Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

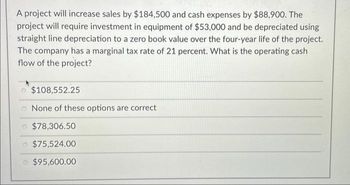

Transcribed Image Text:A project will increase sales by $184,500 and cash expenses by $88,900. The

project will require investment in equipment of $53,000 and be depreciated using

straight line depreciation to a zero book value over the four-year life of the project.

The company has a marginal tax rate of 21 percent. What is the operating cash

flow of the project?

$108,552.25

None of these options are correct

o $78,306.50

$75,524.00

o $95,600.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hughes Corporation is considering a project that would require an investment of $343,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.): Sales Variable expenses Contribution margin Fixed expenses: Salaries Rents Depreciation Total fixed expenses Net operating income $ 227,000 52,000 175,000 O 3.0 years O 5.1 years O 3.2 years O 4.8 years 27,000 41,000 40,000 108,000 $ 67,000 The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:arrow_forwardBennett Company has a potential new project that is expected to generate annual revenues of $261,200, with variable costs of $143,600, and fixed costs of $61,000. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $24,000. The annual depreciation is $25,000 and the tax rate is 21 percent. What is the annual operating cash flow? Multiple Choice $42,600 $127,600 $81,600 $178,616 $49,964arrow_forward2. A project costs $20,000, will be depreciated straight-line to zero over its 3 year life, and will required a net working capital investment of %5,000 up-front. The project generates OCF of $13,000. The fixed assets will be sold for $2,000 at the end of the project. If the firm has a tax rate of 34% and a required return of 12%, what is the project's NPV?arrow_forward

- Bennett Company has a potential new project that is expected to generate annual revenues of $263,000, with variable costs of $144, 400, and fixed costs of $61,600. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $25,000. The annual depreciation is $25,400 and the tax rate is 35 percent. What is the annual operating cash flow? Multiple Choice $127,490 $82,400 $180,212 $45,940 $40,890arrow_forwardThe financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: Projected sales $22 million Operating costs (not including depreciation) $11 million Depreciation $5 million Interest expense $3 million The company faces a 25% tax rate. What is the project's operating cash flow for the first year (t = 1)? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Round your answer to the nearest dollar. $arrow_forwardLaurel's Lawn Care Ltd., has a new mower line that can generate revenues of $174,000 per year. Direct production costs are $58,000, and the fixed costs of maintaining the lawn mower factory are $24,000 a year. The factory originally cost $1.45 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm's tax bracket is 25%. (Enter your answer in dollars not in millions.) Operating cash flowsarrow_forward

- The financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: Projected sales $22 million Operating costs (not including depreciation) $9 million Depreciation $5 million Interest expense $3 million The company faces a 25% tax rate. What is the project's operating cash flow for the first year (t = 1)? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Round your answer to the nearest dollar.arrow_forwardA 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The equipment necessary for the project will cost $360,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the worst-case scenario? es Multiple Choice $77,946 $44,504 0 $70,623 $129,329 $49.221arrow_forwardYou are analyzing a project and have developed the following estimates. The depreciation is $47,900 a year and the tax rate is 21 percent. What is the worst-case operating cash flow? Unit sales Sales price per unit Variable cost per unit Fixed costs -$2,545 $11,145 $88,855 $27,556 O $63,937 Base-Case Lower Bound Upper Bound 9,800 12,800 $34 $24 $ 9,200 11,300 $ 39 $25 $ 9,700 $44 $26 $ 10,200arrow_forward

- ABC, Inc., is considering purchase of a new equipment. The expected sales are expected to be $5,556,982. The annual cash operating expenses are expected to be $2,957,536. The annual depreciation is estimated to be $456,926 and the interest expense is estimated to be $206,975. If the tax rate is 33%, what is the operating cash flow?arrow_forwardSlithering Snakes is considering adding a new product line that is expected to increase annual sales by $355,000 and cash expenses by $277,000. The Initial investment will require $385,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the five-year life of the project. The company has a marginal tax rate of 21 percent. What is the annual value of the depreciation tax shield. Multiple Choice $77,000 $15,223 $16,170 $19,260 $18,180arrow_forwardSun Brite has a new pair of sunglasses it is evaluating. The company expects to sell 5, 700 pairs of sunglasses at a price of $ 152 each and a variable cost of $104 each. The equipment necessary for the project will cost $300,000 and will be depreciated on a straight-line basis over the 9-year life of the project. Fixed costs are $180,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 increase in variable costs per pairs of sunglasses? Multiple Choice -$4,117 -S3, 335 -$4, 503 S3, 705 $3,335arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education