Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

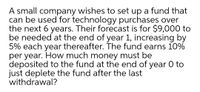

Transcribed Image Text:A small company wishes to set up a fund that

can be used for technology purchases over

the next 6 years. Their forecast is for $9,000 to

be needed at the end of year 1, increasing by

5% each year thereafter. The fund earns 10%

per year. How much money must be

deposited to the fund at the end of year 0 to

just deplete the fund after the last

withdrawal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A fund is built with annual payments increasing by $1 from $1 to $10 and then decreasing by $1 to $0. The first payment of $1 is made today. If the fund is used to purchase a ten-year level annuity with the first payment at twenty years from today, what is the amount of the level payment? (Assume an annual effective rate of interest of 4%.) Possible Answers A B D <$16 c≥ $17 but < $18 E ≥ $16 but < $17 ≥ $18 but < $19 ≥ $19arrow_forwardRATE OF RETURN. You have $5,000 excess cash to invest after you fully funded your emergency fund. You can choose to use the cash on a T-bill that can be purchased for $4,500 (maturing to value at $7,000 after one year) or you can buy two CDs for $2500 each (that can be purchased with a guaranteed 4.5% return after 12 months). Which will give a better return (in percentages)? Show work.arrow_forwardProject A costs $5,300 and will generate annual after-tax net cash inflows of $1,900 for five years. What is the NPV using 5% as the discount rate? Round your present value factor to three decimal places and final answer to the nearest dollar. (Click here to see present value and future value tables) 2,928 xarrow_forward

- An investment of 1000 is to be used to make payments of 100 at the end of every year for as long as possible. If the fund earns an annual effective rate of interest of 6%, find how many regular payments can be made. Also, find the amount of the smaller payment to be paid on the date of the last regular payment to be paid one year after the last regular paymentarrow_forwardHansabenarrow_forwardAcouplewouldliketohave$150,000attheendof7 1/2 years. They can invest $25,000 now and make additional contributions at the end of each month over the 7 1/2 years. If the investment earns 7.2% compounded monthly, what size payments will enable them to reach their goal? Round your answer to the nearest cent.arrow_forward

- A back load fund has initial load of 5% and it will decline by 1% each year after the initial purchase. If you take your money out at the end of year 3, what is the cost of the load if you invested $10,000 in the fund with initial NAV of $23 and adjusted NAV of $36.8 at the end of year 3?arrow_forwardIn a few sentences, answer the following question as completely as you can. Compare discounted cash flow (DCF) and non-discounted cash flow capital budgeting techniques. If you were to evaluate a project, which one of these techniques would you use?arrow_forwardYour RRSP savings of $35,000 are converted to a RRIF at 3.25% compounded monthly that pays $5,100 at the beginning of every month. After how many payments will the fund be depleted? 0 Round to the next paymentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education