FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

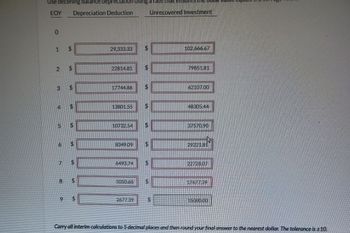

Transcribed Image Text:Use declining balance depreciation using a rate

ΕΟΥ Depreciation Deduction

0

1

2

3

4

5

6

7

8

9

$

$

LA

+A

$

$

LA

$

$

LA

$

$

$

29.333.33

22814.81

17744.86

13801.55

EA

$

$

$

LA

2677.39

10732.54 $

8349.09 $

6493.74 $

5050.68 $

Unrecovered Investment

$

102,666.67

7985181

62107.00

48305.44

37570.90

29221.81

22728.07

17677.39

15000.00

Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±10.

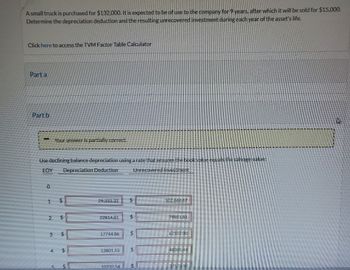

Transcribed Image Text:A small truck is purchased for $132,000. It is expected to be of use to the company for 9 years, after which it will be sold for $15,000.

Determine the depreciation deduction and the resulting unrecovered investment during each year of the asset's life.

Click here to access the TVM Factor Table Calculator

Part a

Part b

- Your answer is partially correct.

Use declining balance depreciation using a rate that ensures the book value equals the salvage value:

ΕΟΥ Depreciation Deduction

Unrecovered Investment

0

1

2

3

$

$

$

4 $

29,333.33

22814.81

17744.86

13801.55

10732.54

$

$

LA

$

$

$

102,666.67

79851.81

62107.00

48305.44

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- We purchase a delivery truck for $70,000 cash. We estimate the following: Cost $70,000 Residual Value $10,000 Life in years 6 years Life in miles 300,000 miles Number of tires 8. 1: IF we have a fiscal year end of 12/31, and we purchase the truck in year 1 on March 1", calculate the depreciation for the first 3 years using the straight-line method:arrow_forward3. Help me answer the given question. Round off to the nearest three (3) decimal placesarrow_forwardA machine can be purchased for $150,000 and used for five years, yielding the following net incomes. In projecting net incomes, straight-line depreciation is applied using a five-year life and a zero salvage value. Compute the machine’s payback period (ignore taxes). (Round the payback period to three decimals.)arrow_forward

- Answer Part A with clear formulasarrow_forwardA machine costs P 7,350, has a life of 8 years and has a salvage value of P 350 at the end of 8 years. In how many years from now when you can sell the machine at P 2,294.44 if depreciation used is SYD Method?arrow_forwardBook value Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery period (years) 5 Elapsed time since purchase (years) 2 Asset A Installed cost $839,000 The remaining book value is $ (Round to the nearest dollar.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 2 3 4 5 6 7 8 3 years 33% 45% 15% 7% 9 10 11 Totals Percentage by recovery year* 5 years 7 years 20% 14% 32% 19% 12% 12% 5% 25% 18% 12% 9% 8% 7% 6% 6% 6% 4% 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year 10 years 10% 18%…arrow_forward

- Help please The following details relate to a particular asset Future Cash flows (per annum) 90,000 Expected period of cash flows 3 years Discount Rate 10% Open market price of asset 210,000 Cost of asset 630,000 Accumulated depreciation 450,000 Calculate both : a)determine the recoverable amount for this asset b)Determine whether the asset is impairedarrow_forwardCost of an x-ray machine is 1.5M pesos that has a useful life of 10 years, salvage value of 20,000 pesos. Find the 5th year depreciation using double declining balance method need answer asaparrow_forwardA tractor for over-the-road hauling is purchased for $105,000.00. It is expected to be of use to the company for 6 years, after which it will be salvaged for $4,200.00. Calculate the depreciation deduction and the unrecovered investment during each year of the tractors life. a. Use straight-line depreciation. Provide depreciation and book value for year 6. Depreciation for year 6 = S__ book value for year 6 = S___arrow_forward

- An underground rock mechanics testing device is to be double declining depreciated. It has a first cost of $25,000 and an estimated salvage of $2,500 after 12 years. (a) What is book value and market value ? (b)Calculate the depreciation and book value for years 1 and 4. (c) Calculate the implied salvage value after 12 years.arrow_forwardA machine was purchased for 100,000 and has a salvage value of 20,000 what is the total depreciation on the 7th year if the economic life is 10 years? Assume i = 8% Use sinking fund methodarrow_forwardA tractor costs $24,140, has an expected life of 12 years, and has a salvage value of $2,300, Use straight line depreciation to find the yearly depreciation Make a depreciation K schedule for the first three years' depreciation Complete the table. Year Depreciation 1 $ 2 $ 3 S Accumulated End-of-year depreciation book value $ $ MAS SAI S 1 cm)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education