Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

plese answer correctly by giving me the right answer

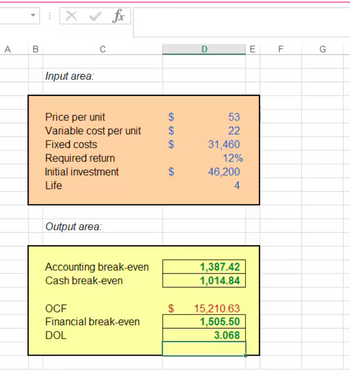

make sure there is no error; use the excel picture example to break down each answer for (a,b,c,d)

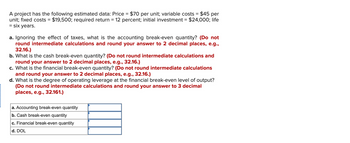

Transcribed Image Text:A project has the following estimated data: Price = $70 per unit; variable costs = $45 per

unit; fixed costs = $19,500; required return = 12 percent; initial investment = $24,000; life

= six years.

a. Ignoring the effect of taxes, what is the accounting break-even quantity? (Do not

round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

b. What is the cash break-even quantity? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

c. What is the financial break-even quantity? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

d. What is the degree of operating leverage at the financial break-even level of output?

(Do not round intermediate calculations and round your answer to 3 decimal

places, e.g., 32.161.)

a. Accounting break-even quantity

b. Cash break-even quantity

c. Financial break-even quantity

d. DOL

Transcribed Image Text:A

B

X✓ fx

Input area:

с

Price per unit

Variable cost per unit

Fixed costs

Required return

Initial investment

Life

Output area:

D

E

F

G

555

53

$

22

31,460

12%

46,200

4

Accounting break-even

Cash break-even

1,387.42

1,014.84

OCF

$

15,210.63

Financial break-even

1,505.50

DOL

3.068

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need answer typing clear urjent no chatgpt used i will give upvotes all answers plsarrow_forwardCreate a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardFill out the missing columns and show the calculation and formulasarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Question 3 Listen What are the values of r and r² for the below table of data? Hint: Make sure your diagnostics are turned on. Enter the data into L1 and L2. Click STAT, CALC, and choose option 8: Lin Reg(a+bx). A r = -0.862 r2=0.743 B r=0.673 2=0.820 X y 5 C r=0.743 r2=-0.862 8 22 23.9 14 9 14 17 20 5.2arrow_forwardAssignment: In the space at the right, type the best formula (or function) needed to perform the following computations. The first one has been done for youarrow_forwardPlease see attached picturearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education