ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

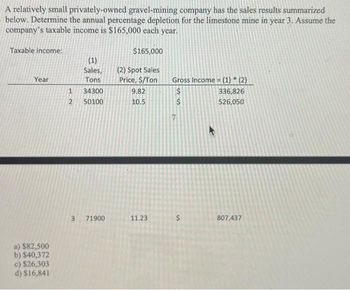

Transcribed Image Text:A relatively small privately-owned gravel-mining company has the sales results summarized

below. Determine the annual percentage depletion for the limestone mine in year 3. Assume the

company's taxable income is $165,000 each year.

Taxable income:

$165,000

(2) Spot Sales

Price, $/Ton

Year

a) $82,500

b) $40,372

c) $26,303

d) $16,841

(1)

Sales,

Tons

1 34300

2 50100

3 71900

9.82

10.5

11.23

Gross Income = (1) * (2)

$

$

7

$

336,826

526,050

807,437

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Calculate the salvage value of equipment with a service life of 15 years if it was purchased 5 years ago for $120 000 and depreciates at the rate of 10% per year. Select one: a. $60 000 b. $70 859 c. $12 000 d. $24 707 e. $5 400 Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism. Answer completely and accurate answer. Rest assured, you will receive an upvote if the answer is accurate.arrow_forward8BE11-11 Francis Corporation purchased an asset at a cost of $50,000 on March 1, 2014. The asset has a useful life of 8 years and a salvage value of $4,000. For tax purposes, the MACRS class life is 5 years. Compute tax depreciation for each year 2014-2019.arrow_forward2arrow_forward

- 2. An asset purchased for $50,000 has a depreciable life of 5 years, and it has a terminal book (salvage) value of $5,000 at the end of its depreciable life. With the straight-line method of depreciation, what is the asset's book value at the end of year 3?arrow_forwardAn equipment costs 500,000 TL and will be used for 7 years at which time the salvage value will be 80,000 TL. What is annual depreciation and the book value at the end of year 4 if Straight Line Depreciation (SLD) is used? 1. End of Year 1 2 3 4 15 6 7 Depreciation o Book Value 500000 a) O ii) SLD: D4 =71,428; BV4= 214285; b) O i) SLD: D4=70,000; BV4= 340,000; C) O i) SLD: D4 =60,000; BV4= 260,000; d) O i) SLD: D4 =60,000; BV4= 200,000; e) i) SLD: D4 =60,000; BV4= 320,000; Boş bırakarrow_forwardAn auto company purchase a new truck for their transportations at a price of $350,000. The company expects to use the truck years. expected salvage value of the truc k is $50,000 after the end of its tenth years of useful life. Use the SOYD method of depreciation to calculate the By of the truck after 2 year? A: $54,545 B: $246,394 C: $249,091 D: $103,636arrow_forward

- Calculate the value of depreciation of gross value is $120 million and the net value is $100 millionarrow_forwardConsider the following financial information for an engineer: Age: 25Status: Single, no childrenGross Income: $54,000 401k investment: $4000Residential status: RentingTotal eligible itemized deductions: $3000 for charitable donations What is the taxable income? (IF you need to use them, assume the standard deduction for single is $12000 and married is $24000).arrow_forwardA front-end loader costs $70,000 and has a depreciable salvage value of $10,000 at the end of its 5-year useful life. Use MACRS depreciation to compute the depreciation schedule and book value of the equipment.arrow_forward

- 4. Last month, a company specializing in wind power plant design and engineering made a capital investment of $460,000 in physical simulation equipment that will be used for at least 5 years, then sold for approximately 30% of the first cost. By law, the assets are MACRS depreciated using a 3-year recovery period. By how much will the sale cause TI and taxes to change in year 5? The TI will increase by $ and the taxes will increase byarrow_forwardLabor costs, materials, all direct and indirect costs, and facilities and productive equipment with a useful life of one year or less are usually depreciated. O True O Falsearrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education