FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

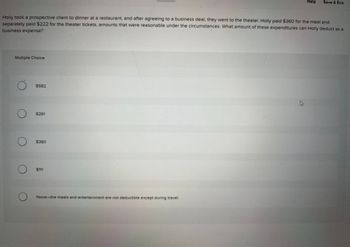

Transcribed Image Text:Multiple Choice

Holly took a prospective client to dinner at a restaurant, and after agreeing to a business deal, they went to the theater. Holly paid $360 for the meal and

separately paid $222 for the theater tickets, amounts that were reasonable under the circumstances. What amount of these expenditures can Holly deduct as a

business expense?

O

O

$582

$291

$360

$111

Help

None-the meals and entertainment are not deductible except during travel.

Save & Exit

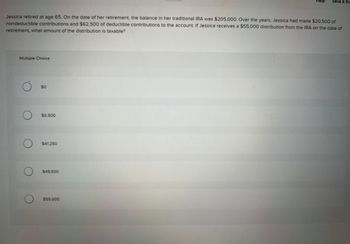

Transcribed Image Text:Jessica retired at age 65. On the date of her retirement, the balance in her traditional IRA was $205,000. Over the years, Jessica had made $20,500 of

nondeductible contributions and $62,500 of deductible contributions to the account. If Jessica receives a $55,000 distribution from the IRA on the date of

retirement, what amount of the distribution is taxable?

Multiple Choice

O

O

$0

$5,500

$41,250

$49,500

Help Save & Ex

$55,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Pls do fast i will give like for sure Solution must be in typed form. beau borrows $15,000 from credit center to buy a car. the lender assigns the right to receive the loan payments to debt collections inc. if beau does not pay the debt, the assignee canarrow_forward28 ezto.mheducation.com ng | Home Saved Help Save & Exit Subm MC Qu. 4-68 Angela is a tenant of Bruce. On... Angela is a tenant of Bruce. On March 1, Angela paid Bruce $2,400 for 3 months of rent. On March 31, Angela's adjusting entries will include one with a debit to: Multiple Choice Prepaid Rent for $800 and a credit to Rent Expense for $800. Rent Expense for $2,400 and a credit to Prepaid Rent for $2,400. Rent Expense for $800 and a credit to Prepaid Rent for $800. Prepaid Rent for $2,400 and a credit to Cash for $2,400. MacBook 30 DII DD F8 F9 F10 F11 F3 F4 F5 F6 F7 %23 2$ & 3 4. 6 7 8. R T. Y U Parrow_forwardok nt Fint rences Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. Problem 1-49 Part-c (Static) c. Suppose that Melissa made the trip to San Francisco primarily to visit the national parks and only attended the business conference as an incidental benefit of being present on the coast at that time. What amount of the airfare can Melissa deduct as a business expense? Deductible amountarrow_forward

- Journal entriesarrow_forwardRequired information [The following information applies to the questions displayed below.] Melissa recently paid $700 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $705 fee to register for the conference, $385 per night for three nights' lodging, $235 for meals, and $480 for cab fare. (Leave no answers blank. Enter zero if applicable.) (Round your answer to the nearest dollar amount.) d. Suppose that Melissa's permanent residence and business wa located in San Francisco. She attended the conference in San Francisco and paid $705 for the registration fee. She drove 156 miles over the course of three days and paid $177 for parking at the conference hotel. In addition, she spent $430 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel and she bought dinner on her way home each night from the conference. What amount of the travel costs can…arrow_forwardHi I need an answer key to the questions in the picture thank youarrow_forward

- PROBLEM 1 Ms. Mabunina Mae Galisfa, a famous licensed lawyer, had the following transactions, in March, 2023, with a rich client, Mr. Cephy Lish: (VAT not included) PROFESSIONAL FEE 1) Received, net of 10% withholding tax on gross professional fee 2) An account receivable or professional fee not yet received 3) Reimbursement received from Mr. Lish, for expenses chargeable to Mr. Lish CASH PAYMAENTS (Suppliers are all VAT registered, with receipts) 1) Purchase of new computer from SM 2) Purchase of office supplies from National Book Store 3) Payment to the Manila Water 4) Payment to Meralco 5) Payment to Globe P360,000 50,000 5,000 50,000 2,000 1,000 5,000 2,000 30,000 5,000 6) Salaries and wages of Mabunina's employees, for March, payroll 7) Payment of operating expenses CASH PAYMENTS (Non-VAT suppliers, with receipts) 1) Payment for repair of an old computer 2) Payment to a mechanic, for car repair Required: Compute the following and write the correct answers on the blank Q1 ខន Q2 Q3…arrow_forwardRequired Information Problem 9-47 (LO 9-2) The following information applies to the questions displayed below. Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa for meals, and $150 for cab fare. (Leave no answers blank. Enter zero If applicable.) Problem 9-47 Part-d d. Suppose that Melissa's permanent residence and business was located in San Francisco. She attended the conference in San Francisco and paid $250 for the registration fee. She drove 100 miles over the course of three days and paid $90 for parking at the conference hotel. In addition, she spent $150 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel and she bought dinner on her way home each night from the conference. What amount of these costs can Melissa deduct as business expenses? (Use standard mileage rate.) (Do not round Intermedlate calculations. Round your final answer to the…arrow_forwardPlease don't provide answer in image format thank you.arrow_forward

- Required information [The following information applies to the questions displayed below.] Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable.) a. What amount of these costs can Melissa deduct as business expenses? Deductible amount Ted Tent Required information [The following information applies to the questions displayed below.] Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants,…arrow_forwardJan 5 Received $800 from a client for auto repair, receipt 250 in general jounalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education