MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

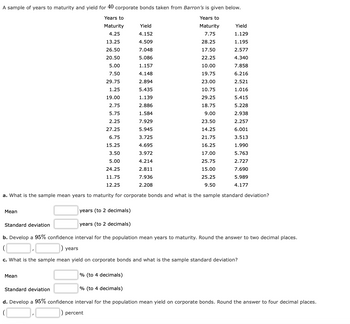

Transcribed Image Text:A sample of years to maturity and yield for 40 corporate bonds taken from Barron's is given below.

Years to

Maturity

Years to

Maturity

4.25

7.75

13.25

28.25

26.50

17.50

20.50

22.25

5.00

10.00

7.50

19.75

29.75

23.00

1.25

10.75

19.00

29.25

2.75

18.75

5.75

9.00

2.25

23.50

27.25

14.25

6.75

21.75

15.25

16.25

3.50

17.00

5.00

25.75

24.25

15.00

11.75

25.25

12.25

9.50

a. What is the sample mean years to maturity for corporate bonds and what is the sample standard deviation?

Mean

years (to 2 decimals)

years (to 2 decimals)

b. Develop a 95% confidence interval for the population mean years to maturity. Round the answer to two decimal places.

Standard deviation

Yield

4.152

4.509

7.048

5.086

1.157

4.148

2.894

5.435

1.139

2.886

1.584

7.929

5.945

3.725

4.695

3.972

4.214

2.811

7.936

2.208

years

Yield

1.129

1.195

2.577

4.340

7.858

6.216

2.521

1.016

5.415

5.228

2.938

2.257

6.001

3.513

1.990

5.763

2.727

7.690

5.989

4.177

Mean

c. What is the sample mean yield on corporate bonds and what is the sample standard deviation?

% (to 4 decimals)

Standard deviation

% (to 4 decimals)

d. Develop a 95% confidence interval for the population mean yield on corporate bonds. Round the answer to four decimal places.

) percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

- Use the following tables to calculate the present value of a $261,000 @ 6%, 6-year bond that pays $15,660 interest annually, if the market rate of interest is 7%. Round to the nearest dollar. Present Value of $1 ¦ Present Value of Annuity of $1 Periods 5 % 6 % 7 % 10 % ¦ Periods 5 % 6 % 7 % 10 % 1 .95238 .94340 .93458 .90909 ¦ 1 .95238 .94340 .93458 .90909 2 .90703 .89000 .87344 .82645 ¦ 2 1.85941 1.83339 1.80802 1.73554 3 .86384 .83962 .81630 .75131 ¦ 3 2.72325 2.67301 2.62432 2.48685 4 .82270 .79209 .76290 .68301 ¦ 4 3.54595 3.46511 3.38721 3.16987 5 .78353 .74726 .71299 .62092 ¦ 5 4.32948 4.21236 4.10020 3.79079 6 .74622 .70496 .66634 .56447 ¦ 6 5.07569 4.91732 4.76654 4.35526 7 .71068 .66506 .62275 .51316 ¦ 7 5.78637 5.58238 5.38929 4.86842 8 .67684 .62741 .58201 .46651 ¦ 8 6.46321 6.20979…arrow_forward7. Calculate the simple interest earned on a $2000 investment at 3.5% per year if the investment period is 6 months. a.$34.50 b.$34.66 c.$420 d.$35.00arrow_forwardAssume a property produces a level NOI of $75,000 per year. The property value is expected to increase by a total of 12 percent over a 4 year holding period. A 10 percent discount rate is considered appropriate. What is the indicated property value? Please show all work. A. $1,012,146 B. $ 595,917 C. $1,001,443 D. $ 599,482arrow_forward

