FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

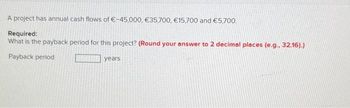

Transcribed Image Text:A project has annual cash flows of €-45,000, €35,700, €15,700 and €5,700.

Required:

What is the payback period for this project? (Round your answer to 2 decimal places (e.g.. 32.16).)

Payback period

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A project has an initial cost of $7,000. The cash inflows are $1,000, $2,600, $3,000, and $4,000 over the next four years, respectively. What is the payback period? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardA project is expected to produce cash inflows of $5,000 for seven years. What is the maximum amount that can be spent on costs to initiate this project and still consider the project as acceptable, given an 11% discount rate? Select one: Oa. $15,884.15 Ob. $23,340.13 Oc. $25,900.63 O d. $23,560.98 Oe. $26,984.02arrow_forwardTwo projects, Alpha and Beta, are being considered using the payback method. Each has an initial cost of $100,000. The annual cash flows for each project are listed below. a) What is the pay back period in years for Alpha? (round to two decimal places) b) What is the pay back period in years for Beta? (round to two decimal places) Year Project Alpha Project Beta 1 25,000 15,000 2 25,000 25,000 3 25,000 45,000 4 25,000 30,000 5 25,000 20,000 25,000 15,000arrow_forward

- What is the payback period for project E? Data Table - X years (Round to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flow Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow year 6 $46,000 $100,000 $20,000 $9,200 $9,200 $10,000 $9,200 $40,000 $9,200 $30,000 $9,200 $0 $9,200 $0 Print Donearrow_forwardIRR A project has an initial cost of $55,000, expected net cash inflows of $11,000 per year for 10 years, and a cost of capital of 10%. What is the project's IRR? Round your answer to two decimal places. %arrow_forwardFind internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 10.50%.Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choices 15.05% 14.60% 14.90% 16.24% 17.73%arrow_forward

- Project L requires an initial outlay at t = 0 of $59,588, its expected cash inflows are $11,000 per year for 9 years, and its WACC is 14%. What is the project's IRR? Round your answer to two decimal places. 5.42 %arrow_forwardAn investment project provides cash inflows of $740 per year for 9 years. What is the project payback period if the initial cost is $1,480? A. 2.00 years B. 2.02 years C. 1.90 years D. 1.94 years E. 2.04 years What is the project payback period if the initial cost is $4,958? A. 6.70 years B. 6.77 years C. 6.37 years D. 6.83 years E. 6.50 years What is the project payback period if the initial cost is $7,400? A. 3.01 years B. Never C. 4.95 years D. 5.25 years E. 1.35 yearsarrow_forwardPayback period. What are the payback periods of projects E and F in the following table: ? Assume all the cash flow is evenly spread throughout the year. If the cutoff period is 3 years, which project(s) do you ассept? ..... What is the payback period for project E? years (Round to one decimal place.)arrow_forward

- (c) Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.) (Round answers to 2 decimal places, e.g. 10.50%.) Annual rate of return Project Bono % Project Edge % Project Clayton %arrow_forwardA project has an initial cost of $52,125, expected net cash inflows of $12,00 per year for 8 years, and a cost of capital of 12%. P11-1. What is the project's NPV? P11-2. What is the project's IRR? P11-3. What is the project's MIRR? P11-4. What is the project's PI? P11-5. What is the project's payback periodarrow_forwardA project requires an increase in inventories, accounts payable, and accounts receivable of $120,000, $50,000, and $80,000, respectively. If opportunity cost of capital is 9% and the project has a life of 13 years, and the working capital investments will be recovered at the end of the life of the project, what is the effect on the NPV of the project? Enter your answer rounded to two decimal places. Enter your response below. Numberarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education