Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

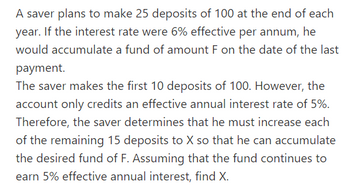

Transcribed Image Text:A saver plans to make 25 deposits of 100 at the end of each

year. If the interest rate were 6% effective per annum, he

would accumulate a fund of amount F on the date of the last

payment.

The saver makes the first 10 deposits of 100. However, the

account only credits an effective annual interest rate of 5%.

Therefore, the saver determines that he must increase each

of the remaining 15 deposits to X so that he can accumulate

the desired fund of F. Assuming that the fund continues to

earn 5% effective annual interest, find X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have finished your time at Kelley and need to start thinking about retirement. You plan on working for 30 moreyears and then retire. Upon your retirement 30 years from today, you plan to have enough money to withdraw $75,000every 6 months, with the first payment coming exactly six months after your retirement day. You expect yourretirement account to earn a return of 8% APR (stated rate), compounded quarterly, on all funds in the retirementaccount. Assume you want to draw on the retirement fund for 20 years after your retirement (40 semiannualwithdrawals), and you want to fund the account with annual level payments, with the first payment being made oneyear from today and the last payment occurring the day of your retirement (30 total payments into the retirementaccount). a) How much do you need in the account on your retirement day to fund the expected semiannual withdrawals?b) How much does each annual payment need to be for the next 30 years to fund the retirement account?arrow_forwardFor planning purposes, an individual wants to be able to spend $90,000 per year, at the end of each year, for an anticipated 30 years in retirement. In order to fund this retirement account, he plan to make annual deposits for 20 years at the end of his each working year. What is the amount he need deposit each year to fund his desired retirement spending? Use 10% as an annual simple rate for all calculations.arrow_forwardAssume that you want to have $ 4450 saved in a sinking fund in 1 year. The account pays 2% compounded monthly. What should be your monthly payments?arrow_forward

- You build a retirement fund by continuously paying into the fund for 30 years, at a rate of 5,000 per year at an effective annual interest rate of 9%. After 30 years, you buy a 30-year annuity immediate with your fund at an effective annual interest rate of 8%. The annuity pays P after one year, and payments increase by 5% thereafter. Find Parrow_forwardTom was trying to determine the best way to save for his retirement. He was selecting between two plans and reasoned that they would provide him the same yield at the end of the terms. Plan A: Deposit $250 per month at 8% annual interest, compounded monthly, for 20 years. Plan B: Deposit $500 per month at 8% annual interest, compounded monthly, for 10 years. Is Tom correct? If not, which plan would provide him the larger annuity? Select the correct answer below: Yes, Tom is correct. Since he is doubling his monthly payment, he can cut the investment time by half. The same amount is deposited either way. No. Plan A will provide a larger savings since there is more time for compound interest to take effect. No. Plan B will provide a larger savings since he is depositing more each month, there is a larger principal for interest to be compounded upon. There is not enough information to determine the answer.arrow_forwardNick set up a savings plan with CIBC whereby he deposits $337 at the end of each quarter for 4 years. Interest throughout the 4-year time period is 1.58% compounded quarterly. The amount in his account at that time will become a term deposit withdrawable after a further 9 years, where interest changes to 4.58% compounded semi-annually. Calculate the total interest earned on the investment. Round your answer to the nearest dollar. Full solution to this problem required.arrow_forward

- A lump sum S deposited into either fund X or fund Y will be exactly sufficient to provide a perpetuity of $100 per year with the first payment due at the end of one year. Fund X will earn interest at an effective annual rate of 10% for the first 30 years and 6% thereafter. Fund Y will earn interest at a level effective annual rate of j. In which of the following ranges is j? someone help?arrow_forwardIf you save $2,000 at the beginning of every year for seven years , for how long can you withdraw $2,760 at the beginning of each year starting seven years from now, assuming that interest is 5% compounded annually.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education