- Monthly Sales 6267.19 7058.06 7119.5 7147.18 7198.52 7298.09 7325.7 7335.68 7355.97 7481.05 7490.23 7530.08 7616.09 7682.69 7684.14 7704.12 7704.98 7779.28 7798.23 7815.15 7844.16 7890.21 7977.6 7993.16 8021.03 8028.37 8068.86 8082.42 8096.17 8119.25 8129.21 8190.68 8255.28 8282.44 8376.31 8392.4 8400.95 8451.16 8456.66 8505.35 8539.25 8543.65 8573.05 8641.78 8667.48 8751.08 8777.97 8800.08 8888.65 8907.03 9096.87 9241.74 9411.68 9450.73 9484.62 9514.57 9521.4 9524.91 9733.44 10123.24 Given the company’s performance record and based on the empirical rule of normal distribution (also known as the 68%-95%-99.7% rule), what would be the lower bound of the range of sales values that contains 68% of the monthly sales? What would be the upper bound of the range of sales values that contains 68% of the monthly sales?arrow_forwardConsider a 5-year, 4.0% coupon rate, $1,000 face value bond that pays quarterly coupons. How much is this bond worth if its yield to maturity is 4.7%? O a. $647.7 b. $1,204.1 O c. $969.0 O d. $1,269.8 O e. $1,507.0 O f. $1,039.0 O g. $1,245.9 h. $1,326.8arrow_forwardTable 1: Accumulated Interest Year 1 Lower-Risk Customer Higher-Risk Customer ACCUMULATED INTEREST Figure 1: Accumulated Interest 14,000.00 12,000.00 10,000.00 8,000.00 6,000.00 4,000.00 2,000.00 0 1 1,396.55 2,605.48 2 3,190.68 3,190.68 6,096.38 8,628.07 10,668.88 1,396.55 Accumulated Interest 2 6,096.38 Ⓒ2,605.48 3 Lower-Risk Customer 3,602.39 4,359.66 4,846.10 3 8,628.07 4 3,602.39 YEAR Ⓒ10,668.88 Ⓒ4,359.66 Higher-Risk Customer 5 Ⓒ12,065.44 5 Ⓒ4,846.10 12,065.44 12,616.45 5,026.46 6 6 Ⓒ12,616.45 5,026.46 4) Using the graph in 3), calculate the difference in the accumulated interest amount earned in year 5 by the credit card company charging 27.5 % versus 12.3% nominal annual rate of interest. 7arrow_forward

- You've collected the following information from your favorite financial website. 52-Week Price Lo 10.43. Acevedo .36 Hi 77.40 56.46 130.93 50.24 35.00 Stock (Dividend). 34.07 Georgette, Incorporated 2.19 YBM 2.00 69.50 13.95 20.74 a. Highest dividend yield b. Lowest dividend yield Dividend Yield 2.6 5.3 2.2 5.2 1.5 % % PE Ratio 6 10 10 Manta Energy .80 6 Winter Sports .32 28 Find the quote for the Georgette, Incorporated. Assume that the dividend is constant. a. What was the highest dividend yield over the past year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What was the lowest dividend yield over the past year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Close Price 13.90 Net Change -.24 -.01 3.07 -.26 .18 41.08 88.97 15.43 22arrow_forwardWhat level of production will maximum potential profit given the parabolic profit function, profit = P(q) = 2q? + 600q - 10000. O A. 200 О в. 100 ОС. 50 O D. 150 Click to select your answer. MAR 2. MacBook Air esc 888 F4 F1 F2 F3 F5 F6 F7 #: $ & 3 4 6. 7 Q W E R tabarrow_forwardThe following table lists several corporate bonds. Treat these as zero coupon bonds, as in Example 2. Company AT&T Bank of America General Electric Goldman Sachs Verizon Wells Fargo Time to Maturity (years) 10 10 2 3 8 7 Annual Compound Interest Rate (%) 2.97 4.42 6.12 6.81 5.41 3.18 If you paid a total of $6,215.89 for General Electric bonds, what is their maturity value? (Round your answer to the nearest $1.) $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman