent and charges an annual Repo rate of 4.5 per cent. What is the price at which the bank will repurchase the £30 million MBS at the end of 50 days when the Repo rate interest applies only on the sum of money being lent by the prime broker ? Use a 360 day-count.arrow_forward

- Economics Annual premiums are paid into a 3 year unit linked endowment policy where 98% of each premium is allocated to units in a fund that carries a 3% bid- offer spread and charges management fees of 0.75% of assets at the end of each policy year. The policy has a death benefit of the bid value of units payable at the end of the year of death subject to a minimum of £12,500. The survival benefit is the bid value of units at the end of the term. The life assurance company estimates that expenses are £95 per policy per year. (a) Produce projected revenue accounts for each year of a policy with an annual premium of £5,000 assuming the annual rate of mortality is 0.00498, an investment return of 6.9% per annum and an interest rate on cash balances of 3% per annum. (b) Does the life assurance company meet its internal profit margin objective of 5% on this policy if its risk discount rate is 5.5% per annum?arrow_forwardThe present value of a $1000 discount bond with five years to maturity is $825. Calculate its yield-to-maturity. (Enter your answer in decimal form, up to three decimal places. Example: If your answer is 8.1%, enter it as 0.081) Answer:arrow_forwardIdentify two (2) derivative investment products and how they allow investors to hedge against risk while creating unnecessary risk to the global economy.arrow_forward

- A mortgage that requires a down payment of 5% of the purchase price of the house is called a good deal. an "upside-down" loan a subprime loan a prime loanarrow_forwardRyan and Rebecca have 30 years to retirement. They are taking a personal finance course and have calculated their projected retirement income and investment needs. Based on their calculations and taking into account their Social Security and pension incomes, they have a projected shortfall of $6,250.00 per year. Use the following tables to answer the questions about future value interest factors. Interest Factors—Future Value Interest Factors—Future Value of an Annuity Excel Periods 3.00% 5.00% 6.00% 8.00% 9.00% 20 1.810 2.653 3.210 4.661 5.600 25 2.090 3.386 4.290 6.848 8.620 30 2.420 4.322 5.740 10.062 13.260 35 2.810 5.516 7.690 14.785 20.410 40 3.260 7.040 10.280 21.724 31.410 The impact of the inflation factor Continuing their worksheet, they consult a friend, economics professor Dr. Garcia, who believes that they can expect the average annual inflation rate to be 5%, possibly 6% tops. Complete the following table by…arrow_forwardA bond is a financial asset where the issuer is obliged to pay a bond holder interest at specified intervals (the coupon) and/or to repay the principal at a specified future date (the maturity date). pays a rate of return (interest) that fluctuates with market conditions. receives regular payments from the bond holder determined at a market rate at the time of payment. pays a higher rate of return (yield) as the price of the bond rises.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education